- France

- /

- Aerospace & Defense

- /

- ENXTPA:EXA

Exail Technologies (ENXTPA:EXA) Reports 47% Price Increase Over The Last Quarter

Reviewed by Simply Wall St

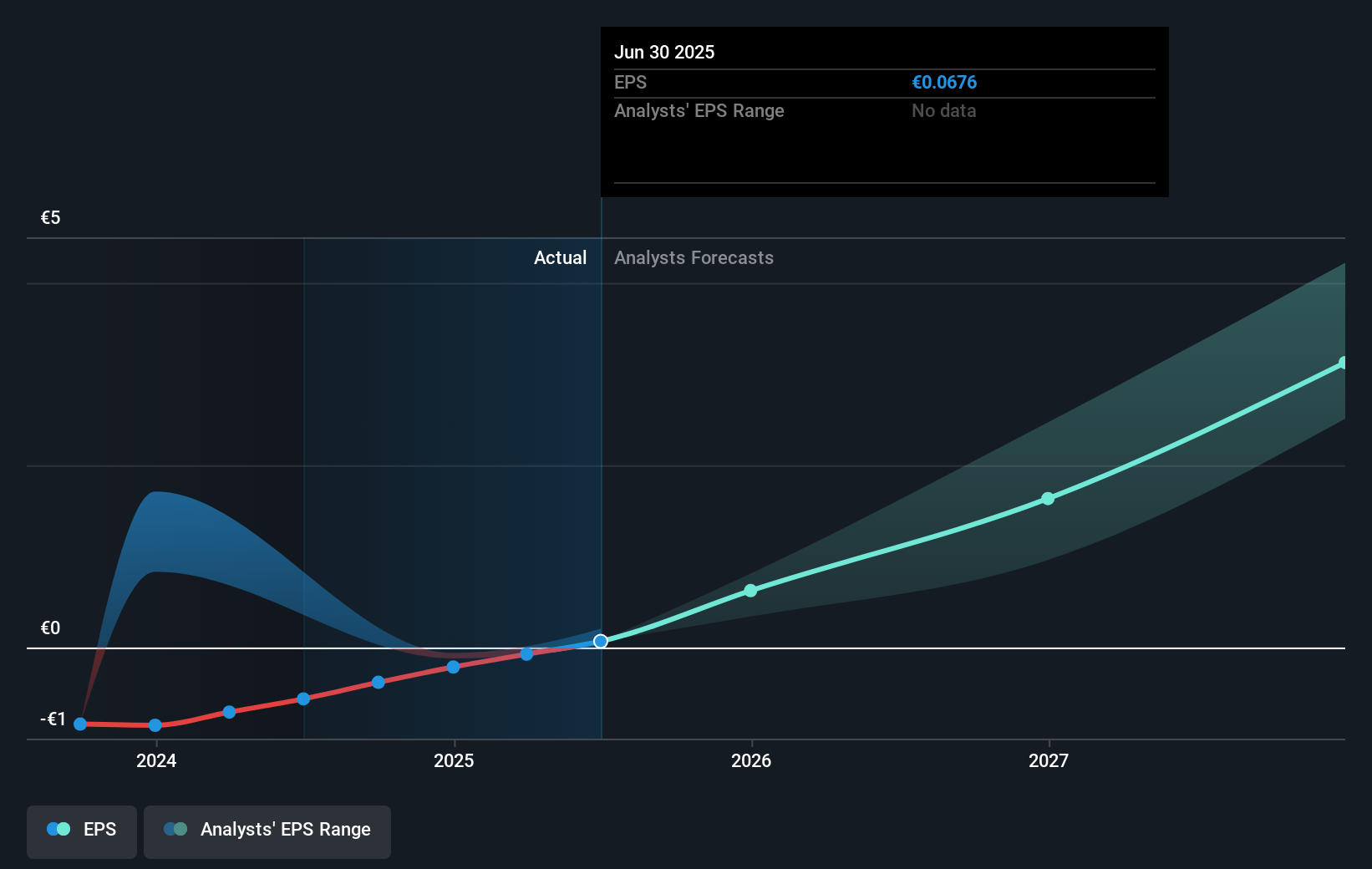

Exail Technologies (ENXTPA:EXA) recently achieved a significant milestone with the first sale of its DriX H-9 autonomous surface drone to a global hydrographic authority for naval defense, enhancing its foothold in the USV market. This came alongside a major European navy's order for five DriX H-8 drones. These developments, along with the confirmed expectation of double-digit revenue growth for 2025, likely bolstered market sentiment, aligning with the overall market's strong performance and contributing to a 47.21% share price increase over the quarter, amidst global interest in drone technologies.

We've identified 1 warning sign for Exail Technologies that you should be aware of.

Over the past five years, Exail Technologies has achieved a very large total shareholder return of 1250.47%. This significant growth outpaces the broader French market's one-year return of 4.3% and the French Aerospace & Defense industry, which saw a 45.8% return over the same period. The long-term performance underscores the company's strategic placement within its industry and continued focus on innovation, as demonstrated by recent contract wins and technological advancements.

The sales of the DriX autonomous surface drones to global navies could positively impact Exail's revenue and earnings forecasts, with increased demand potentially driving up future sales. However, it's notable that despite a current share price of €116.00, the price target stands at €123.83, suggesting a potential upside according to consensus analyst evaluations. This recent market activity, buoyed by strategic contracts and product milestones, has significantly influenced investor sentiment and future growth expectations.

Review our growth performance report to gain insights into Exail Technologies' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exail Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXA

Exail Technologies

Provides robotics, maritime, navigation, aerospace, and photonics technologies solutions in France and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives