Alstom (ENXTPA:ALO) Valuation Spotlight After Major Polish Rail Contract and 30-Year Service Win

Reviewed by Simply Wall St

Alstom (ENXTPA:ALO) just secured a milestone contract, agreeing to deliver 42 Coradia Max double-deck electric trains and 30 years of comprehensive maintenance to PKP Intercity. This deal marks a major boost for the company’s position in Poland and reinforces its long-term service portfolio.

See our latest analysis for Alstom.

Investors have warmed up to Alstom lately, with news of its Polish mega-contract sparking a notable shift in sentiment. The stock is up over 8% in the past week alone. While recent momentum is encouraging, the past year’s total shareholder return sits at just over 3%. This highlights a business with stabilizing prospects but still a long road back from deeper five-year losses.

If this resurgence in rail and infrastructure inspires you, expand your search with our interactive auto manufacturers screener and see what else is gaining traction in global transport: See the full list for free.

Yet with shares rebounding, investors now face a pressing question: has Alstom’s turnaround potential left room for further upside, or is the recent contract win already fully reflected in the current valuation?

Most Popular Narrative: 1.3% Undervalued

According to the most popular narrative, Alstom’s fair value is set at €23.06, just above the latest close of €22.75. This analysis weighs the company’s renewed profitability against its climb back from five-year lows, highlighting a delicate but optimistic shift in sentiment.

Alstom's strategy of focusing on high-quality, margin-accretive orders, especially in Services and Signaling, is expected to improve revenue growth and increase future gross margins. The company is conducting industrial restructuring to optimize its manufacturing setup, which aims to enhance operational efficiency and potentially improve net margins and earnings.

There is more to this story than meets the eye. Which future revenue stream and blockbuster margin forecast underpin this target? Peel back the curtain on the full narrative to see what surprising assumptions drive such a close call in fair value for Alstom.

Result: Fair Value of €23.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain disruptions and lingering low-margin legacy contracts could still hinder Alstom’s path to margin recovery and improved earnings.

Find out about the key risks to this Alstom narrative.

Another View: High Valuation Risks Linger

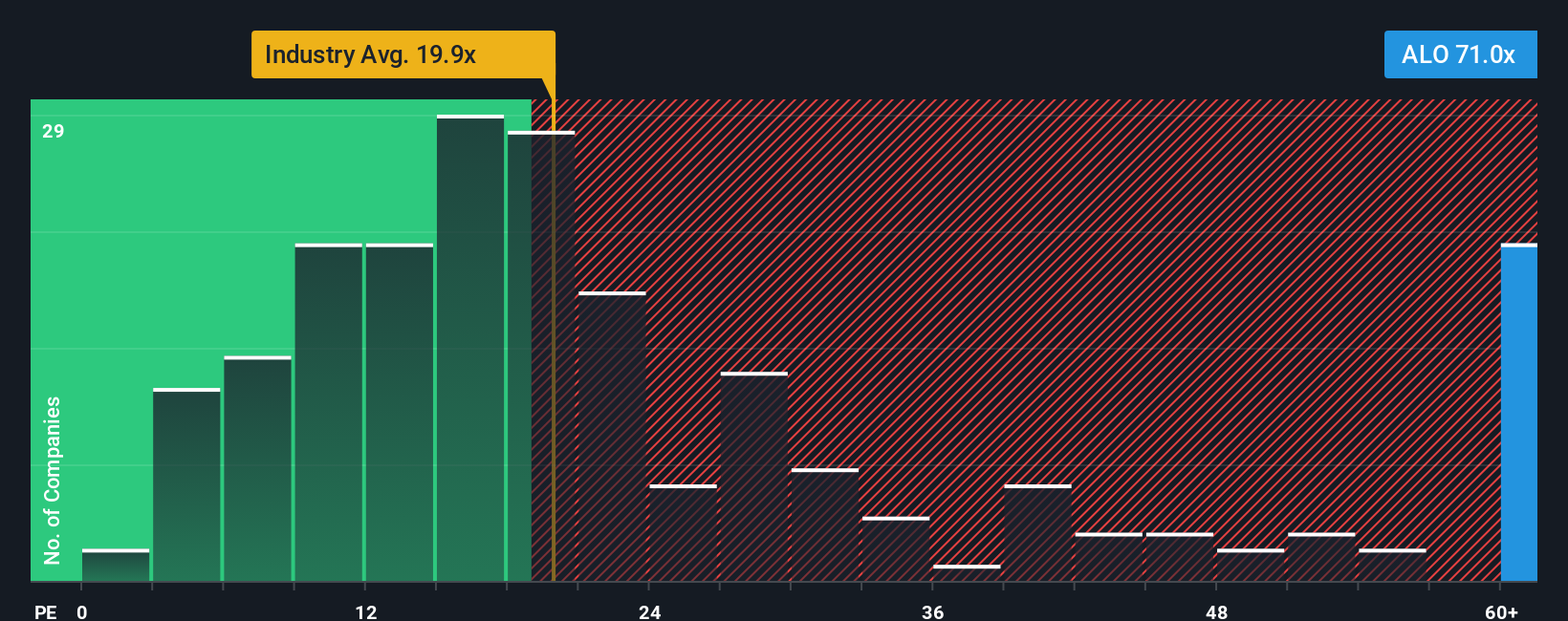

A closer look at Alstom’s price-to-earnings ratio paints a less optimistic picture. The company is trading at 74.3 times earnings, far above the European Machinery industry average of 19.7x and even higher than its fair ratio of 36.7x. This sizable premium could signal valuation risk if investor hopes fall short. Will the market keep rewarding optimism, or could a reversion close the gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alstom Narrative

Not sold on these perspectives or have a different angle on Alstom’s story? Dive into the data yourself and craft a personal viewpoint in just a few minutes. Do it your way

A great starting point for your Alstom research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors stay ahead by scouting fresh opportunities. Don’t let the next breakout slip by. Expand your horizons and act on these proven strategies.

- Capitalize on high yield potential and lock in passive income through these 14 dividend stocks with yields > 3% with robust dividends above 3%.

- Unleash your portfolio’s tech edge by adding artificial intelligence leaders. Jump into these 27 AI penny stocks making waves in automation and disruption.

- Strengthen your position with real value and secure overlooked gems using these 880 undervalued stocks based on cash flows based on solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALO

Alstom

Provides solutions for rail transport industry in Europe, the Americas, the Asia Pacific, the Middle East, Central Asia, and Africa.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives