- France

- /

- Auto Components

- /

- ENXTPA:ML

Did Weaker Nine-Month Sales and Lower Guidance Just Shift Michelin’s (ENXTPA:ML) Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this week, Compagnie Générale des Établissements Michelin Société en commandite par actions reported group sales of €19.28 billion for the nine months ended September 30, 2025, down from €20.17 billion a year earlier.

- This sales decrease, tied to market contractions and heightened competition in North America and Europe, prompted Michelin to revise its full-year guidance downward and lower profit forecasts.

- We'll assess how this sales decline and revised outlook impact Michelin's longer-term growth story and investment considerations.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Compagnie Générale des Établissements Michelin Société en commandite par actions Investment Narrative Recap

To be a shareholder in Compagnie Générale des Établissements Michelin Société en commandite par actions, you need to believe in the company’s ability to recover margins and drive growth amid market contractions and intense competition, especially in North America and Europe. While this week’s guidance downgrade highlights the ongoing margin risk from low-cost competitors and softer OE demand, it does not meaningfully alter the importance of restructuring efforts as the most immediate margin catalyst, and sustaining competitiveness remains the core short-term risk.

One recent announcement with direct relevance is the new €400,000,000 share buyback program (October 2025), an initiative that will see all repurchased shares cancelled. Such actions can support shareholder value even as earnings pressure persists, though the underlying challenge remains boosting operating performance in the face of cyclical and structural headwinds.

Yet, in contrast to margin-recovery efforts, investors should be aware of the ongoing threat from low-cost imports eroding market share and pricing power in...

Compagnie Générale des Établissements Michelin Société en commandite par actions' narrative projects €29.1 billion revenue and €2.9 billion earnings by 2028. This requires 2.9% yearly revenue growth and a €1.3 billion earnings increase from €1.6 billion today.

Uncover how Compagnie Générale des Établissements Michelin Société en commandite par actions' forecasts yield a €31.36 fair value, a 12% upside to its current price.

Exploring Other Perspectives

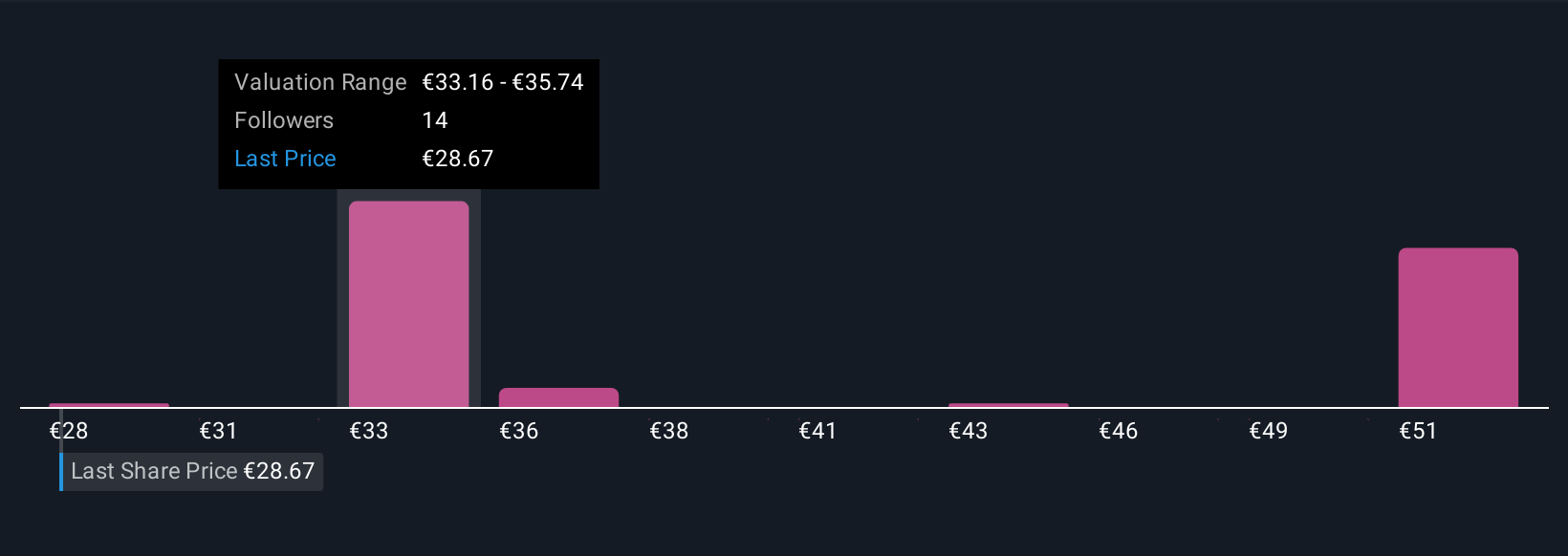

Simply Wall St Community members’ fair value estimates for Michelin range widely from €28.00 to €73.47, incorporating four distinct perspectives. Ongoing pressures in North American and European markets continue to drive debate about margin recovery and long-term revenue growth.

Explore 4 other fair value estimates on Compagnie Générale des Établissements Michelin Société en commandite par actions - why the stock might be worth just €28.00!

Build Your Own Compagnie Générale des Établissements Michelin Société en commandite par actions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Compagnie Générale des Établissements Michelin Société en commandite par actions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Compagnie Générale des Établissements Michelin Société en commandite par actions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Compagnie Générale des Établissements Michelin Société en commandite par actions' overall financial health at a glance.

No Opportunity In Compagnie Générale des Établissements Michelin Société en commandite par actions?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ML

Compagnie Générale des Établissements Michelin Société en commandite par actions

Engages in the manufacture and sale of tires worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion