- France

- /

- Auto Components

- /

- ENXTPA:FR

Valeo (ENXTPA:FR) Valuation in Focus Following Recent 4% Share Price Gain

Reviewed by Kshitija Bhandaru

Valeo (ENXTPA:FR) stock has recently seen some movement, drawing investor attention for its performance in the automotive sector. Over the past month, shares have gained 4%. This has invited a closer look at underlying drivers and current valuation.

See our latest analysis for Valeo.

Valeo’s recent 1-month share price return of 4% stands out in an otherwise steady year, as the company’s longer-term picture reveals a muted 1-year total shareholder return of just 4.9%. The latest gains suggest some optimism is returning to the stock, but momentum is still building and the longer-term recovery story is far from complete.

If you’re curious what else is happening across the auto sector, now is a timely moment to explore other auto manufacturers. See the full list for free.

This leaves investors with a key question: is Valeo trading below its true worth and offering value, or has the market already factored in the company’s potential for growth, making a further upside less likely?

Most Popular Narrative: 7.6% Undervalued

The widely-followed narrative values Valeo shares at €11.54, which is about 7.6% above the last close of €10.66. This gap raises questions about what could underpin further upside.

Valeo's strategic focus on electrification, ADAS, software development, and smart lighting positions the company to capture growing market demand and potentially drive future revenue growth, particularly as their competitive positioning in these segments is strong.

What’s behind the market’s bullish outlook? The core of this narrative is future-focused innovation and margin expansion, but the real twist lies in a set of bold profitability assumptions usually reserved for tech disruptors. Eager to know the full set of financial projections backing up this price target? The surprises are in the details. Unlock them by reading more.

Result: Fair Value of €11.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant order cancellations and ongoing challenges in Valeo’s electrification business could quickly reshape the current optimistic outlook.

Find out about the key risks to this Valeo narrative.

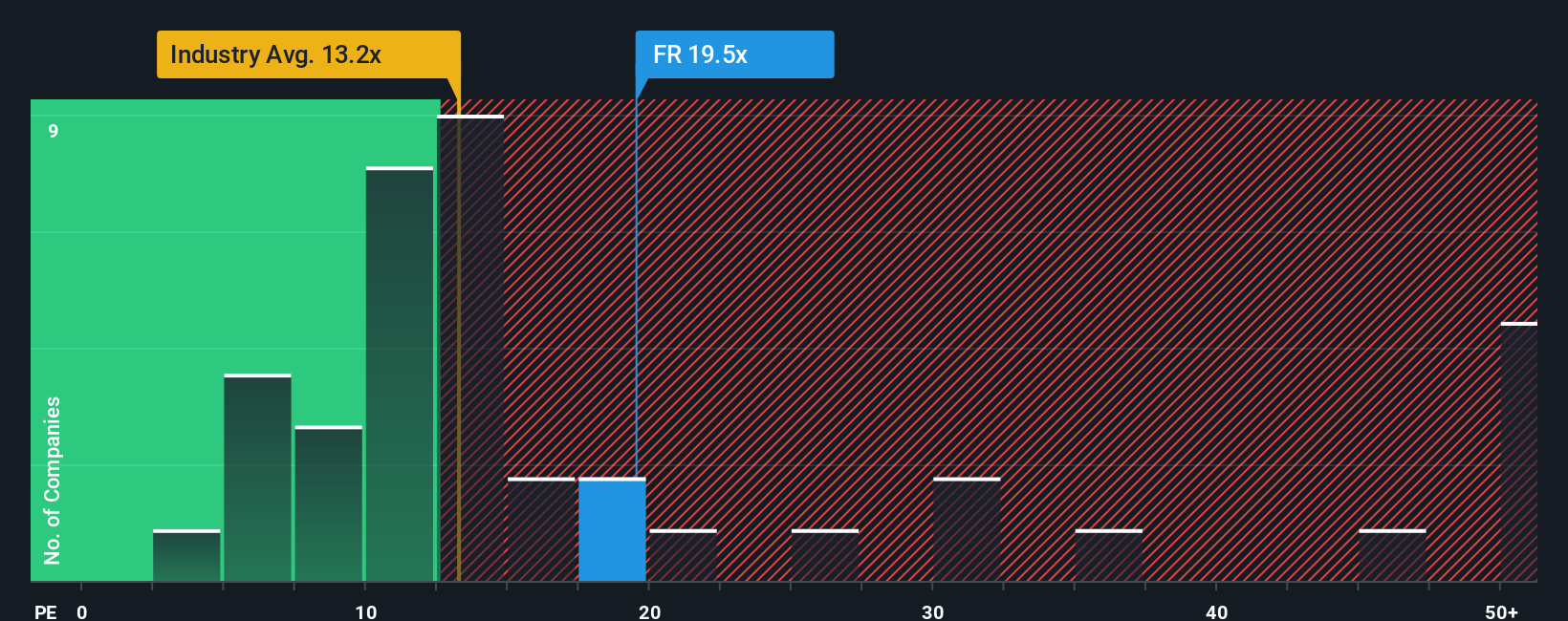

Another View: Multiples Send a Mixed Signal

Looking beyond analyst forecasts, Valeo is currently priced at 20.8 times earnings, which is almost double the European Auto Components industry average of 13.1. This makes the stock look expensive versus its closest peers, though it is still trading well below its fair ratio of 34.2. Is this a sign of hidden value or a warning that expectations are out of sync?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Valeo Narrative

If you think there’s another angle or want to dig deeper into the numbers yourself, you can build your own custom narrative in just a few minutes. Do it your way

A great starting point for your Valeo research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep a few fresh ideas up their sleeve. Act now to find tomorrow's opportunities, as the best deals rarely last long.

- Seize the chance to uncover income potential by reviewing these 19 dividend stocks with yields > 3%, which features yields surpassing the norm for steady cash flow.

- Get ahead of major tech shifts by selecting these 24 AI penny stocks, a group set to benefit from artificial intelligence and the coming wave of innovation.

- Capitalize on overlooked gems by targeting these 901 undervalued stocks based on cash flows, options poised for growth based on strong cash flows and sustainable business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FR

Valeo

A technology company, designs, produces, and sells products and systems for the automotive markets in France, other European countries, Africa, North America, South America, and Asia.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives