The simplest way to invest in stocks is to buy exchange traded funds. But if you pick the right individual stocks, you could make more than that. To wit, the Valeo SA (EPA:FR) share price is 41% higher than it was a year ago, much better than the market return of around 18% (not including dividends) in the same period. That's a solid performance by our standards! Zooming out, the stock is actually down 34% in the last three years.

See our latest analysis for Valeo

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last twelve months, Valeo actually shrank its EPS by 69%.

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Revenue was pretty stable on last year, so deeper research might be needed to explain the share price rise.

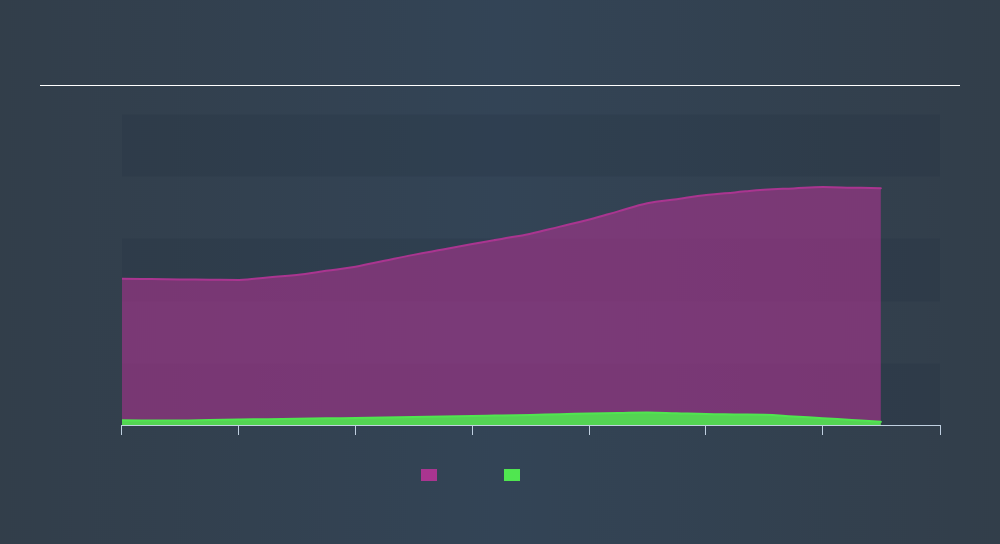

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Valeo is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Valeo in this interactive graph of future profit estimates.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Valeo the TSR over the last year was 48%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Valeo shareholders have received a total shareholder return of 48% over one year. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 4.1% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Importantly, we haven't analysed Valeo's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

But note: Valeo may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:FR

Valeo

A technology company, designs, produces, and sells products and systems for the automotive markets in France, other European countries, Africa, North America, South America, and Asia.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives