Three Euronext Paris Dividend Stocks With Yields From 3% To 4%

Reviewed by Simply Wall St

Amid a backdrop of fluctuating global markets, France's CAC 40 Index has shown resilience, posting modest gains as investors respond to broader economic signals such as easing U.S. inflation rates. In this context, selecting dividend stocks from the Euronext Paris with yields ranging from 3% to 4% could appeal to those looking for potential stability and steady income streams in their investment portfolios.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Rubis (ENXTPA:RUI) | 7.03% | ★★★★★★ |

| Samse (ENXTPA:SAMS) | 9.73% | ★★★★★★ |

| CBo Territoria (ENXTPA:CBOT) | 6.86% | ★★★★★★ |

| Métropole Télévision (ENXTPA:MMT) | 9.75% | ★★★★★☆ |

| Teleperformance (ENXTPA:TEP) | 3.44% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.16% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 4.00% | ★★★★★☆ |

| Sanofi (ENXTPA:SAN) | 3.98% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.32% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 8.73% | ★★★★★☆ |

Click here to see the full list of 38 stocks from our Top Euronext Paris Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

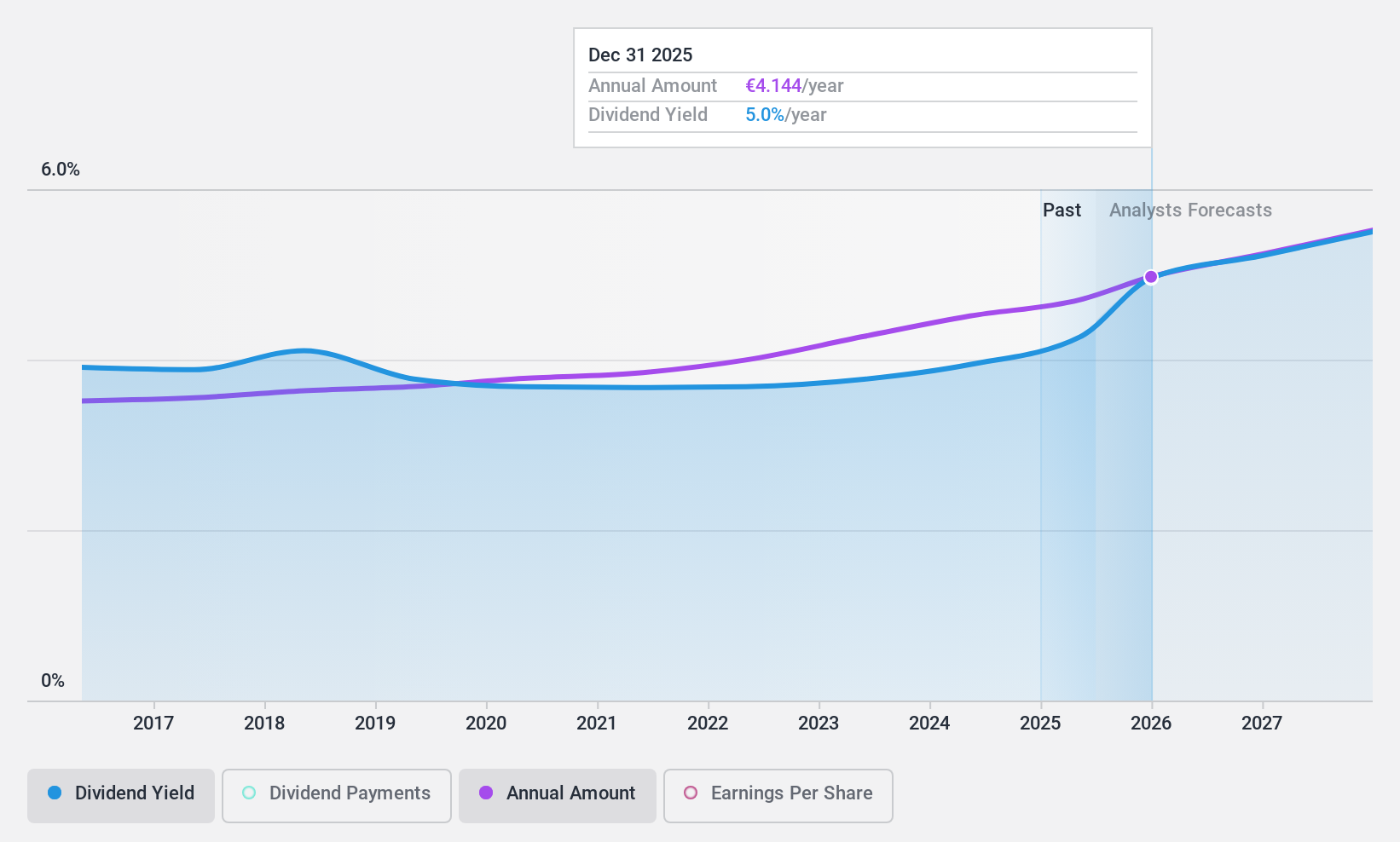

Sanofi (ENXTPA:SAN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sanofi is a global healthcare company involved in researching, developing, manufacturing, and marketing therapeutic solutions, with a market capitalization of approximately €118.01 billion.

Operations: Sanofi generates €38.12 billion from its Biopharma segment and €5.21 billion from Consumer Healthcare.

Dividend Yield: 4%

Sanofi, a prominent player in the global healthcare sector, offers a steady dividend yield of 3.98%, slightly below the top quartile for French market dividends. Despite lower profit margins this year at 9.8% compared to last year's 18.1%, Sanofi maintains a sustainable dividend with an earnings payout ratio of 87.2% and cash payout ratio at 65%. The company has consistently increased its dividends over the past decade, ensuring reliability for investors seeking stable income streams from their investments in healthcare stocks.

- Get an in-depth perspective on Sanofi's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Sanofi's current price could be quite moderate.

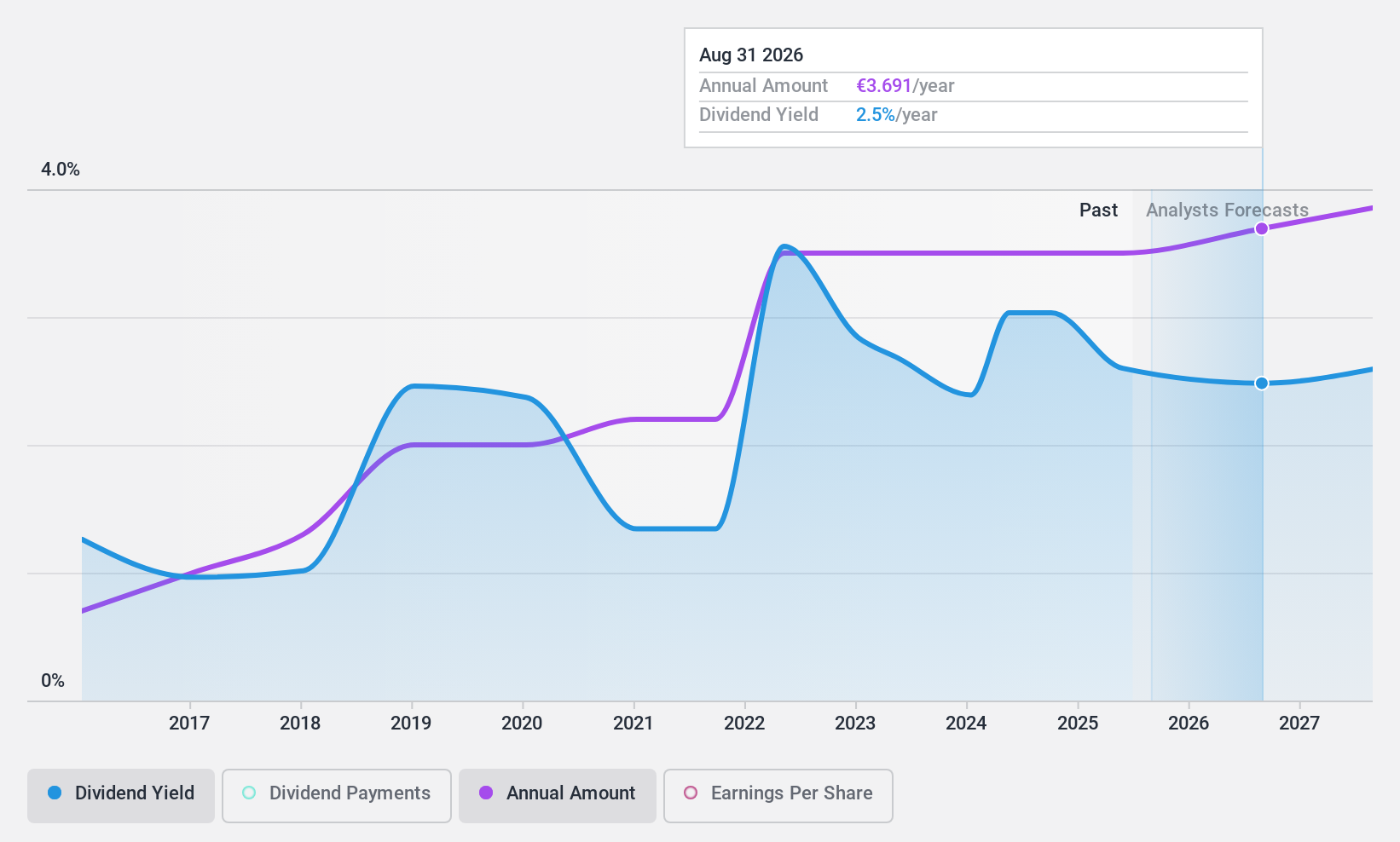

Trigano (ENXTPA:TRI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Trigano S.A. designs, manufactures, and markets leisure vehicles for both individual and professional use across Europe, with a market capitalization of approximately €2.23 billion.

Operations: Trigano S.A. generates €3.59 billion from leisure vehicles and €188.90 million from leisure equipment sales.

Dividend Yield: 3%

Trigano's dividend yield stands at 3.04%, which is below the French market's top quartile average of 5.28%. Despite a low payout ratio of 18.4%, indicating potential sustainability, its dividends are poorly covered by both earnings and cash flows, with an extremely high cash payout ratio of 8451.5%. Recent financials show strong performance with a significant increase in net income and sales, yet analysts forecast a decrease in earnings by an average of 5.4% annually over the next three years. Dividends have been stable for the past decade, reflecting reliability despite financial inconsistencies.

- Navigate through the intricacies of Trigano with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Trigano is trading behind its estimated value.

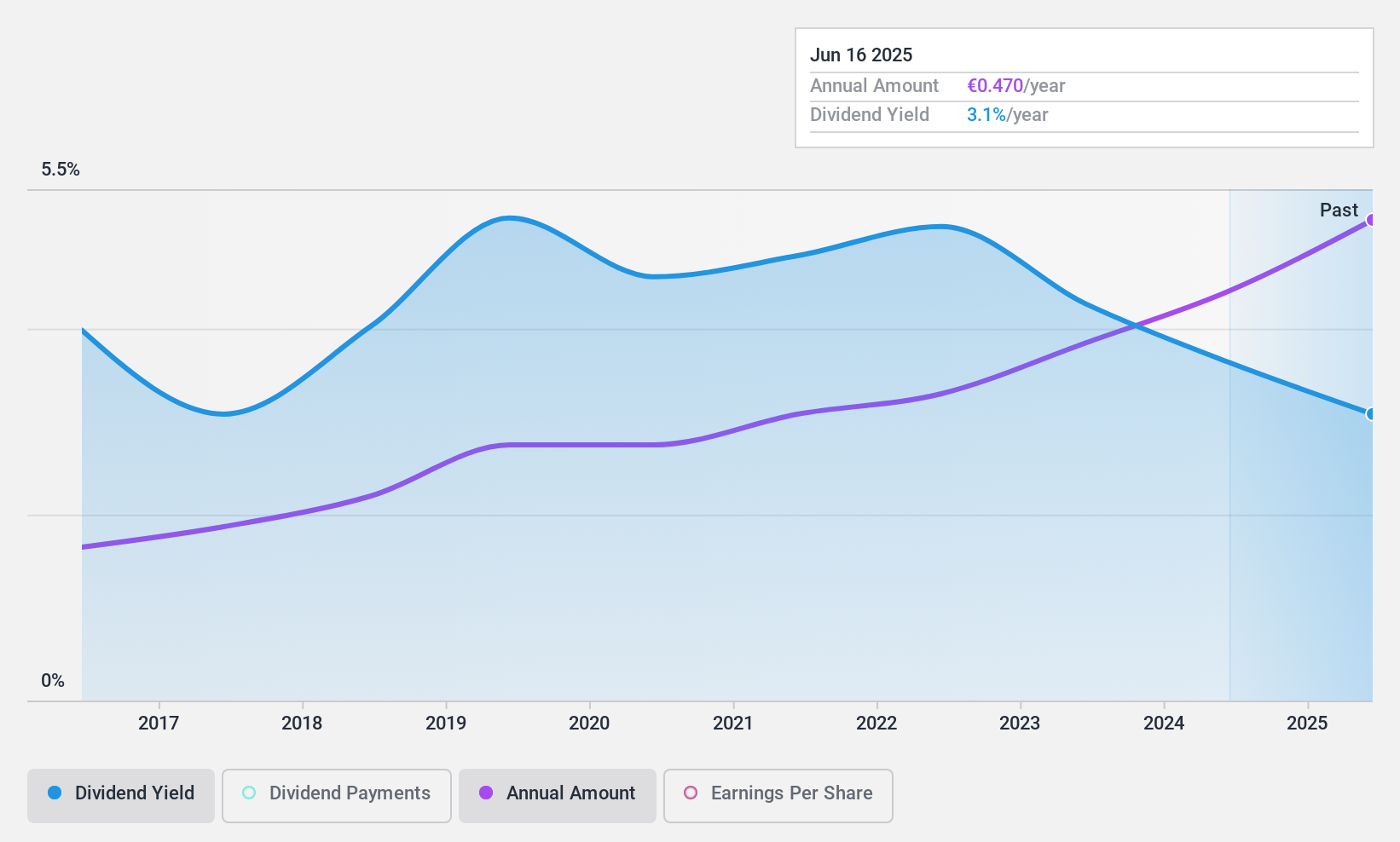

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: VIEL & Cie société anonyme is an investment company operating in interdealer broking, online trading, and private banking across Europe, the Middle East, Africa, the Americas, and Asia-Pacific with a market capitalization of approximately €0.61 billion.

Operations: VIEL & Cie société anonyme generates revenue primarily through professional intermediation at €1.01 billion and online trading, contributing €65.12 million.

Dividend Yield: 4%

VIEL & Cie has demonstrated a consistent dividend track record, with payments growing steadily over the last decade. Its current 4% dividend yield is below the top quartile of French dividend stocks, which averages 5.28%. However, its dividends are well-supported financially, evidenced by a low payout ratio of 25.8% and an even lower cash payout ratio of 20.1%, ensuring sustainability from both earnings and cash flow perspectives. The stock is also trading at a significant discount to its estimated fair value, marked at 31.3% below par.

- Take a closer look at VIEL & Cie société anonyme's potential here in our dividend report.

- Upon reviewing our latest valuation report, VIEL & Cie société anonyme's share price might be too pessimistic.

Turning Ideas Into Actions

- Unlock our comprehensive list of 38 Top Euronext Paris Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SAN

Sanofi

A healthcare company, engages in the research, development, manufacture, and marketing of therapeutic solutions in the United States, Europe, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives