- France

- /

- Aerospace & Defense

- /

- ENXTPA:AIR

Airbus (ENXTPA:AIR) Valuation in Focus After A321XLR U.S. Commercial Launch Spurs Market Buzz

Reviewed by Simply Wall St

Airbus (ENXTPA:AIR) is back in the spotlight as American Airlines made headlines for becoming the first U.S. carrier to receive and schedule flights with the new Airbus A321XLR. This major delivery has sparked heightened interest among investors and industry watchers.

See our latest analysis for Airbus.

Airbus shares have caught a solid updraft this year, with a 30% share price return year-to-date and an impressive 52% total shareholder return over the past twelve months. Momentum is clearly building, thanks not only to marquee deliveries like the A321XLR debut with American Airlines but also to headline-making moves such as the planned merger of European satellite operations and steady order wins from major global carriers. The latest share price of $208.45 puts Airbus near its highs, driven by both robust short-term trading and long-term confidence in its expanding aerospace footprint.

If the action in aerospace has you watching the sector closely, consider exploring more leaders and up-and-comers with our See the full list for free.

But after such a remarkable run, are investors underestimating Airbus’ long-term growth potential? Alternatively, is all the good news already reflected in the price, leaving little room for upside from here?

Most Popular Narrative: Fairly Valued

At a recent close of €208.45, Airbus trades just above the narrative's fair value of €204.75. This tepid difference signals widespread agreement on where the company should be priced right now, setting the stage for a deeper look at the drivers and assumptions behind this consensus view.

Long-term industry tailwinds are expected to bolster Airbus’s order book and production forecasts, offering confidence in future growth projections. Upward price target adjustments suggest positive sentiment around margin expansion and execution of the existing backlog.

Want the numbers behind this tight consensus? Find the single forecast that drives bullish projections and the controversial margin assumption that could tip the scale either way. Discover why analyst disagreement is rising and what it means for the future value of Airbus.

Result: Fair Value of $204.75 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain bottlenecks or a downturn in global travel demand could quickly challenge the current optimism regarding Airbus’s growth outlook.

Find out about the key risks to this Airbus narrative.

Another View: What About Cash Flow?

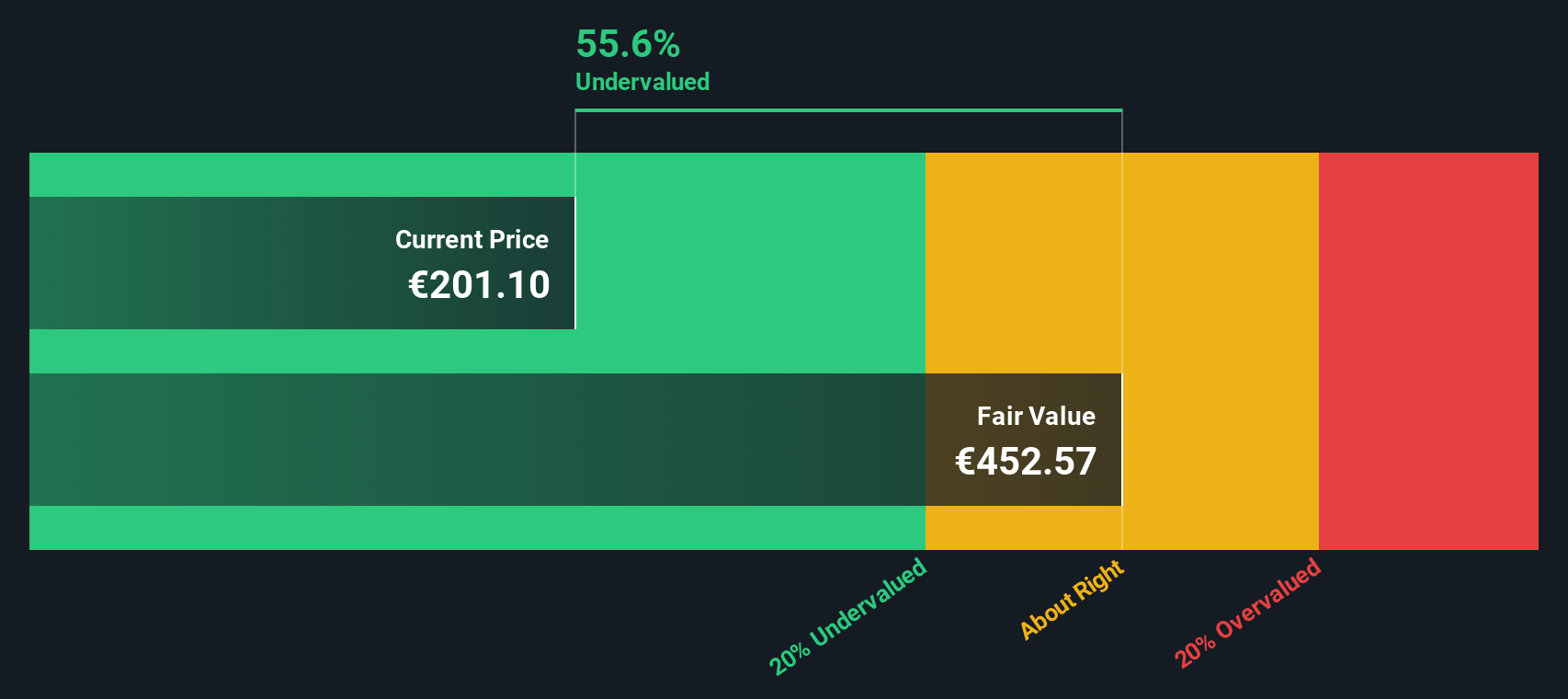

While most analysts see Airbus as fairly valued based on its price versus predicted earnings, our DCF model tells a very different story. The SWS DCF model estimates Airbus's fair value at €445.48 per share, which is more than double the current market price. That signals substantial undervaluation by this method. Could the biggest risk be missing a bigger upside?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Airbus Narrative

If the current narrative does not match your perspective or you prefer hands-on analysis, explore the data to quickly craft your own take in just a few minutes with our Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Airbus.

Looking for more investment ideas?

Smart investors never settle for one opportunity. Get ahead of the next big trend by expanding your research with these high-potential stock lists from Simply Wall Street:

- Uncover strong income streams by checking out these 17 dividend stocks with yields > 3% that consistently provide yields above 3% for stable, reliable returns.

- Ride the innovation wave and stay at the forefront of technology with these 27 AI penny stocks offering exposure to companies shaping the future of artificial intelligence.

- Find hidden value opportunities among these 868 undervalued stocks based on cash flows poised for growth based on robust cash flow fundamentals. Don’t let these bargains pass you by.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AIR

Airbus

Engages in the design, manufacture, and delivery of aeronautics and aerospace products, services, and solutions worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives