- France

- /

- Aerospace & Defense

- /

- ENXTPA:AM

Does Recent Defense Deals Mean Dassault Aviation Shares Are Still a Bargain in 2025?

Reviewed by Bailey Pemberton

- Curious if Dassault Aviation société anonyme is a hidden gem or priced to perfection? You are not alone. Many investors want to know if now is the right time to take a closer look.

- The stock has climbed an impressive 44.7% over the past year and 37.5% year to date, even though it has dipped 1.8% in the last week and 3.8% over the past month.

- Recent headlines spotlight Dassault Aviation’s continued prominence in defense contracts and growing interest in its Falcon business jet series, contributing to increased investor attention. Significant international deals and geopolitical developments have put the company back in focus, helping to fuel recent share price moves.

- With a top-tier valuation score of 6/6, Dassault Aviation currently ranks strong across all major checks for being undervalued. Next, we will break down what this means using different valuation methods. At the end, we will reveal a smarter approach to understanding the company’s true value.

Approach 1: Dassault Aviation société anonyme Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s fair value by projecting its future cash flows and discounting them back to today’s value, reflecting what those flows are worth now. For Dassault Aviation société anonyme, the DCF model starts with the latest twelve months’ Free Cash Flow, which stands at approximately €1.17 billion. Analyst estimates suggest some near-term fluctuations, including negative projected cash flows in the next few years, followed by a significant recovery.

Looking ahead ten years, projections indicate Dassault Aviation’s Free Cash Flow could reach around €5.78 billion by 2035, based on a combination of analyst forecasts and reasonable extrapolations. These longer-range figures are derived from a two-stage Free Cash Flow to Equity model, which is a common DCF approach for established industrial companies.

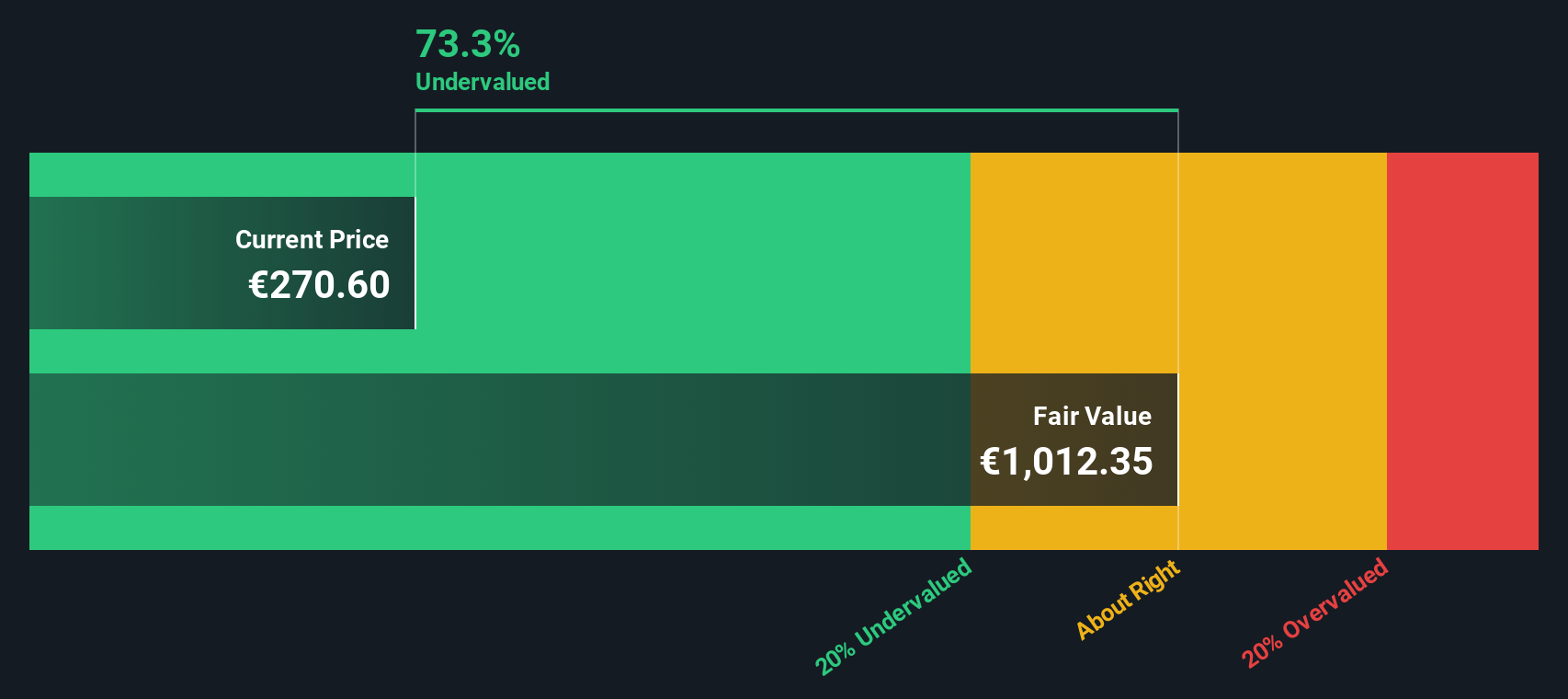

After bringing all projections into the present, the DCF model calculates the intrinsic value of Dassault Aviation société anonyme stock at €1,012.36 per share. Compared to its current trading price, the model suggests the stock is trading at a 73.4% discount to intrinsic value. In other words, it appears significantly undervalued by modern valuation standards.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Dassault Aviation société anonyme is undervalued by 73.4%. Track this in your watchlist or portfolio, or discover 932 more undervalued stocks based on cash flows.

Approach 2: Dassault Aviation société anonyme Price vs Earnings

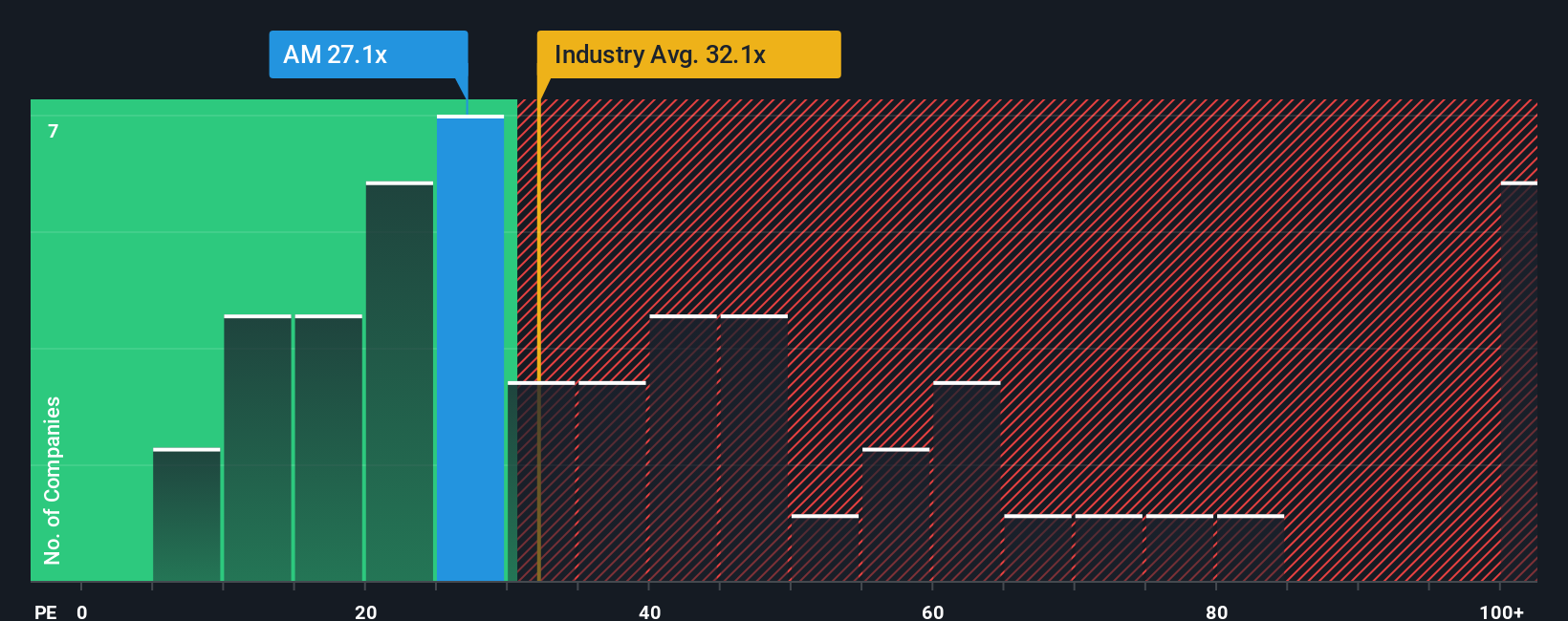

The Price-to-Earnings (PE) ratio is widely regarded as a go-to metric for valuing profitable companies. It shows how much investors are willing to pay for each euro of earnings, making it especially relevant when a business like Dassault Aviation société anonyme is not only profitable but also demonstrating future growth potential.

It is important to remember that a "fair" PE ratio for a stock is influenced by expectations around future earnings growth and company-specific risks. Companies expecting steady growth or enjoying lower risks typically command higher PE ratios, while those facing more uncertainty often trade at a lower multiple.

Dassault Aviation société anonyme trades at a PE of 26.9x, a figure that stands out when compared to the Aerospace & Defense industry average of 45.6x and the peer group average of 35.4x. This means Dassault appears cheaper than its main benchmarks. However, looking beyond industry norms, Simply Wall St’s proprietary "Fair Ratio" adjusts for details like company growth prospects, profit margins, risk, size, and industry specifics. For Dassault, the Fair Ratio is 29.3x.

The Fair Ratio provides a more tailored comparison than a simple benchmark by considering the company’s unique attributes, ensuring investors get a view grounded in both fundamentals and context. Put simply, it helps investors avoid being misled by broad averages and get closer to the stock’s true value.

With Dassault Aviation société anonyme’s actual PE ratio of 26.9x falling just below its Fair Ratio of 29.3x, the stock is trading at a modest discount and appears undervalued by this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Dassault Aviation société anonyme Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company, your view of what drives Dassault Aviation société anonyme, how you see its future, and what you think it is worth. Narratives connect your perspective to a forecast for revenue, earnings, and margins, and then link that directly to an estimated fair value, making your investment thesis both grounded and actionable.

With Narratives, you do not need to be a financial expert to invest with confidence. On Simply Wall St’s Community page, millions of investors use Narratives to clearly document, share, and compare their outlooks. Narratives offer a practical way to decide whether to buy, hold, or sell by showing if your fair value is above or below the current price based on your own assumptions. As news or earnings break, these Narratives update automatically, keeping your investment case current and responsive.

For example, one Narrative on Dassault Aviation société anonyme might forecast robust defense spending and margin improvements, supporting a bullish €390 price target, while another may focus on civil market risks and set a more cautious €280 target, reflecting a different perspective on the same underlying data.

Do you think there's more to the story for Dassault Aviation société anonyme? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AM

Dassault Aviation société anonyme

Designs and manufactures military aircraft, business jets, and space systems in France, the United States, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.