- France

- /

- Auto Components

- /

- ENXTPA:OPM

Is Compagnie Plastic Omnium SA's (EPA:POM) High P/E Ratio A Problem For Investors?

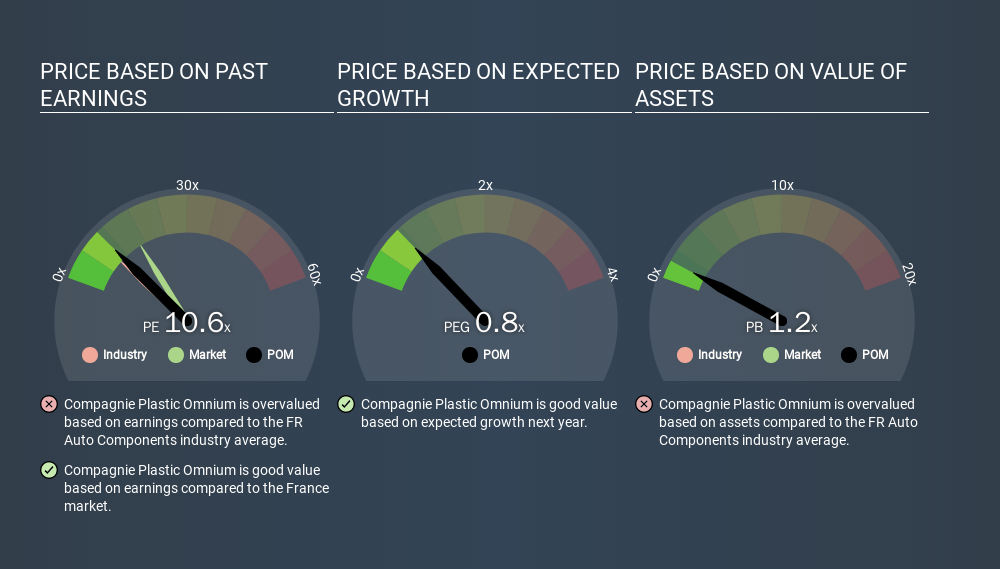

This article is for investors who would like to improve their understanding of price to earnings ratios (P/E ratios). We'll look at Compagnie Plastic Omnium SA's (EPA:POM) P/E ratio and reflect on what it tells us about the company's share price. Compagnie Plastic Omnium has a price to earnings ratio of 10.60, based on the last twelve months. In other words, at today's prices, investors are paying €10.60 for every €1 in prior year profit.

Check out our latest analysis for Compagnie Plastic Omnium

How Do You Calculate A P/E Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Price per Share ÷ Earnings per Share (EPS)

Or for Compagnie Plastic Omnium:

P/E of 10.60 = €18.725 ÷ €1.766 (Based on the trailing twelve months to December 2019.)

(Note: the above calculation results may not be precise due to rounding.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio means that investors are paying a higher price for each €1 of company earnings. That isn't necessarily good or bad, but a high P/E implies relatively high expectations of what a company can achieve in the future.

How Does Compagnie Plastic Omnium's P/E Ratio Compare To Its Peers?

The P/E ratio indicates whether the market has higher or lower expectations of a company. You can see in the image below that the average P/E (9.4) for companies in the auto components industry is lower than Compagnie Plastic Omnium's P/E.

That means that the market expects Compagnie Plastic Omnium will outperform other companies in its industry. Shareholders are clearly optimistic, but the future is always uncertain. So further research is always essential. I often monitor director buying and selling.

How Growth Rates Impact P/E Ratios

If earnings fall then in the future the 'E' will be lower. That means unless the share price falls, the P/E will increase in a few years. Then, a higher P/E might scare off shareholders, pushing the share price down.

Compagnie Plastic Omnium saw earnings per share decrease by 51% last year. But EPS is up 3.0% over the last 5 years. And EPS is down 5.8% a year, over the last 3 years. This might lead to low expectations.

Remember: P/E Ratios Don't Consider The Balance Sheet

Don't forget that the P/E ratio considers market capitalization. That means it doesn't take debt or cash into account. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

So What Does Compagnie Plastic Omnium's Balance Sheet Tell Us?

Compagnie Plastic Omnium's net debt is 22% of its market cap. This could bring some additional risk, and reduce the number of investment options for management; worth remembering if you compare its P/E to businesses without debt.

The Bottom Line On Compagnie Plastic Omnium's P/E Ratio

Compagnie Plastic Omnium's P/E is 10.6 which is below average (17.0) in the FR market. Since it only carries a modest debt load, it's likely the low expectations implied by the P/E ratio arise from the lack of recent earnings growth.

Investors should be looking to buy stocks that the market is wrong about. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. So this free report on the analyst consensus forecasts could help you make a master move on this stock.

You might be able to find a better buy than Compagnie Plastic Omnium. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTPA:OPM

OPmobility

Designs and produces intelligent exterior systems, customized complex modules, lighting systems, energy storage systems, and electrification solutions for all mobility players in Europe, North America, China, rest of Asia, South America, the Middle East, and Africa.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)