Stock Analysis

3 Prominent Euronext Paris Dividend Stocks Offering Up To 8.1% Yield

Reviewed by Simply Wall St

Amidst a backdrop of political uncertainty and fluctuating market indices in France, investors are increasingly seeking stable returns, making dividend stocks an attractive option. In this context, understanding the characteristics of prominent dividend-yielding stocks on Euronext Paris can offer valuable insights for those looking to navigate through current market volatility.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Samse (ENXTPA:SAMS) | 8.74% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.30% | ★★★★★★ |

| CBo Territoria (ENXTPA:CBOT) | 6.72% | ★★★★★★ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 4.04% | ★★★★★☆ |

| Sanofi (ENXTPA:SAN) | 4.33% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.09% | ★★★★★☆ |

| Teleperformance (ENXTPA:TEP) | 3.80% | ★★★★★☆ |

| Carrefour (ENXTPA:CA) | 6.25% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.29% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 8.16% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top Euronext Paris Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Piscines Desjoyaux (ENXTPA:ALPDX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Piscines Desjoyaux SA is a company that designs, manufactures, and markets swimming pools and related products globally, with a market capitalization of approximately €109.94 million.

Operations: Piscines Desjoyaux SA generates €138.65 million from its swimming pools segment.

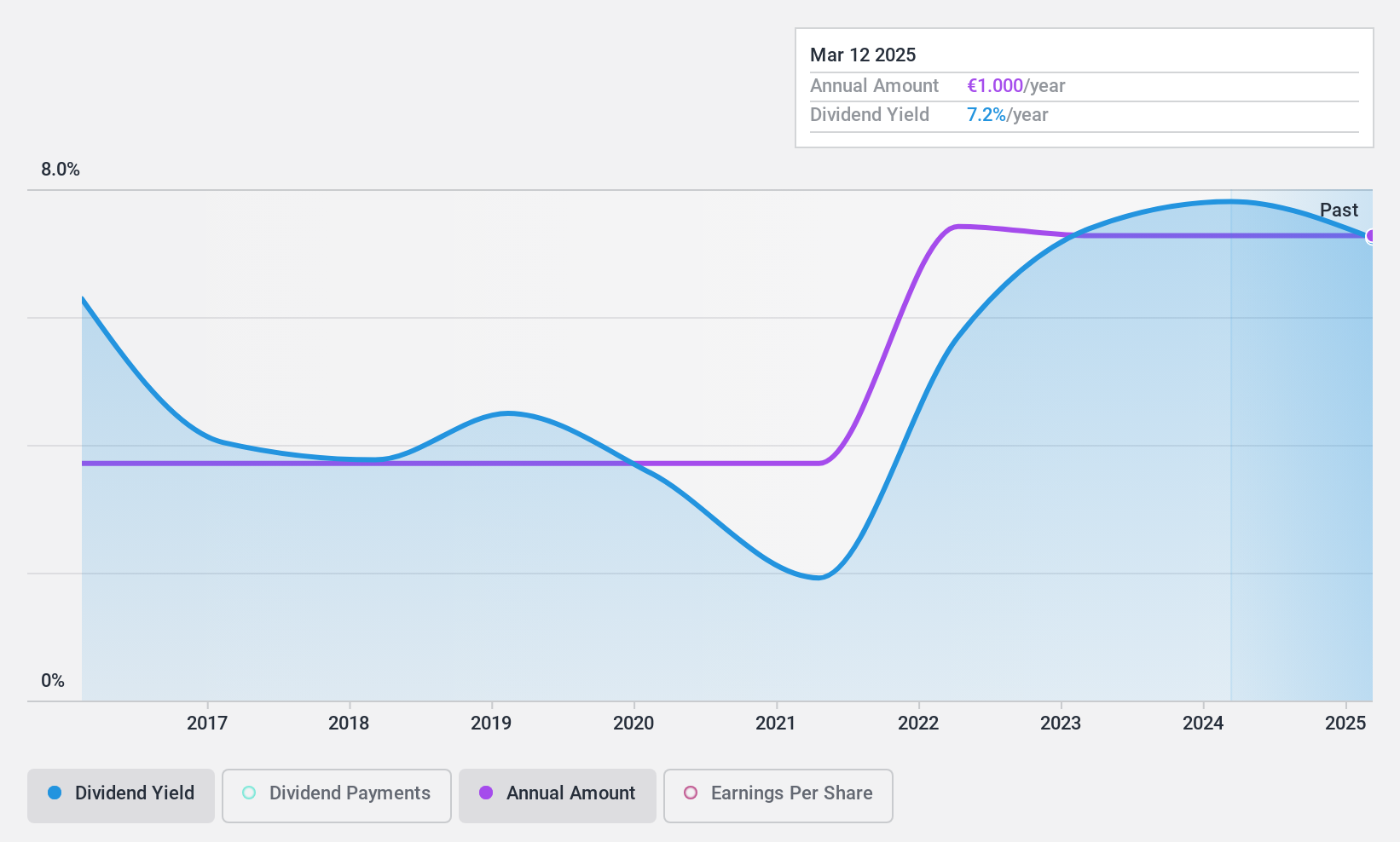

Dividend Yield: 8.2%

Piscines Desjoyaux offers a compelling dividend yield at 8.16%, placing it in the top 25% of French dividend payers. The company has demonstrated a stable and growing dividend over the past decade, supported by a reasonable payout ratio of 55.6%. Additionally, its price-to-earnings ratio stands at an attractive 6.8x, well below the French market average of 15.9x. However, there is insufficient data to confirm if dividends are fully covered by earnings or cash flows.

- Click here and access our complete dividend analysis report to understand the dynamics of Piscines Desjoyaux.

- Our comprehensive valuation report raises the possibility that Piscines Desjoyaux is priced higher than what may be justified by its financials.

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative operates as a cooperative bank in France, offering a range of banking services to various client segments, with a market capitalization of approximately €0.98 billion.

Operations: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative generates €505.07 million from its retail banking operations in France and €80.01 million from non-business activities.

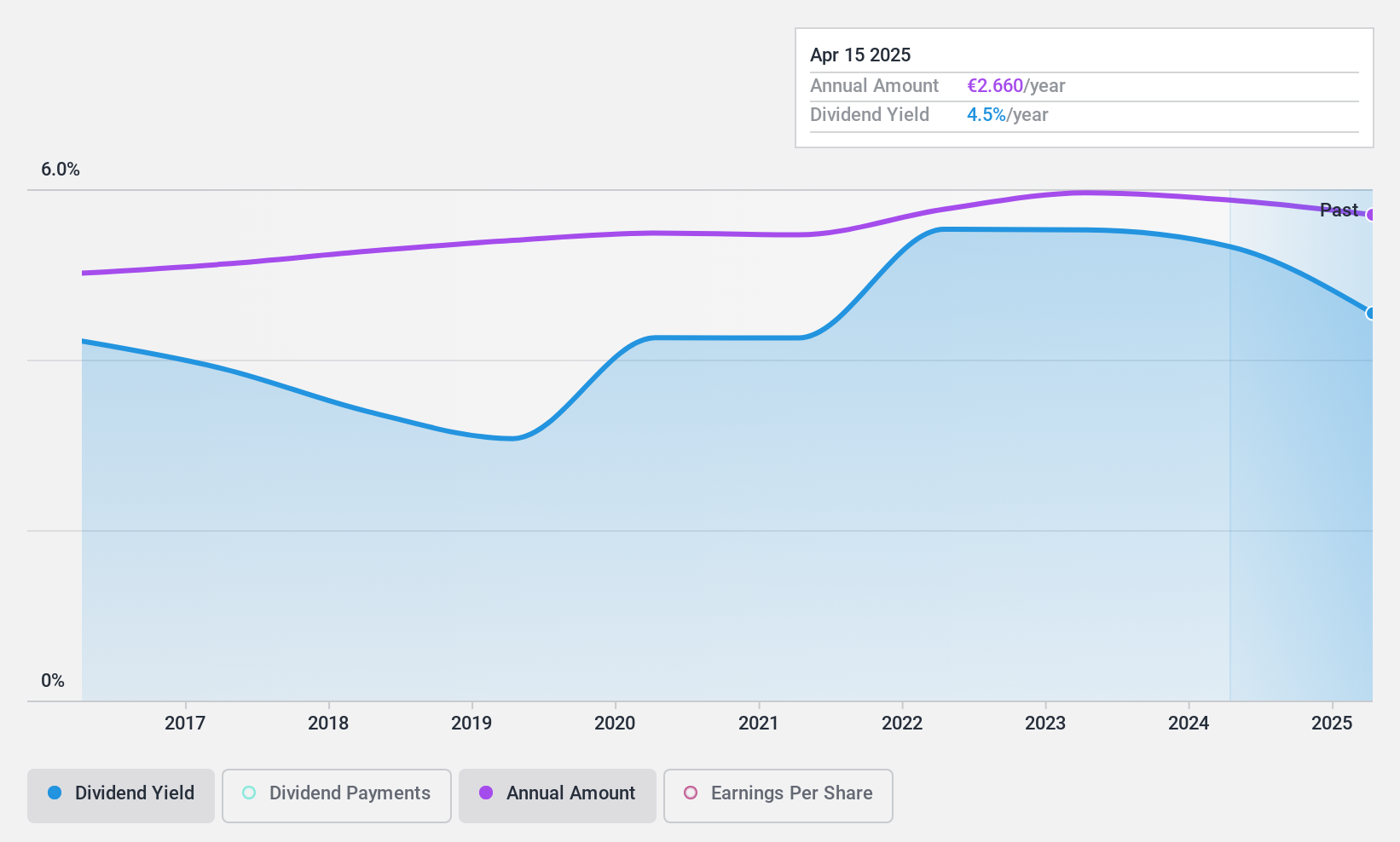

Dividend Yield: 5.5%

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative maintains a consistent dividend growth over the past decade, with a current yield of 5.55%, slightly below the top quartile of French dividend stocks. The dividends are well-supported by a payout ratio of 30.9%, indicating sustainability from earnings. Despite trading at 63.8% below its estimated fair value, concerns persist due to insufficient data on future coverage and cash flow adequacy for dividends beyond three years.

- Dive into the specifics of Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative here with our thorough dividend report.

- Upon reviewing our latest valuation report, Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative's share price might be too pessimistic.

Compagnie Générale des Établissements Michelin Société en commandite par actions (ENXTPA:ML)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Compagnie Générale des Établissements Michelin Société en commandite par actions is a global tire manufacturer with a market capitalization of approximately €26.51 billion.

Operations: Compagnie Générale des Établissements Michelin generates revenue through three primary segments: Automotive and Related Distribution (€14.34 billion), Road Transportation and Related Distribution (€6.98 billion), and Specialty Businesses and Related Distribution (€7.03 billion).

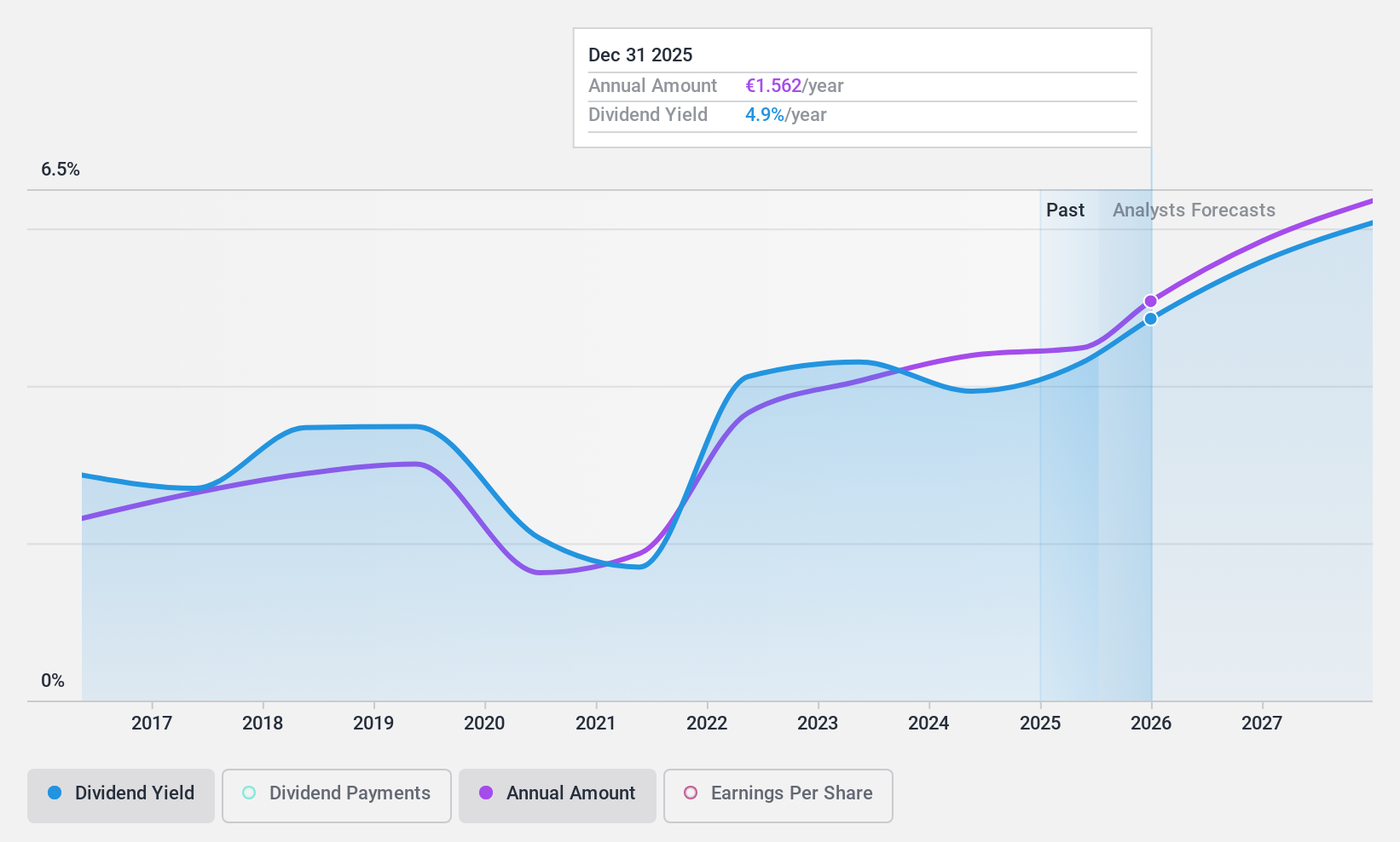

Dividend Yield: 3.6%

Compagnie Générale des Établissements Michelin Société en commandite par actions offers a modest dividend yield of 3.64%, lower than the top quartile of French dividend stocks at 5.61%. Despite this, its dividends are sustainably covered by earnings and cash flows, with payout ratios of 48.7% and 31.6% respectively, indicating reliability in payments. However, the company's dividend history shows volatility over the past decade, reflecting some inconsistency in its payouts to shareholders.

- Delve into the full analysis dividend report here for a deeper understanding of Compagnie Générale des Établissements Michelin Société en commandite par actions.

- Our expertly prepared valuation report Compagnie Générale des Établissements Michelin Société en commandite par actions implies its share price may be too high.

Make It Happen

- Unlock our comprehensive list of 31 Top Euronext Paris Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CRLA

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative

Provides various banking products and services to individuals, professionals and associations, farmers, businesses, private banking customers, and public and social housing community clients in France.

Flawless balance sheet, good value and pays a dividend.