Assessing Alstom’s Share Price After 7% Monthly Surge and 2025 Outlook

Reviewed by Bailey Pemberton

If you have Alstom in your portfolio or are simply weighing a buy, the stock’s recent movements probably have your attention. After all, in just the past month the share price is up by 7.2%, and it notched a 4.8% gain in the last week alone. Over the past year, Alstom has delivered a 15.9% return. That kind of momentum hints at renewed optimism among investors. However, when compared with the 40.2% three-year climb and a five-year return that is actually down 38.0%, the picture looks more complex. These swings often reflect changes in how the market views company risk and future growth, especially as the rail sector continues to evolve. Some global industry trends and market developments have played into this, pushing analysts and investors to keep reevaluating just how much Alstom should be worth right now.

Of course, seeing double-digit gains in one period and steep declines over another makes it important to step back and answer a fundamental question: is Alstom actually undervalued, or is the strong price rebound already factoring in all the positives? Our latest value score for the company, based on six key checks, suggests caution. The score comes in at 0, meaning Alstom is not undervalued by any traditional measure right now.

However, valuing a company is never quite as simple as following a checklist. Next, I will walk you through the most common valuation techniques used to gauge Alstom’s potential, followed by a perspective at the end that investors often overlook but that could make all the difference.

Alstom scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Alstom Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those amounts back to today. This reflects the time value of money and the risks associated with those cash flows. For Alstom, the latest reported Free Cash Flow is €480.7 million, providing a baseline for these projections.

Analysts anticipate Alstom's annual cash flow to rise, reaching €625 million by 2030. While forecasts from analysts typically extend only five years, Simply Wall St extrapolates projections out to 2035. The growth rate is adjusted to gradually moderate, providing a more comprehensive long-term picture. This approach helps account for cycles in Alstom's rail business and fluctuations in large-scale contracts.

Based on this 2 Stage Free Cash Flow to Equity model, Alstom's estimated intrinsic value is €18.64 per share. However, the DCF calculation suggests the stock is trading at a premium, with the current price sitting 17.7% above what the cash flows would justify. This indicates the market may already be pricing in a lot of positive expectations or future growth ahead of actual results.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Alstom.

Approach 2: Alstom Price vs Earnings

For companies that are profitable, the Price-to-Earnings (PE) ratio remains one of the most widely used valuation tools. It distills the relationship between a stock’s market price and its current earnings, making it easier for investors to assess whether they are paying too much for expected growth or getting a bargain.

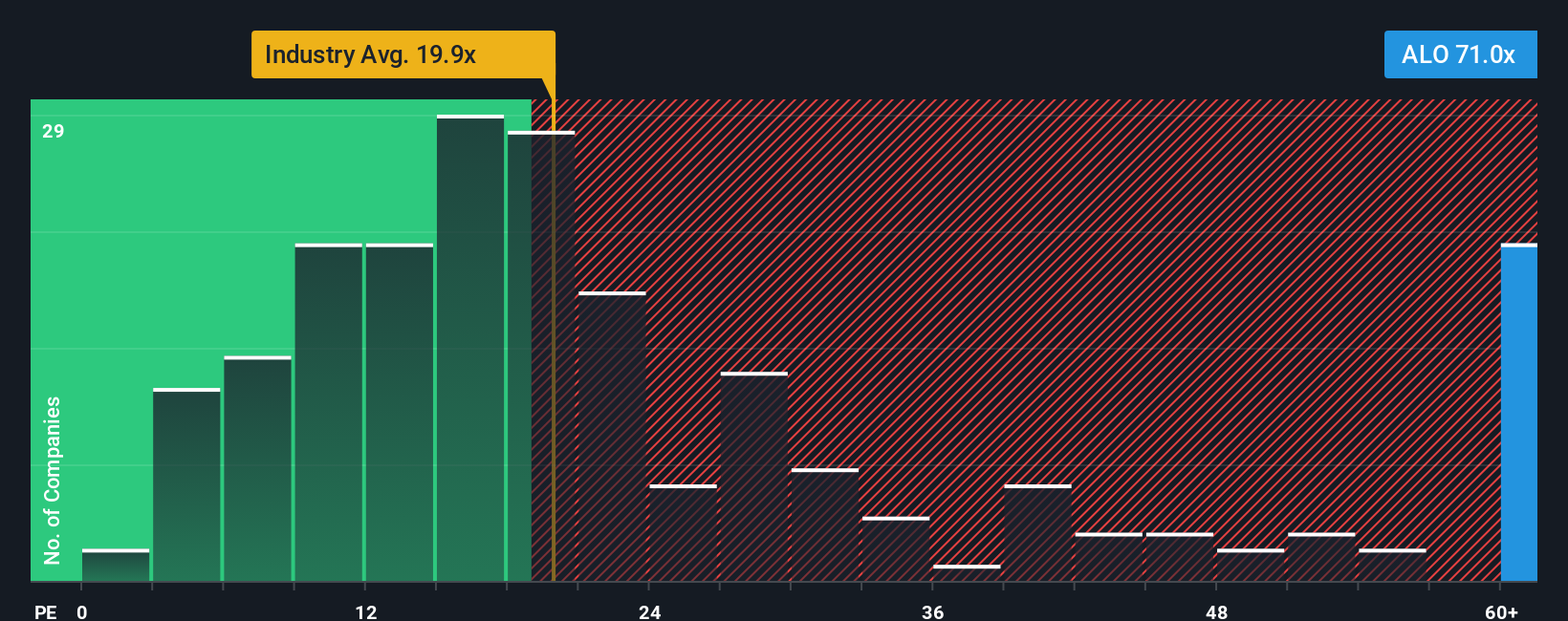

Generally, a higher PE ratio can be justified by stronger growth prospects or lower perceived risks, while a lower PE may reflect slower growth or higher uncertainty. For Alstom, the current PE ratio stands at 71.4x, which is notably above both the Machinery industry average of 24.5x and the average of its closest peers at 16.8x. Even in fast-growing sectors, such a wide premium is worth examining closely.

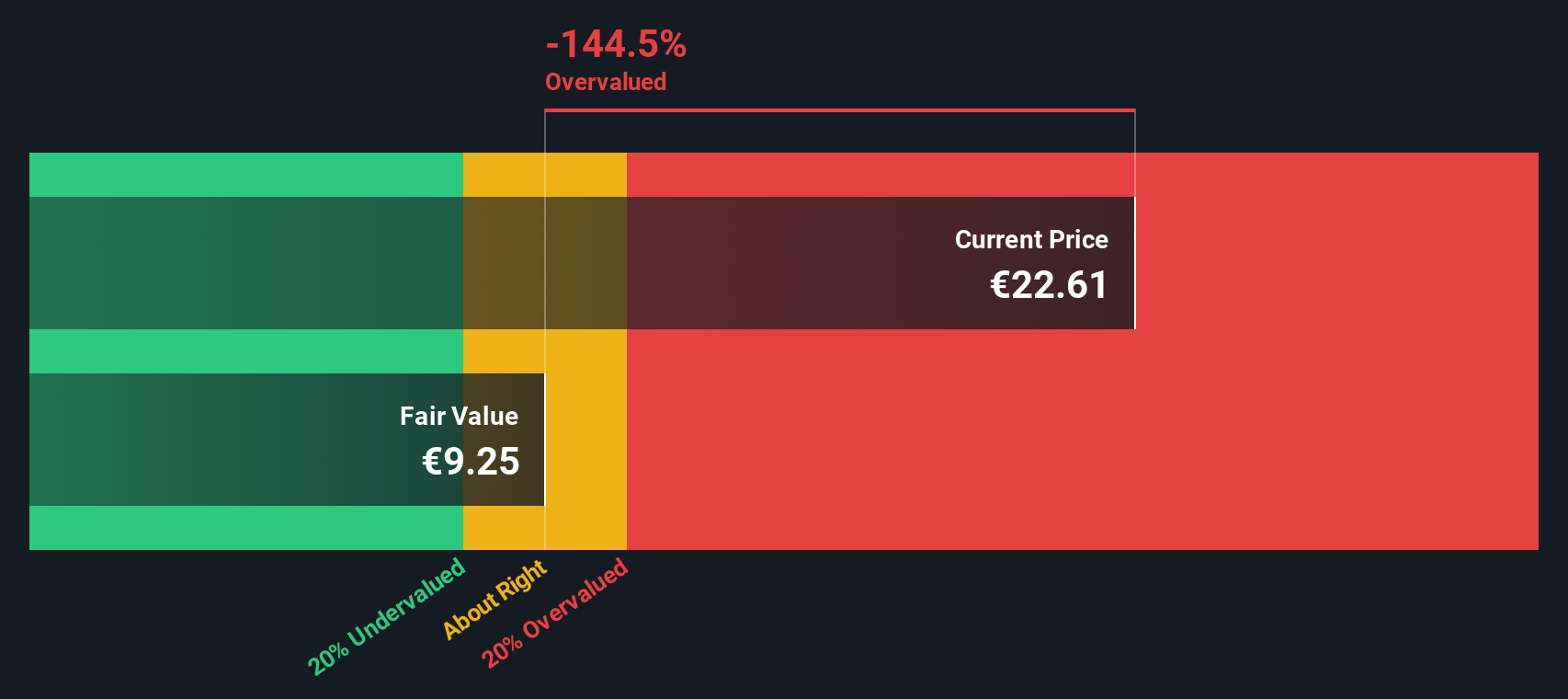

Simply Wall St’s “Fair Ratio” goes deeper than simple benchmarks by factoring in Alstom’s expected earnings growth, profit margins, its specific industry outlook, market capitalization, and perceived risks. This proprietary Fair Ratio represents what would be considered a reasonable PE multiple, adjusting for company-specific fundamentals rather than broad averages. For Alstom, the calculated Fair Ratio is 35.8x, which is roughly half of its current market PE.

Comparing these numbers, Alstom’s PE ratio is substantially higher than the Fair Ratio. This suggests the market may be pricing in considerably more optimism or overlooking risks that the Fair Ratio accounts for.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Alstom Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is simply your story about a company, connecting your view of Alstom’s strengths and risks to specific, transparent financial forecasts such as future revenue, earnings, and margins, which lead directly to your Fair Value estimate.

Narratives make valuation accessible to everyone by letting you add context and logic behind the numbers, so you can compare what you believe with what the market currently prices in. On the Simply Wall St platform, Narratives are at the heart of the Community page. They are used by millions of investors who track their thinking and see it updated live whenever important news or results are released.

By using Narratives, you can see at a glance whether the current share price is above or below your estimated Fair Value, helping you decide when it might be time to buy, sell, or wait. For example, one investor with a bullish Narrative may see Alstom’s fair value at €33.0, while a more cautious peer might think it is just €9.0.

Do you think there's more to the story for Alstom? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALO

Alstom

Provides solutions for rail transport industry in Europe, the Americas, the Asia Pacific, the Middle East, Central Asia, and Africa.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives