- France

- /

- Construction

- /

- ENXTPA:FGR

Is Eiffage’s EUR171 Million Belgian Prison Project Changing the Investment Outlook for ENXTPA:FGR?

Reviewed by Sasha Jovanovic

- Eiffage announced that its concessions division has signed a EUR171 million DBFM contract with the Belgian Building Authority and Federal Public Justice Service to deliver, operate, and maintain a new 39,000 m2 prison facility in Wallonia, Belgium, supported by a consortium of subsidiaries and specialist partners.

- This long-term project marks Eiffage's second major prison contract in Belgium, demonstrating the company's ability to secure repeat high-value infrastructure opportunities in international markets and target advanced environmental certifications such as BREEAM Excellent.

- We'll explore how securing this 25-year public-private partnership in Belgium bolsters Eiffage's order book visibility and international footprint.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Eiffage Investment Narrative Recap

For shareholders in Eiffage, the core belief centers on resilience in infrastructure and concessions, with international projects helping balance regional challenges. The newly signed EUR171 million Belgian prison contract supports short-term order book stability and affirms international credentials, but it does not materially change the immediate outlook, as the biggest near-term influence remains the weak French property market.

Among recent announcements, the September win by Eiffage’s Smulders subsidiary of a EUR1.5 billion contract for offshore wind substations stands out as most relevant in context with the new Belgian contract: both underpin Eiffage’s efforts to diversify international revenue and build long-term, environmentally-focused project pipelines, supporting the group’s growing non-French activities.

Yet, just as these wins improve order visibility abroad, investors should also focus on the risk from persisting weakness at home in France, where...

Read the full narrative on Eiffage (it's free!)

Eiffage's outlook anticipates €26.8 billion in revenue and €1.3 billion in earnings by 2028. This requires 2.5% annual revenue growth and a €333 million increase in earnings from the current €967 million.

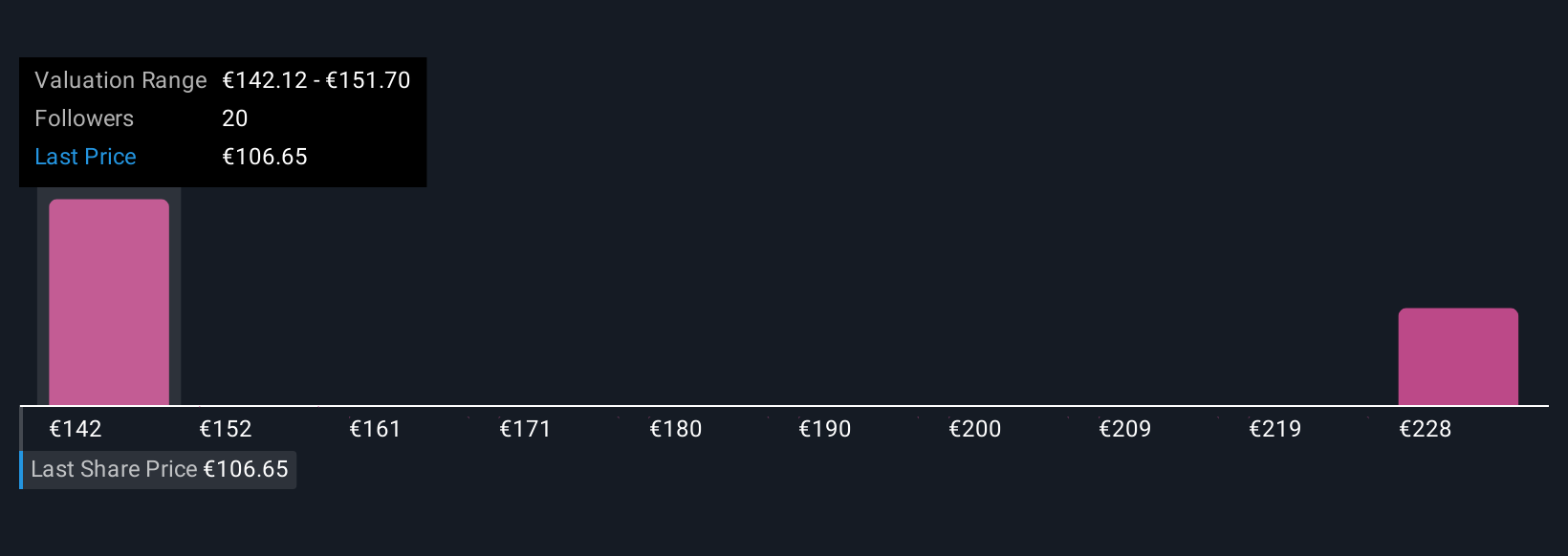

Uncover how Eiffage's forecasts yield a €142.12 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community for Eiffage range widely, from €142.12 to €236.40 across three individual analyses. While international project gains spark optimism, ongoing concerns about France's real estate sector could weigh on returns regardless of broader market valuations, so it pays to review different viewpoints.

Explore 3 other fair value estimates on Eiffage - why the stock might be worth over 2x more than the current price!

Build Your Own Eiffage Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eiffage research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Eiffage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eiffage's overall financial health at a glance.

No Opportunity In Eiffage?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eiffage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FGR

Eiffage

Engages in the construction and concessions industries in France, rest of Europe, and internationally.

Very undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives