When you buy and hold a stock for the long term, you definitely want it to provide a positive return. Furthermore, you'd generally like to see the share price rise faster than the market Unfortunately for shareholders, while the Bouygues SA (EPA:EN) share price is up 20% in the last five years, that's less than the market return. Zooming in, the stock is up a respectable 9.2% in the last year.

View our latest analysis for Bouygues

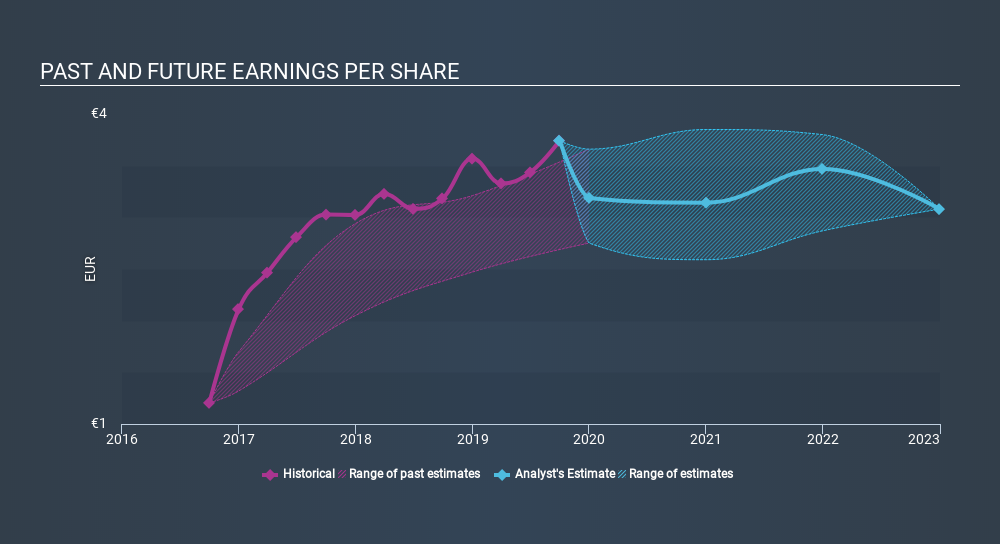

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last half decade, Bouygues became profitable. That would generally be considered a positive, so we'd expect the share price to be up. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. We can see that the Bouygues share price is up 17% in the last three years. In the same period, EPS is up 46% per year. This EPS growth is higher than the 5.5% average annual increase in the share price over the same three years. Therefore, it seems the market has moderated its expectations for growth, somewhat. This unenthusiastic sentiment is reflected in the stock's reasonably modest P/E ratio of 9.91.

The image below shows how EPS has tracked over time.

We know that Bouygues has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Bouygues's financial health with this free report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Bouygues, it has a TSR of 50% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Bouygues shareholders are up 15% for the year (even including dividends) . But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 8.5% per year over five year. This suggests the company might be improving over time. Before forming an opinion on Bouygues you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

We will like Bouygues better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTPA:EN

Bouygues

Operates in the construction, energy, telecom, media, and transport infrastructure sectors in France and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives