European Stocks That May Be Trading Below Estimated Value In July 2025

Reviewed by Simply Wall St

As European markets experience tentative optimism amid potential trade agreements with the U.S., the pan-European STOXX Europe 600 Index has seen a modest rise. In this environment, identifying stocks that may be trading below their estimated value can offer investors opportunities to potentially capitalize on market inefficiencies and favorable economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Talenom Oyj (HLSE:TNOM) | €3.52 | €6.94 | 49.3% |

| StrongPoint (OB:STRO) | NOK11.20 | NOK22.39 | 50% |

| Selvita (WSE:SLV) | PLN34.90 | PLN69.79 | 50% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €55.20 | €109.12 | 49.4% |

| JOST Werke (XTRA:JST) | €51.90 | €102.81 | 49.5% |

| Green Oleo (BIT:GRN) | €0.79 | €1.58 | 50% |

| Expert.ai (BIT:EXAI) | €1.516 | €3.01 | 49.6% |

| ATON Green Storage (BIT:ATON) | €2.13 | €4.22 | 49.5% |

| Atea (OB:ATEA) | NOK142.40 | NOK282.90 | 49.7% |

| Aquila Part Prod Com (BVB:AQ) | RON1.44 | RON2.88 | 50% |

Let's explore several standout options from the results in the screener.

Exosens (ENXTPA:EXENS)

Overview: Exosens develops, manufactures, and sells electro-optical technologies focusing on amplification, detection, and imaging across various regions globally with a market capitalization of €2.04 billion.

Operations: The company's revenue is derived from two main segments: €280.20 million from amplification and €117.50 million from detection and imaging.

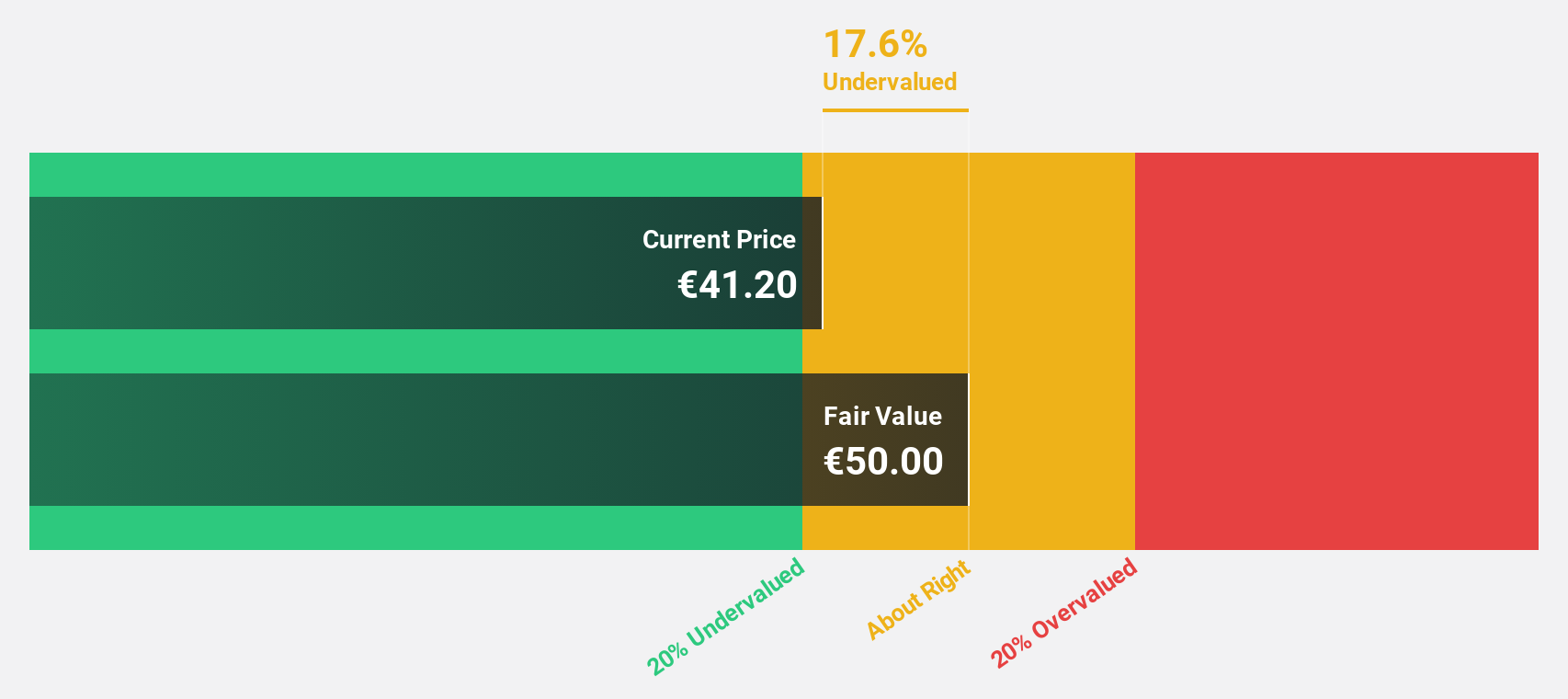

Estimated Discount To Fair Value: 20.1%

Exosens is trading at €40.1, below its estimated fair value of €50.2, indicating it's undervalued by over 20%. Recent earnings showed strong growth with net income rising to €27.9 million from €2.9 million year-over-year, and sales increasing to €224.5 million from €186.9 million. Earnings are forecasted to grow significantly at 26% annually, outpacing the French market's 13%, despite a slower revenue growth rate of 11% per year.

- Insights from our recent growth report point to a promising forecast for Exosens' business outlook.

- Dive into the specifics of Exosens here with our thorough financial health report.

Lisi (ENXTPA:FII)

Overview: Lisi S.A. designs and produces assembly and component solutions for the aerospace, automotive, and medical sectors in France and internationally, with a market cap of €2.19 billion.

Operations: The company's revenue is derived from three main segments: €1.13 billion from LISI Aerospace, €561.21 million from LISI Automotive, and €183.94 million from LISI Medical.

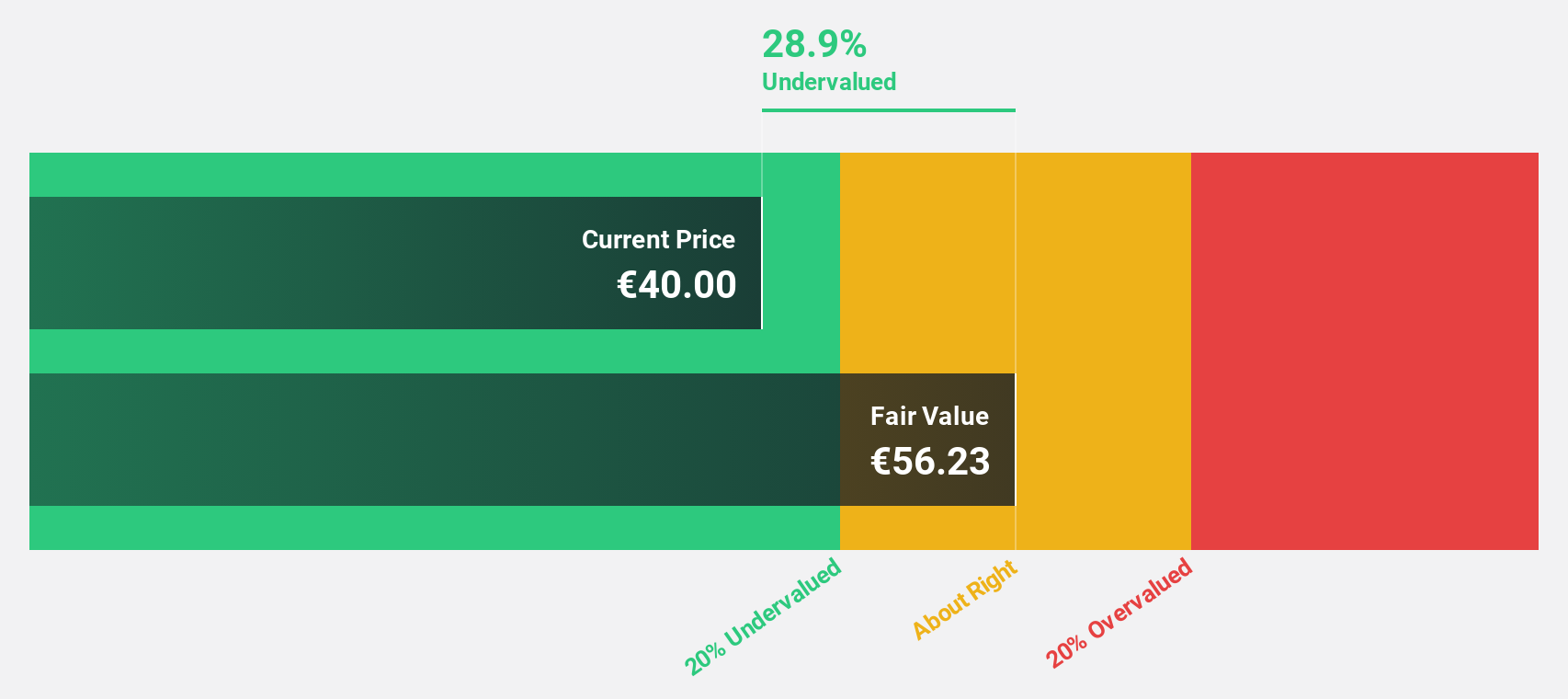

Estimated Discount To Fair Value: 17.7%

Lisi is trading at €48, below its estimated fair value of €58.3, reflecting an undervaluation of 17.7%. The company's earnings are projected to grow significantly by 31.2% annually over the next three years, surpassing the French market's average growth rate of 13%. Recent half-year results show revenue increased to €1.03 billion from €961.46 million year-over-year, with net income rising to €38.51 million from €31.57 million, although high debt levels remain a concern.

- According our earnings growth report, there's an indication that Lisi might be ready to expand.

- Click here to discover the nuances of Lisi with our detailed financial health report.

Cicor Technologies (SWX:CICN)

Overview: Cicor Technologies Ltd., along with its subsidiaries, develops and manufactures electronic components, devices, and systems on a global scale with a market cap of CHF844.83 million.

Operations: The company's revenue is primarily derived from its Advanced Substrates Division, contributing CHF40.70 million, and its Electronic Manufacturing Services Division, which accounts for CHF492.60 million.

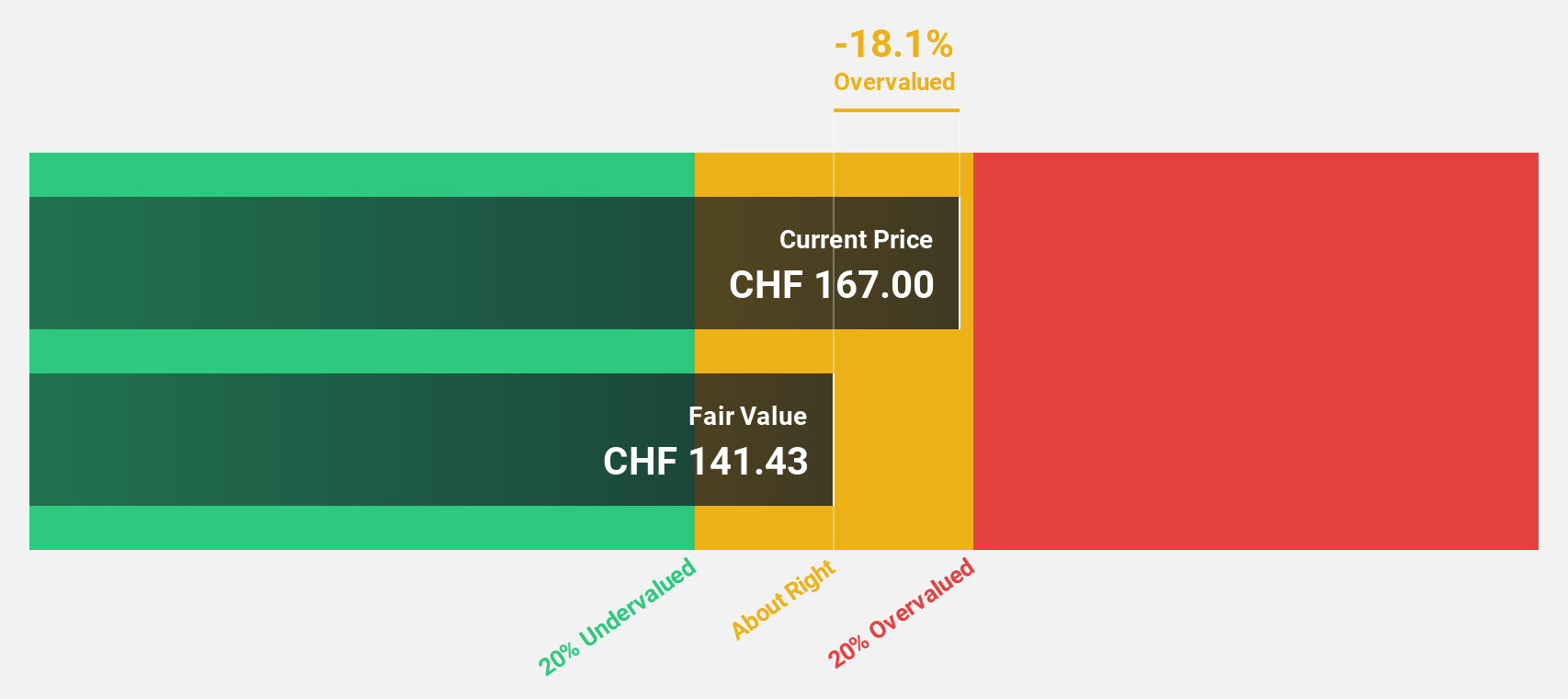

Estimated Discount To Fair Value: 14.4%

Cicor Technologies is trading at CHF194, below its estimated fair value of CHF226.64, indicating a 14.4% undervaluation. Despite high debt and recent shareholder dilution, earnings are forecast to grow significantly by 37.7% annually over the next three years, outpacing the Swiss market's growth rate of 11.3%. Recent acquisitions in Europe enhance Cicor’s position in aerospace and defense sectors, though H1 net income declined to CHF8.48 million from CHF11.89 million year-over-year.

- Upon reviewing our latest growth report, Cicor Technologies' projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Cicor Technologies' balance sheet health report.

Where To Now?

- Unlock more gems! Our Undervalued European Stocks Based On Cash Flows screener has unearthed 191 more companies for you to explore.Click here to unveil our expertly curated list of 194 Undervalued European Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CICN

Cicor Technologies

Develops, and manufactures electronic components, devices, and systems worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives