- Finland

- /

- Electric Utilities

- /

- HLSE:FORTUM

Fortum (HLSE:FORTUM) Margin Decline Challenges Narrative of Resilient Earnings Quality

Reviewed by Simply Wall St

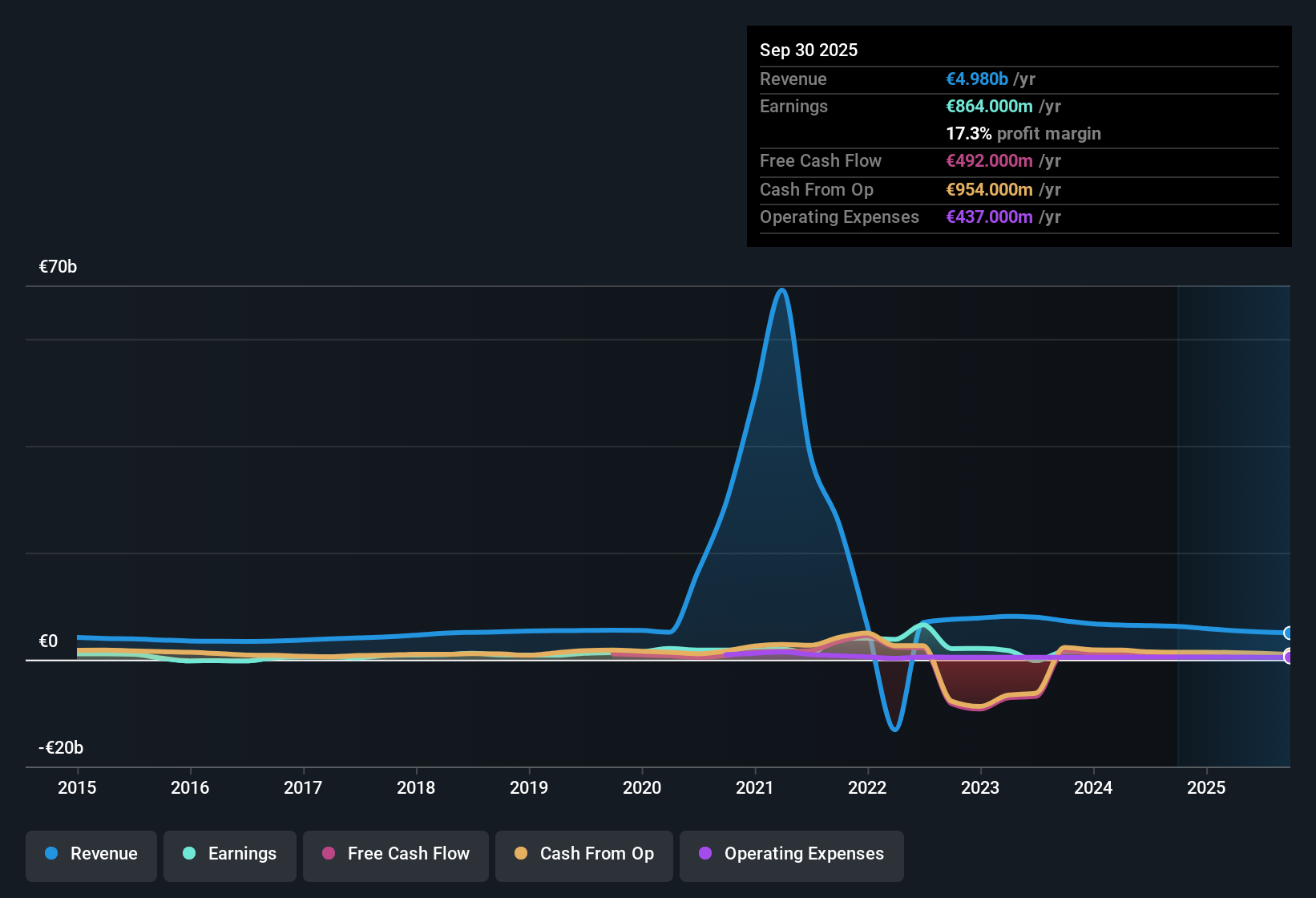

Fortum Oyj (HLSE:FORTUM) reported revenue growth of 2.2% per year and earnings growth of 1.5% per year, both trailing the Finnish market averages of 4% and 18.1%, respectively. Current net profit margins sit at 17.3%, a dip from last year's 19.8%, while the company’s earnings have declined at a sharp rate of 21.4% per year over the past five years. Despite these headwinds, Fortum’s shares are trading at €19.87, below the estimated fair value of €25.45, highlighting a dynamic where high-quality earnings are tempered by slower growth and compressed profitability.

See our full analysis for Fortum Oyj.Next, we will see how the fresh numbers stack up against the main narratives driving Fortum's share price. Some stories may gain momentum, while others may be called into question.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Retreat Yet Remain Solid

- Net profit margins dropped to 17.3% from last year's 19.8%, showing a narrowing cushion for profitability relative to the prior period.

- Despite this contraction, recent margin levels reinforce the view that Fortum’s core earnings quality stands out among European utilities.

- Margins remain stronger than many peers, even as total earnings have been shrinking by an average of 21.4% per year over the last five years.

- This aligns with the prevailing market view that the company’s operations retain resilience, although the path to higher growth remains a challenge given recent trends.

Premium Price Tag Puts Value in Focus

- Shares trade at a Price-to-Earnings ratio of 20.6x, well above the European electric utilities industry average of 13.1x and the peer average of 19.3x.

- This premium valuation directly tests the market’s willingness to pay up for perceived earnings quality.

- This contrasts with Fortum's below-market revenue and earnings growth forecasts: 2.2% and 1.5% per year respectively, both lagging the Finnish market averages.

- It raises the question of whether strong fundamentals alone are enough to justify paying a higher multiple in the current environment.

DCF Fair Value Gap Signals Upside

- With a current share price of €19.87 sitting below the DCF fair value estimate of €25.45, there is a notable gap suggesting potential for future price appreciation on a discounted cash flow basis.

- Prevailing market analysis suggests investors are weighing this upside potential against concerns about long-term earnings durability.

- This reflects a mixed sentiment where underlying value arguments are balanced by doubts about dividend sustainability, as highlighted in risk disclosures.

- The valuation conversation remains complex, as the stock's discount to DCF fair value coexists with weaker recent profit trends and margin pressure.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Fortum Oyj's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Fortum’s below-market growth and narrowing profit margins raise concerns about its ability to deliver consistent results through changing conditions.

If dependable earnings matter most to you, consider stable growth stocks screener (2119 results) to discover companies that have shown steady performance regardless of market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:FORTUM

Fortum Oyj

Engages in the generation and sale of electricity and heat in Finland, Sweden, the Netherlands, Ireland, Denmark, Belgium, the United Kingdom, Switzerland, Spain, France, Germany, Norway, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives