- France

- /

- Aerospace & Defense

- /

- ENXTPA:EXA

Can Exail Technologies (ENXTPA:EXA) Turn Autonomous Naval Innovation Into Sustainable Industry Leadership?

Reviewed by Simply Wall St

- Exail Technologies recently announced the first sale of its DriX H-9 autonomous surface drone to a leading global hydrographic authority for naval defense applications, marking an important milestone in its expanding unmanned maritime portfolio.

- The H-9’s doubled at-sea autonomy, enhanced payload, and advanced multi-mission capabilities highlight Exail's growing presence in autonomous solutions for both defense and civil markets.

- We'll explore how Exail’s innovation in extended USV autonomy is shaping the company’s broader investment narrative and industry relevance.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Exail Technologies' Investment Narrative?

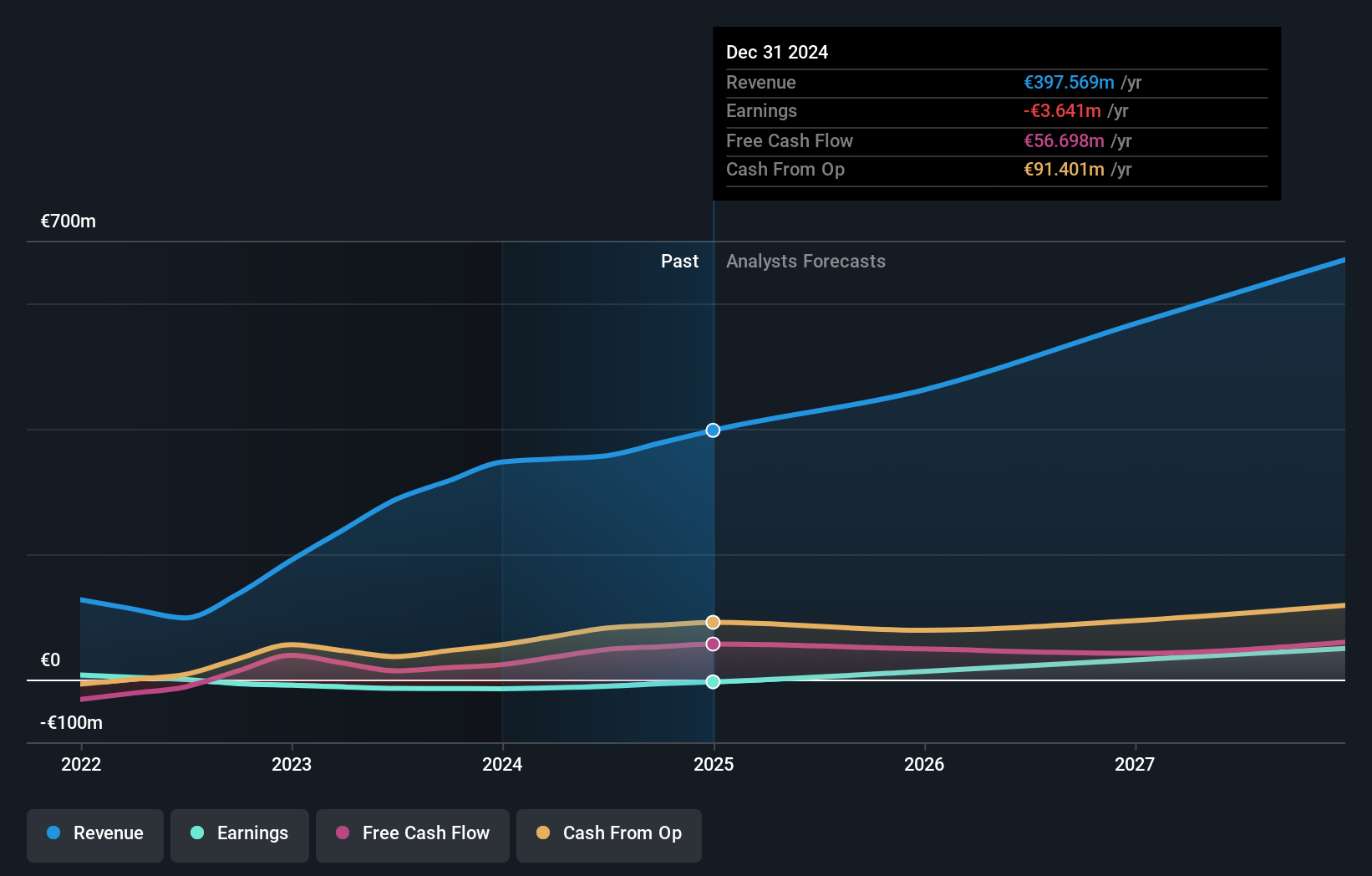

For anyone looking at Exail Technologies, the story today hinges on whether breakthrough sales of its advanced unmanned systems can turn promising momentum into stronger financial performance. The high-profile H-9 drone sale to a top hydrographic authority not only reinforces Exail’s growing presence in naval defense but also suggests that recent product innovation is resonating with institutional clients. This milestone could act as a fresh catalyst for near-term sentiment, especially as Exail is targeting double-digit revenue growth for 2025 and has lined up several major contract wins in recent months. However, the company’s shares are already trading at a premium when compared to industry peers, while its profitability remains elusive with a continuing net loss. The latest news may reframe the most pressing short-term question: can Exail translate robust sales momentum and contract wins into sustained earnings growth, or do high volatility, valuation, and a lack of consistent profitability remain the bigger hurdles ahead?

Yet despite the contract wins, Exail remains unprofitable, a detail every investor should consider.

Exploring Other Perspectives

Explore 9 other fair value estimates on Exail Technologies - why the stock might be worth 48% less than the current price!

Build Your Own Exail Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Exail Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Exail Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Exail Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exail Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXA

Exail Technologies

Provides robotics, maritime, navigation, aerospace, and photonics technologies solutions in France and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives