- France

- /

- Auto Components

- /

- ENXTPA:ML

Assessing Michelin Shares as Innovation in EV Partnerships Drives Investor Interest in 2025

Reviewed by Bailey Pemberton

- Curious about whether Compagnie Générale des Établissements Michelin Société en commandite par actions is undervalued, overhyped, or a rare find in today’s market? You are in the right place to break down what really matters for investors like you.

- The stock price has been steady over the past week, but gained 4.9% during the last month. Year-to-date it has slipped by 11.6%. Longer term investors have seen a 22.1% gain over three years and 26.3% over five years, despite a 5.4% dip in the past twelve months.

- Recent headlines around Michelin have spotlighted the company’s ongoing innovation in sustainable mobility and strategic partnerships with EV manufacturers. Industry observers have paid close attention as Michelin prioritizes environmental responsibility, which has kept investors watching for signals of long-term growth or new risks.

- Right now, Michelin clocks in with a valuation score of 3 out of 6 on our undervaluation checks. Let’s walk through the standard valuation approaches next, and stick around because we will explore an even better way to understand what the numbers are telling us at the end.

Approach 1: Compagnie Générale des Établissements Michelin Société en commandite par actions Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and discounting them back to today’s value. This method helps investors understand whether a stock is trading above or below what its future cash generation potential is actually worth.

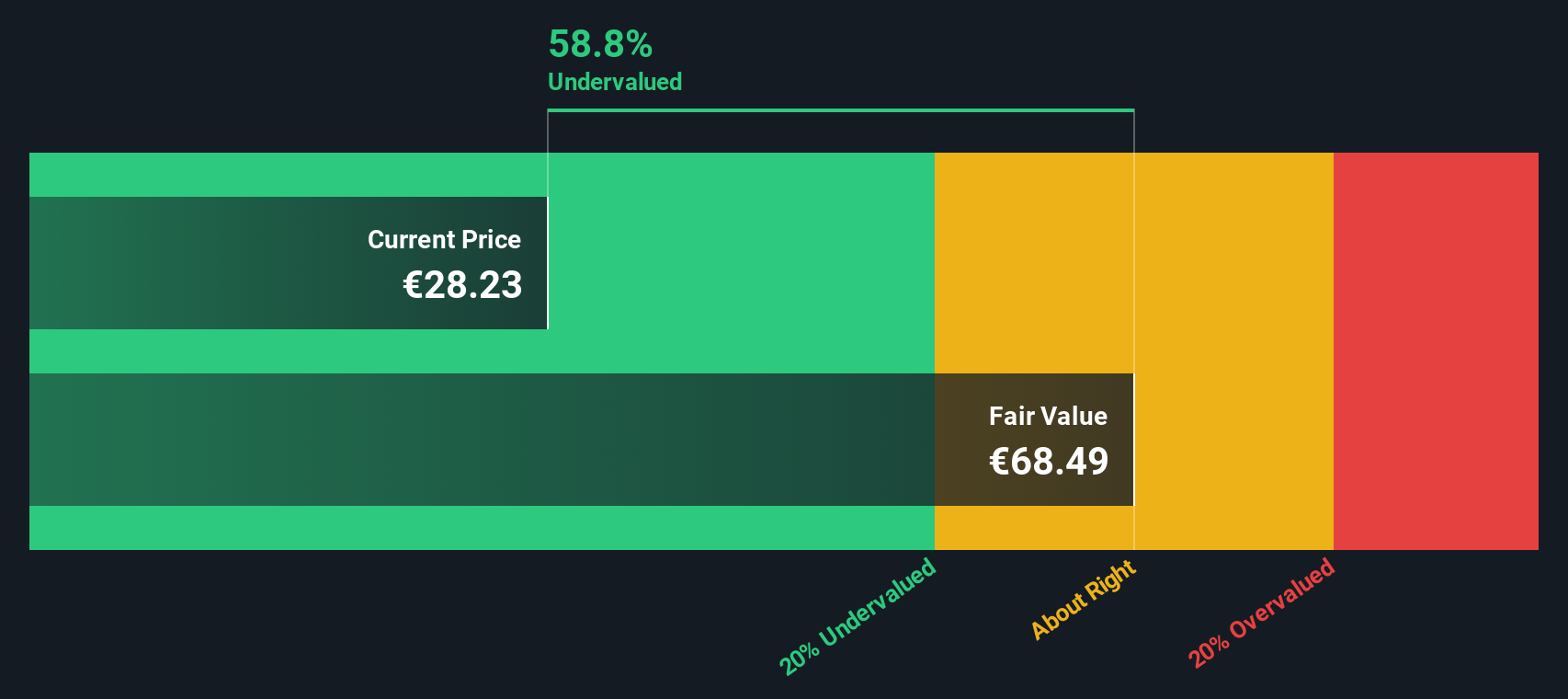

For Michelin, the most recent reported Free Cash Flow (FCF) came in at approximately €1.36 billion. According to analysts, this figure is expected to rise steadily over the next decade, reaching around €3.24 billion by 2029. Estimates for the years beyond 2029 are extrapolated based on current growth trends, providing a longer-term picture despite the limit of direct analyst forecasts. All cash flows are presented in euros.

Applying the DCF approach, the estimated fair value for Michelin shares is €68.71. This valuation suggests Michelin is currently trading at a substantial discount, approximately 58.6% below its intrinsic value as calculated through projected cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Compagnie Générale des Établissements Michelin Société en commandite par actions is undervalued by 58.6%. Track this in your watchlist or portfolio, or discover 886 more undervalued stocks based on cash flows.

Approach 2: Compagnie Générale des Établissements Michelin Société en commandite par actions Price vs Earnings

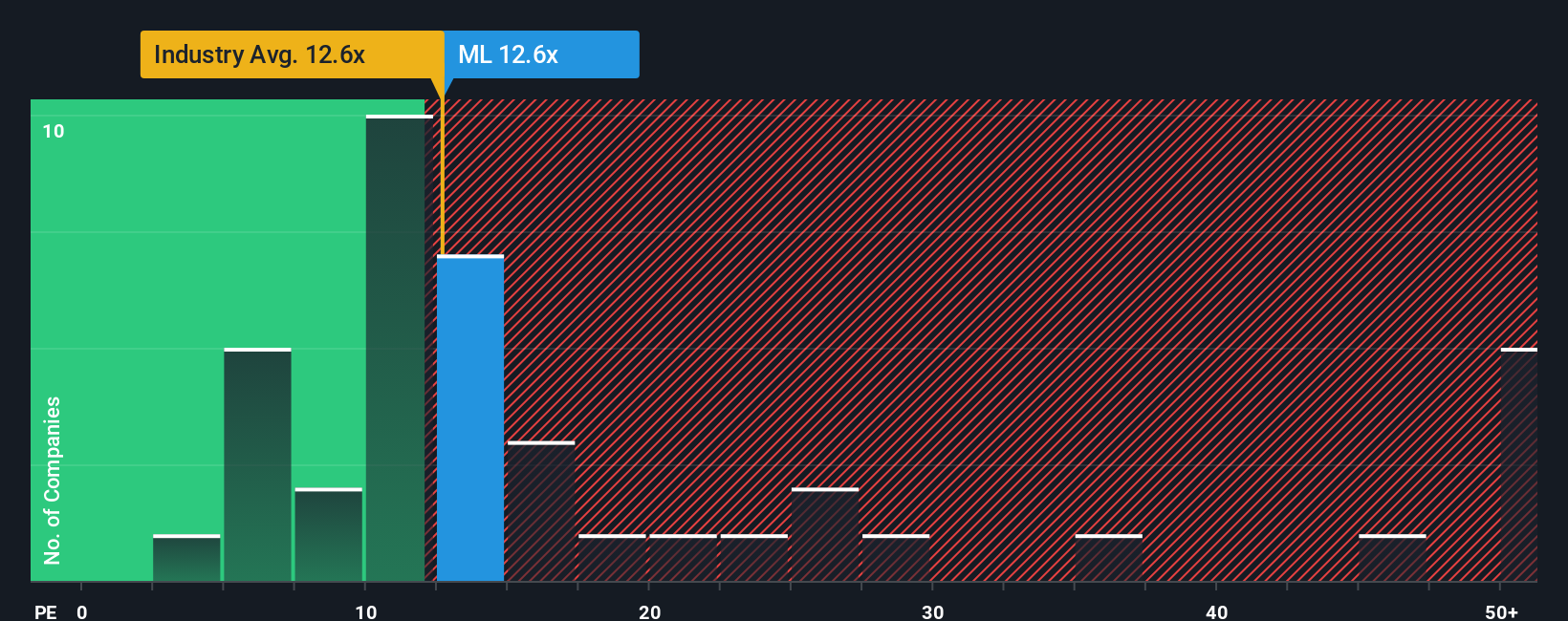

For profitable companies like Michelin, the Price-to-Earnings (PE) ratio is a widely used metric to assess valuation. The PE ratio is meaningful because it shows how much investors are willing to pay for each euro of current earnings, making it a go-to measure for established businesses with consistent profitability.

The “right” PE ratio is influenced by a company’s growth prospects and risk profile. Fast-growing, stable businesses usually deserve a higher multiple, while lower-growth or riskier names may warrant a discount.

Michelin’s current PE ratio stands at 12.7x. When stacked against competitors, this is below the peer average of 16.5x and the Auto Components industry average of 20.6x. A glance at these numbers might suggest the shares are attractively priced, but raw comparisons can miss important context.

That is where the Simply Wall St Fair Ratio comes in. This proprietary benchmark adjusts for Michelin’s specific earnings growth rates, market cap, profit margins, industry factors, and risk. It offers a more personalized assessment. For Michelin, the Fair PE Ratio is calculated at 12.0x. This nuanced approach helps investors avoid surface-level traps by providing a targeted view on valuation rather than only relying on broad industry averages or peer groupings.

Comparing Michelin’s actual PE ratio to the Fair Ratio shows they are very close, with just a 0.7x difference. This means the stock price aligns with company fundamentals and expectations.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Compagnie Générale des Établissements Michelin Société en commandite par actions Narrative

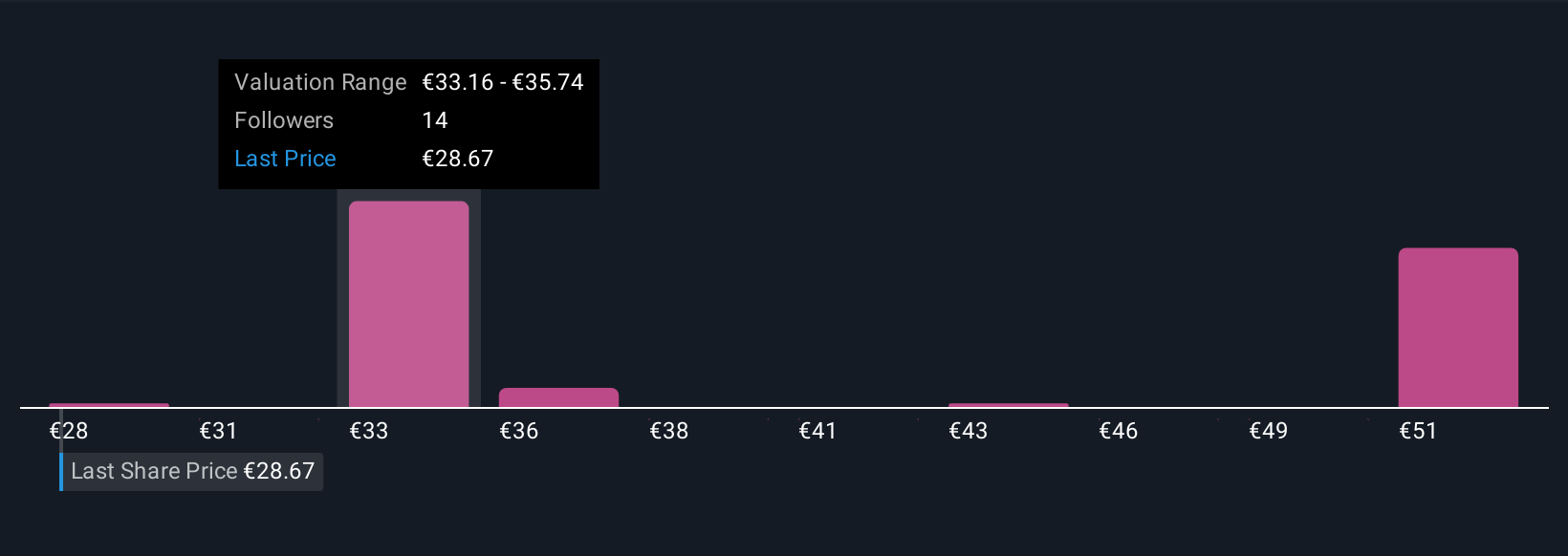

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal investment story for a company, turning financial assumptions such as future revenue, margins, and fair value into a clear, actionable perspective. By building a Narrative on Simply Wall St’s Community page, you link Michelin’s unique business context and industry outlook to your own forecasts, making it easy to see not just where the numbers land, but why.

Narratives are practical and accessible; millions of investors use them to track the latest information and make smarter buy or sell decisions by constantly comparing fair value to the current market price. They update dynamically as new news or earnings are released, so your story always stays relevant to today’s market environment.

For example, some investors may take an optimistic view of Michelin’s long-term sustainability leadership and set a higher fair value target around €43.00, while others focused on increased industry risk and slower growth may set a lower target near €28.00. Narratives make it clear how these different perspectives translate into real investment choices.

Do you think there's more to the story for Compagnie Générale des Établissements Michelin Société en commandite par actions? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ML

Compagnie Générale des Établissements Michelin Société en commandite par actions

Engages in the manufacture and sale of tires worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives