- France

- /

- Construction

- /

- ENXTPA:DG

What Vinci (ENXTPA:DG)'s Resilient 2025 Guidance Amid Tax Headwinds Means For Shareholders

Reviewed by Sasha Jovanovic

- Vinci SA recently confirmed its 2025 earnings guidance following solid third-quarter results, reporting group revenue of €19.4 billion, up 4.7%, and continued growth in airport traffic and Energy Solutions segments.

- The company also highlighted that a one-off increase in France's corporate income tax for large companies is expected to reduce 2025 net income by an estimated €0.4 billion, underscoring its exposure to regulatory changes in its home market.

- We’ll assess how Vinci’s ability to maintain positive guidance despite higher French corporate taxes influences its investment narrative and outlook.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Vinci Investment Narrative Recap

To be a Vinci shareholder, one needs to believe in the company's ability to convert sustained demand for global infrastructure, decarbonization, and mobility into resilient cash flow, despite heavy French exposure. Vinci’s confirmation of its 2025 earnings guidance and strong revenue growth signal that momentum in its core businesses remains intact, while the €0.4 billion tax charge from the 2025 French corporate income tax is not expected to materially affect the short-term growth catalysts but does reinforce a key long-term risk around margin pressure. Among recent developments, Vinci’s announcement of a 4.2% year-on-year increase in airport passenger traffic during the third quarter is most relevant, underscoring one of the major short-term revenue growth levers that is supporting its positive outlook. This operational strength in Concessions, and especially Airports, remains a core factor underpinning guidance, and adds visibility to Vinci’s near-term performance as the broader infrastructure cycle persists. However, investors should also remain mindful that while growth has proven resilient, ongoing regulatory changes in France could present new challenges for Vinci’s...

Read the full narrative on Vinci (it's free!)

Vinci's narrative projects €81.5 billion in revenue and €6.1 billion in earnings by 2028. This requires 3.4% yearly revenue growth and a €1.3 billion earnings increase from the current €4.8 billion.

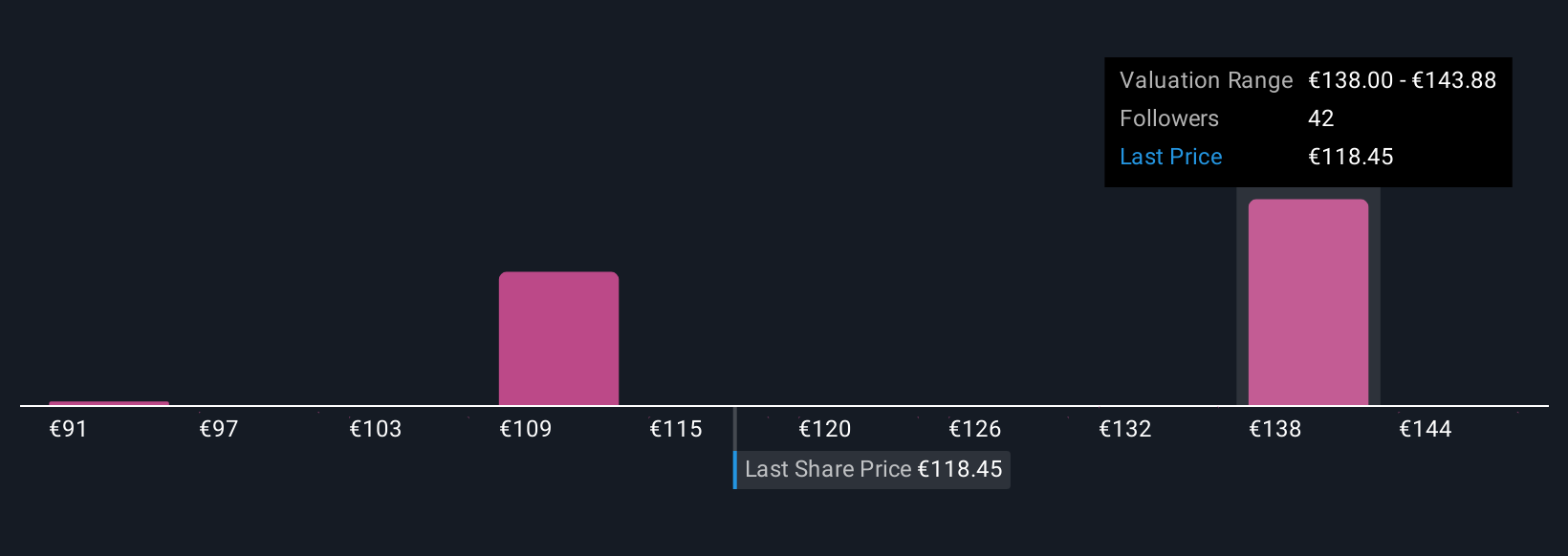

Uncover how Vinci's forecasts yield a €138.24 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Nine individual fair value estimates from the Simply Wall St Community range from €91.00 to €149.75 per share. While many see Vinci’s airport and energy segments driving growth, others emphasize that further tax changes in France could temper profitability in future years.

Explore 9 other fair value estimates on Vinci - why the stock might be worth 24% less than the current price!

Build Your Own Vinci Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vinci research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Vinci research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vinci's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:DG

Vinci

Engages in concessions, energy, and construction businesses in France and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives