- France

- /

- Auto Components

- /

- ENXTPA:ALDEL

Delfingen Industry S.A. (EPA:ALDEL) Looks Just Right With A 36% Price Jump

Delfingen Industry S.A. (EPA:ALDEL) shareholders would be excited to see that the share price has had a great month, posting a 36% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 42% over that time.

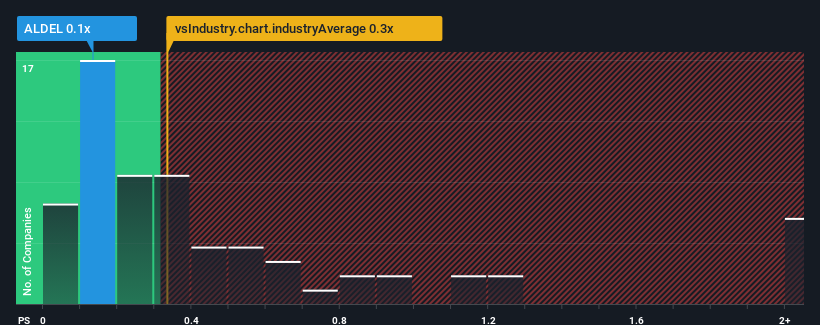

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Delfingen Industry's P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Auto Components industry in France is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

We've discovered 4 warning signs about Delfingen Industry. View them for free.See our latest analysis for Delfingen Industry

How Has Delfingen Industry Performed Recently?

Delfingen Industry has been struggling lately as its revenue has declined faster than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Delfingen Industry will help you uncover what's on the horizon.How Is Delfingen Industry's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Delfingen Industry's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 6.9% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 17% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 1.9% each year during the coming three years according to the dual analysts following the company. That's shaping up to be similar to the 2.4% per year growth forecast for the broader industry.

With this information, we can see why Delfingen Industry is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Its shares have lifted substantially and now Delfingen Industry's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that Delfingen Industry maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Delfingen Industry (1 is a bit concerning!) that you need to be mindful of.

If you're unsure about the strength of Delfingen Industry's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALDEL

Delfingen Société Anonyme

Provides protection and routing systems for electrical networks and on-board fluid transfer solutions to industrial and automotive sectors worldwide.

Very undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives