- France

- /

- Aerospace & Defense

- /

- ENXTPA:AIR

Is Airbus Still Offering Value After 53% Rally and Record Order Book in 2025?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Airbus stock is offering genuine value or just riding the wave, you are in the right place. Let us break it down so you can invest with confidence.

- The stock is up a remarkable 53.0% over the past year and nearly 29% year-to-date, suggesting that investors are seeing both growth potential and perhaps adjusting for risk as market trends shift.

- Recently, news about Airbus' expanding order book and collaborations on next-generation aircraft platforms have captured headlines, reinforcing investor enthusiasm. Developments in sustainable aviation partnerships and commitments from major airlines have only added fuel to the momentum, signaling broader confidence in Airbus' outlook.

- Currently, Airbus scores 4 out of 6 on our valuation checks, but numbers rarely tell the whole story. In the next section, we will unpack how traditional valuation methods stack up for Airbus and point to an even smarter way to think about what this score really means.

Approach 1: Airbus Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them to today's value. This approach is widely used to provide an intrinsic valuation by focusing on the actual money the business is expected to generate, adjusted for the time value of money.

For Airbus, the current Free Cash Flow stands at €3.81 Billion. Analysts anticipate strong momentum, forecasting annual growth and projecting Free Cash Flow to reach approximately €9.45 Billion by 2029. It is important to note that official analyst estimates extend to 2029, while longer-term projections beyond that point are extrapolated. The DCF calculation uses these projections under a two-stage Free Cash Flow to Equity approach to weigh both near-term consensus and longer-term possibilities.

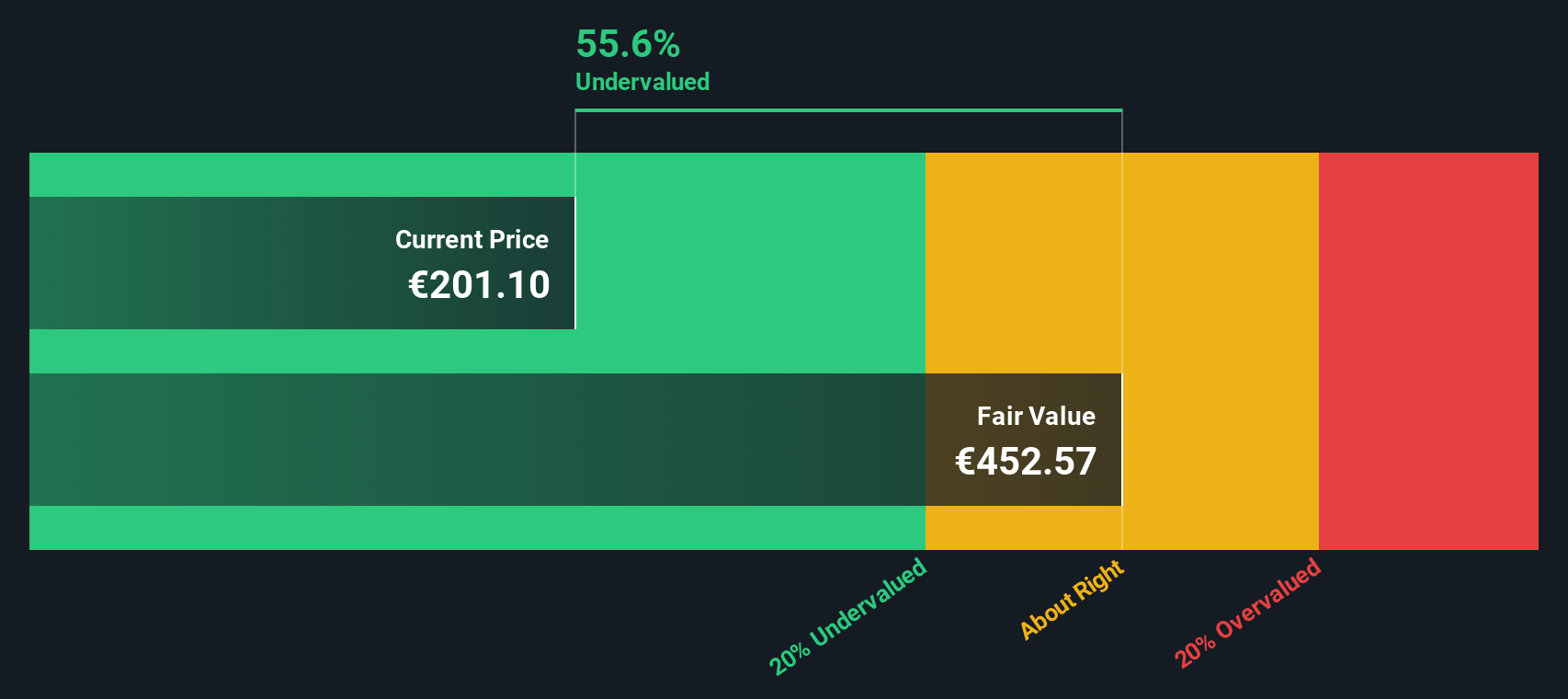

Based on this method, the estimated intrinsic value of Airbus is €329.71 per share. This figure suggests the stock is trading at a 37.4% discount compared to its calculated fair value, indicating it may be undervalued at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Airbus is undervalued by 37.4%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: Airbus Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely recognized valuation tool, especially meaningful for profitable companies like Airbus. Investors often use the PE ratio to gauge how much they are paying for each euro of earnings, making it effective for comparing companies with steady or growing profits.

Growth expectations and perceived risk both play a pivotal role in what constitutes a “normal” or “fair” PE ratio. Fast-growing companies or those with strong competitive advantages generally command higher ratios, while industries facing greater uncertainty or slower growth typically see lower valuations.

Currently, Airbus trades at a PE ratio of 32.18x. This is below both the industry average of 46.70x for Aerospace & Defense and the peer group average of 36.40x. This suggests Airbus is priced more conservatively than many of its rivals. However, benchmarks can only tell part of the story. Simply Wall St’s proprietary "Fair Ratio" for Airbus is estimated at 35.06x, a figure determined by analyzing factors such as projected earnings growth, the company’s profit margin, its market capitalization, operating risks, and its industry context.

The Fair Ratio offers a more nuanced and company-specific perspective compared to blunt peer or industry averages. It blends the unique strengths and risks of Airbus with a wider market context to arrive at a more tailored yardstick for fair value.

Comparing the actual PE ratio of 32.18x to the Fair Ratio of 35.06x suggests Airbus is moderately undervalued by this approach. The gap is substantial enough to lean in favor of value-oriented investors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Airbus Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal story about a company, connecting its real-world context and outlook with your financial projections, such as future revenue, earnings, and margins. This approach allows you to put your assumptions into a concrete fair value.

Narratives help you bridge the gap between numbers and business reality by linking what you believe about Airbus, from growing order books to cost challenges, with a tailored, dynamic valuation model. On Simply Wall St’s Community page, millions of investors use Narratives as an easy, accessible way to visualize and share their perspectives, update forecasts as news or earnings are released, and debate when to buy or sell by comparing their Fair Value to the current Price.

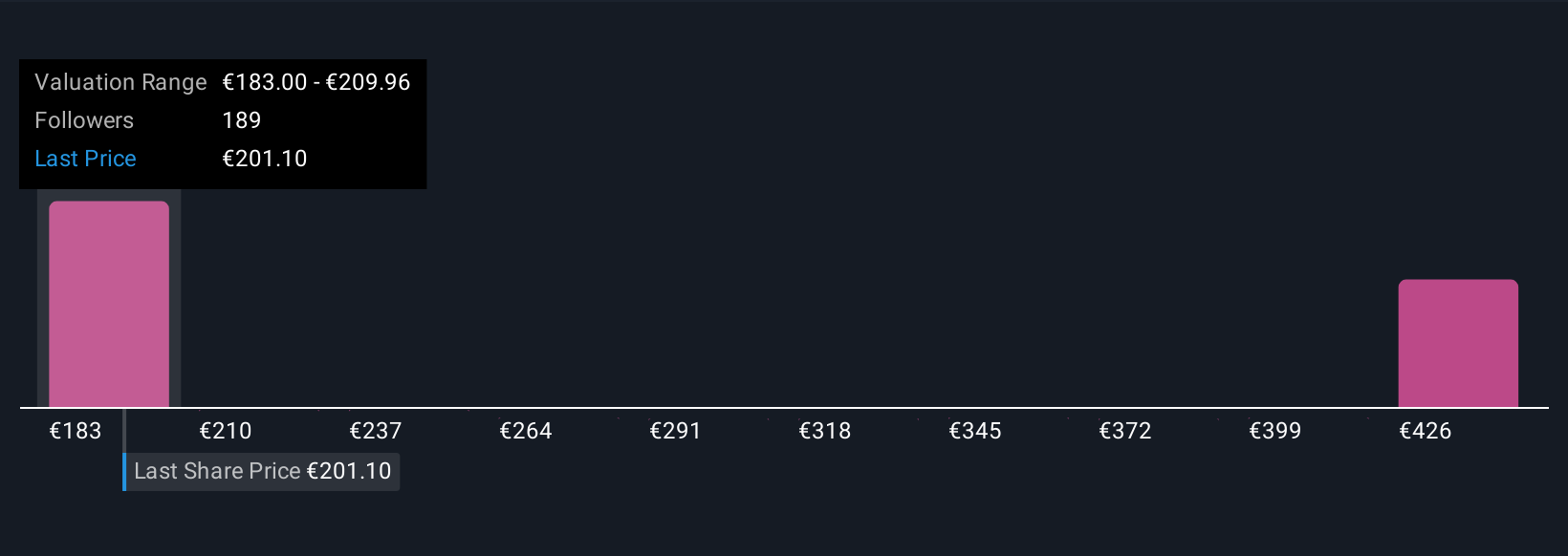

For example, one Airbus Narrative might reflect strong faith in fleet modernization and sustainable aviation, resulting in a bullish fair value as high as €244.0 per share. Another may focus on supply chain stress and macroeconomic risks, coming in as low as €140.0. This gives you a view of how your outlook compares and helps you make decisions more confidently.

Do you think there's more to the story for Airbus? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AIR

Airbus

Engages in the design, manufacture, and delivery of aeronautics and aerospace products, services, and solutions worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives