- France

- /

- Aerospace & Defense

- /

- ENXTPA:AIR

Is Airbus Still Attractive After a 52% Surge and Strong Cash Flow Outlook?

Reviewed by Bailey Pemberton

If you are wondering what to do with Airbus stock right now, you are not alone. With shares closing recently at 208.45 and an impressive 51.7% gain over the past year, investors are grappling with the classic dilemma: keep riding the rally or lock in profits? Over the past five years, Airbus has soared 256.4%, showing resilience and recovery momentum as global travel demand steadily returns. Just in the last month, the stock is up 6.5%, and it has climbed 4.0% in the last week alone.

Several recent developments continue to shape investor sentiment. The industry has benefited from major upticks in aircraft orders and a bullish outlook on aviation recovery, with Airbus regularly making headlines for securing new contracts and expanding its production capacity. There are also ongoing discussions about sustainability investments and technology partnerships, both of which are boosting confidence in Airbus’s growth story and potential competitive edge.

But is the stock still attractively valued at these levels? According to our scorecard, Airbus is undervalued in 5 out of 6 key checks, giving it a robust value score of 5. In the coming sections, we will break down how we arrive at that score using different valuation approaches. Plus, stay tuned for a perspective on valuation that might change how you weigh the numbers altogether.

Approach 1: Airbus Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and discounting them back to today’s value. In Airbus’s case, the model draws on both analyst forecasts and extrapolated estimates to map expected Free Cash Flow (FCF) well into the next decade, all denominated in euros (€).

Currently, Airbus generates €2.7 billion in Free Cash Flow over the last twelve months. Analyst projections see this figure growing rapidly, with 2029 FCF estimated at €11.6 billion. Looking even further, extrapolated data shows FCF potentially surpassing €20 billion by 2035. This suggests a robust growth trajectory backed by momentum in the aerospace sector.

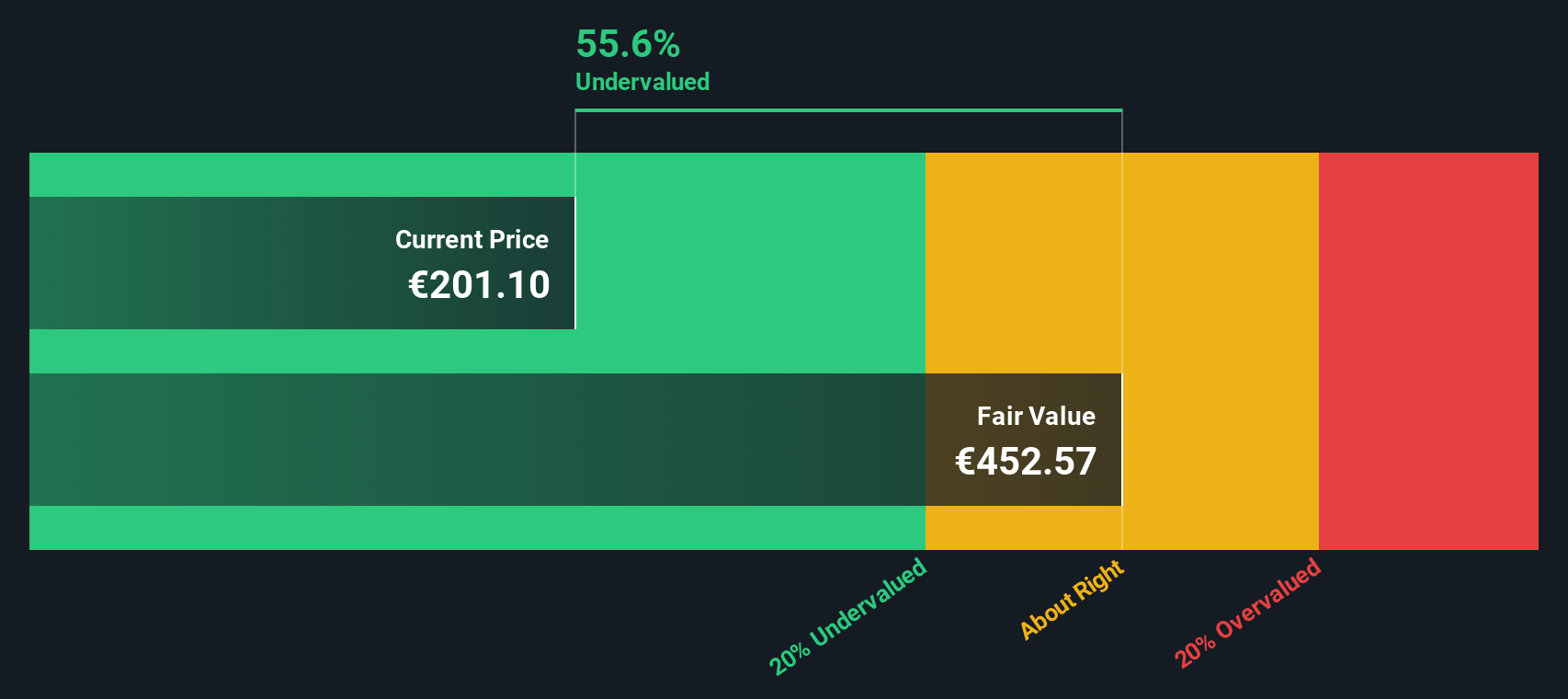

The DCF model calculates Airbus’s intrinsic value at €445.60 per share. This implies the stock is currently trading at a 53.2% discount to its fair value based on these cash flow projections. This considerable gap indicates that Airbus shares are significantly undervalued compared to what its underlying cash generation potential suggests.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Airbus is undervalued by 53.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Airbus Price vs Earnings

The price-to-earnings (PE) ratio is a widely used valuation metric for established, profitable companies like Airbus. Because it directly reflects what investors are willing to pay for each euro of earnings, the PE ratio helps gauge market sentiment and expectations for future growth.

What counts as a “normal” or fair PE ratio depends on a company’s growth prospects and perceived risk. Higher expected growth or lower risk typically justifies elevated PE multiples, while slower growth or heightened uncertainty often pulls them down.

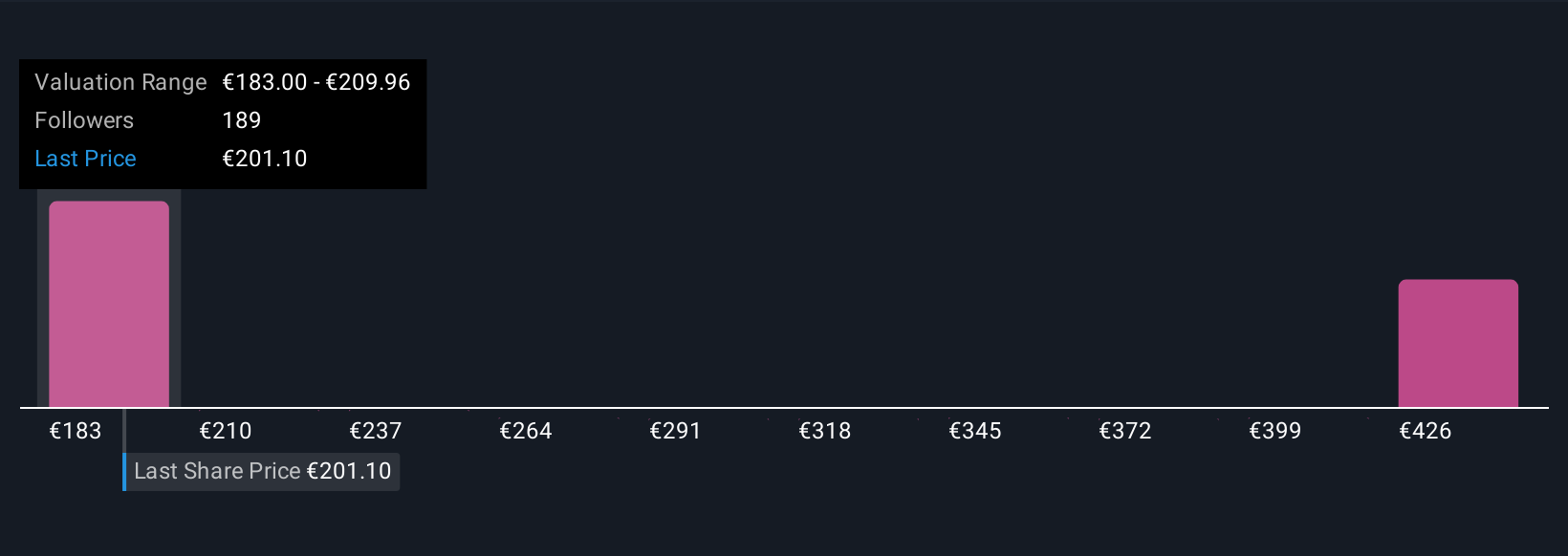

Airbus currently trades at a PE ratio of 33.44x. That sits comfortably below the Aerospace and Defense industry average of 47.54x, and also underperforms the peer group average of 35.96x. However, instead of relying solely on these broad benchmarks, Simply Wall St calculates a more nuanced measure called our Fair Ratio. Airbus’s Fair Ratio stands at 34.77x, which blends key factors unique to Airbus such as its earnings growth outlook, profit margins, industry norms, market capitalization, and risk profile. This approach offers a much clearer picture than simple industry or peer comparisons, as it holistically weighs the company’s upside and challenges.

Given that Airbus’s current PE ratio is just slightly below its Fair Ratio, the stock appears to be ABOUT RIGHT on this fundamental basis.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Airbus Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or perspective explaining why you believe a company like Airbus is worth a certain amount, based on your expectations for its future revenue, earnings, and profit margins.

Narratives help you connect the dots between the company’s journey, your assumptions about its financial future, and a fair value for its shares. It is a straightforward and dynamic tool available to everyone on the Simply Wall St platform, built right into the Community page used by millions of investors.

With Narratives, you can clearly see how your version of Airbus’s story stacks up. Are you optimistic about order growth and decarbonization, or do current risks around supply chains and costs matter more to you? By tying your projected fair value to the current share price, Narratives make it easy to decide whether it might be time to buy, hold, or sell.

Narratives automatically update when new information or news arrives, allowing you to adjust your view as the facts change. For example, some investors see a future fair value for Airbus as high as €244.0, expecting robust demand and margin gains, while others are more cautious, setting targets as low as €140.0 to reflect ongoing production and supply challenges.

Do you think there's more to the story for Airbus? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AIR

Airbus

Engages in the design, manufacture, and delivery of aeronautics and aerospace products, services, and solutions worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives