- Germany

- /

- Capital Markets

- /

- XTRA:MLP

3 European Dividend Stocks Yielding Up To 5.5%

Reviewed by Simply Wall St

The European stock market has experienced a positive shift, with the pan-European STOXX Europe 600 Index rising by 1.77% amid relief from the reopening of the U.S. federal government, although enthusiasm was tempered by cooling sentiment around artificial intelligence investments. In this environment, dividend stocks can offer investors a degree of stability and income potential, making them an attractive option for those looking to navigate uncertain economic landscapes while benefiting from regular payouts.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.30% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.65% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.34% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.16% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.60% | ★★★★★☆ |

| Evolution (OM:EVO) | 4.86% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.35% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.71% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.68% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 5.41% | ★★★★★☆ |

Click here to see the full list of 222 stocks from our Top European Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

BRD - Groupe Société Générale (BVB:BRD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BRD - Groupe Société Générale S.A. offers a variety of banking and financial services to both corporate clients and individuals in Romania, with a market capitalization of RON15.61 billion.

Operations: BRD - Groupe Société Générale S.A.'s revenue segments consist of RON2.39 billion from Retail, RON1.40 billion from Non-Retail, and RON310.33 million from the Corporate Center.

Dividend Yield: 4.7%

BRD - Groupe Société Générale's dividend payments are well covered by earnings with a payout ratio of 46.5%, though the dividend yield of 4.72% is below top-tier levels in Romania. Despite a history of volatility and unreliability in dividends, recent earnings growth and a low price-to-earnings ratio suggest potential value. However, high non-performing loans at 2.7% present risks to financial stability, impacting future dividend reliability and sustainability.

- Take a closer look at BRD - Groupe Société Générale's potential here in our dividend report.

- Our expertly prepared valuation report BRD - Groupe Société Générale implies its share price may be too high.

Eiffage (ENXTPA:FGR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eiffage SA operates in the construction and concessions sectors across France, Europe, and internationally, with a market cap of €10.80 billion.

Operations: Eiffage SA's revenue is primarily derived from its Infrastructures segment at €9.17 billion, followed by Energy Systems at €7.68 billion, Concessions at €4.18 billion, and Construction at €4.10 billion.

Dividend Yield: 4.2%

Eiffage's dividend payments are well covered by earnings and cash flows, with a payout ratio of 45.5% and a cash payout ratio of 17.7%. However, the dividend yield of 4.19% is below the top tier in France, and its dividend history has been volatile over the past decade. Recent projects like the €171 million Vresse-sur-Semois prison contract in Belgium highlight strong revenue streams but high debt levels pose potential risks to financial stability.

- Delve into the full analysis dividend report here for a deeper understanding of Eiffage.

- Insights from our recent valuation report point to the potential undervaluation of Eiffage shares in the market.

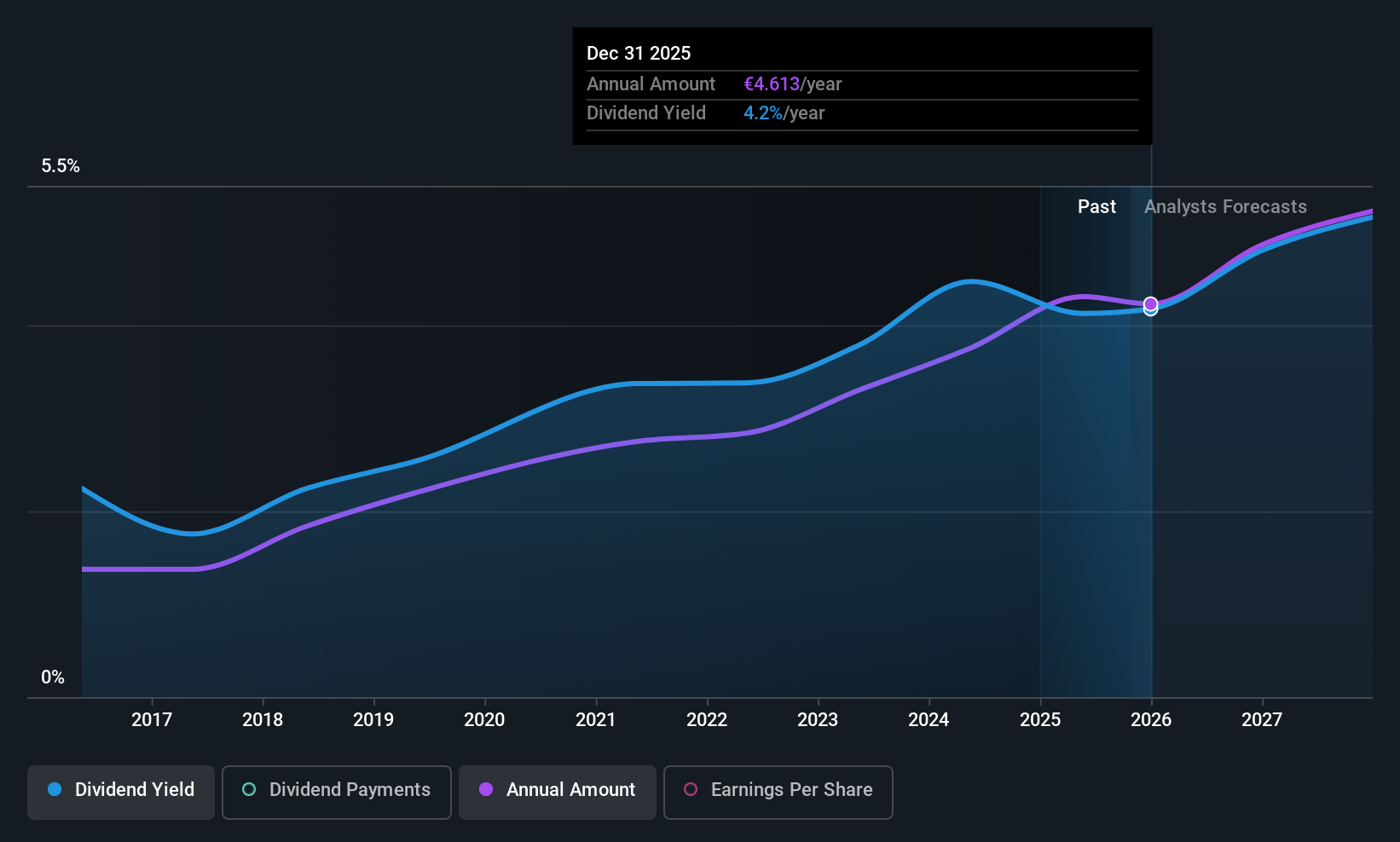

MLP (XTRA:MLP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MLP SE, with a market cap of €703.57 million, offers financial services to private, corporate, and institutional clients in Germany through its subsidiaries.

Operations: MLP SE generates revenue through various segments, including financial consulting for private clients (€376.50 million), corporate and institutional client services (€298.20 million), and real estate brokerage (€125.70 million) in Germany.

Dividend Yield: 5.6%

MLP's dividend yield of 5.59% ranks in the top 25% of German dividend payers, yet its history shows volatility with drops over 20%. Despite a reasonable payout ratio of 59.5%, the high cash payout ratio of 396.3% indicates dividends are not well covered by cash flows, raising sustainability concerns. Recent earnings growth and trading at a significant discount to fair value suggest potential upside, but investors should be cautious about dividend reliability.

- Click here and access our complete dividend analysis report to understand the dynamics of MLP.

- Upon reviewing our latest valuation report, MLP's share price might be too pessimistic.

Key Takeaways

- Access the full spectrum of 222 Top European Dividend Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MLP

MLP

Provides financial services to private, corporate, and institutional clients in Germany.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives