- France

- /

- Electrical

- /

- ENXTPA:NHOA

Investors Who Bought ENGIE Eps (EPA:EPS) Shares Five Years Ago Are Now Up 68%

Stock pickers are generally looking for stocks that will outperform the broader market. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. To wit, the ENGIE Eps share price has climbed 68% in five years, easily topping the market return of 29% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 38% in the last year.

Check out our latest analysis for ENGIE Eps

Given that ENGIE Eps didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 5 years ENGIE Eps saw its revenue grow at 44% per year. Even measured against other revenue-focussed companies, that's a good result. While the compound gain of 11% per year is good, it's not unreasonable given the strong revenue growth. If the strong revenue growth continues, we'd expect the share price to follow, in time. Of course, you'll have to research the business more fully to figure out if this is an attractive opportunity.

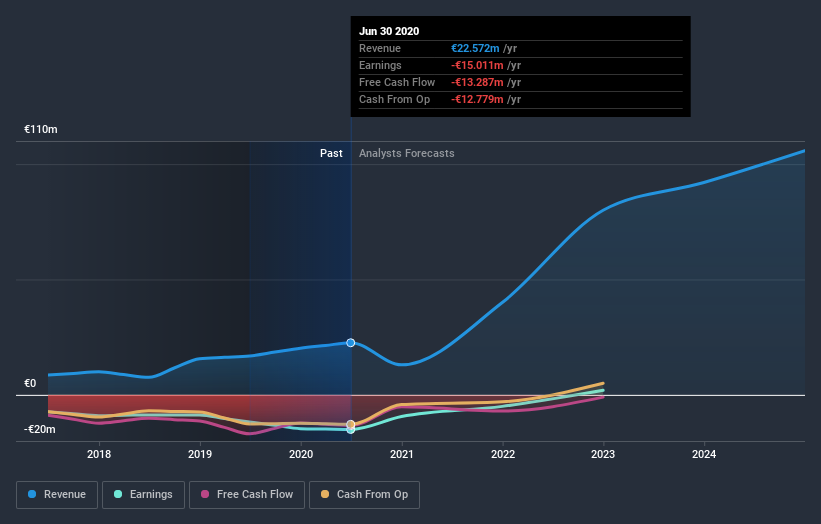

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between ENGIE Eps' total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. ENGIE Eps hasn't been paying dividends, but its TSR of 76% exceeds its share price return of 68%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's good to see that ENGIE Eps has rewarded shareholders with a total shareholder return of 38% in the last twelve months. That's better than the annualised return of 12% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand ENGIE Eps better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for ENGIE Eps you should be aware of, and 1 of them makes us a bit uncomfortable.

We will like ENGIE Eps better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

When trading ENGIE Eps or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NHOA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:NHOA

NHOA

Provides energy storage, E-mobility, and EV fastcharging infrastructure related solutions in France.

Adequate balance sheet very low.

Similar Companies

Market Insights

Community Narratives