- Finland

- /

- Telecom Services and Carriers

- /

- HLSE:ELISA

Elisa (HLSE:ELISA): Exploring Valuation After Sales and Net Income Growth with Fresh 2025 Guidance

Reviewed by Simply Wall St

Elisa Oyj (HLSE:ELISA) just released its latest earnings, showing higher sales and net income for both the third quarter and the first nine months of 2025. The company also shared updated full-year guidance.

See our latest analysis for Elisa Oyj.

Elisa Oyj’s latest earnings update follows a year where momentum has faded, with the company’s share price slipping 13.8% over the past month and recording a year-to-date share price return of -9.7%. Its 1-year total shareholder return of -8.5% reflects broader market caution, even as the company reports reliable growth in sales and net income. Recent guidance signals management’s confidence in digital services and mobile data as key revenue drivers for the future.

If you’re interested in expanding your search beyond telecom, now is the perfect time to discover fast growing stocks with high insider ownership

With shares now trading at a meaningful discount to analyst price targets despite positive earnings momentum, the key question is whether Elisa Oyj is undervalued and due for a rebound, or if the market already anticipates any upside from this point.

Price-to-Earnings of 16.8x: Is it justified?

With Elisa Oyj trading at a price-to-earnings (P/E) ratio of 16.8x, the stock is priced slightly below the European telecom industry average but above that of its closest peers. The last close was €38.24, suggesting the market may be cautious compared to analyst enthusiasm.

The price-to-earnings ratio measures how much investors are willing to pay per euro of earnings. It is a standard yardstick for valuing profitable companies. For telecoms, where growth tends to be steady rather than explosive, the P/E offers insight into expectations for future profit stability and incremental gains.

Elisa’s P/E is lower than the sector average of 17.8x. This implies that investors see the company as more attractively priced than the broader European telecom group. However, Elisa looks expensive versus its peer group, which trades at just 13.6x. This notable premium could reflect confidence in its earnings quality, or perhaps market optimism about its digital services segment.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 16.8x (ABOUT RIGHT)

However, ongoing share price weakness and below-peer returns remain notable risks. These factors could dampen sentiment if growth expectations falter or market headwinds intensify.

Find out about the key risks to this Elisa Oyj narrative.

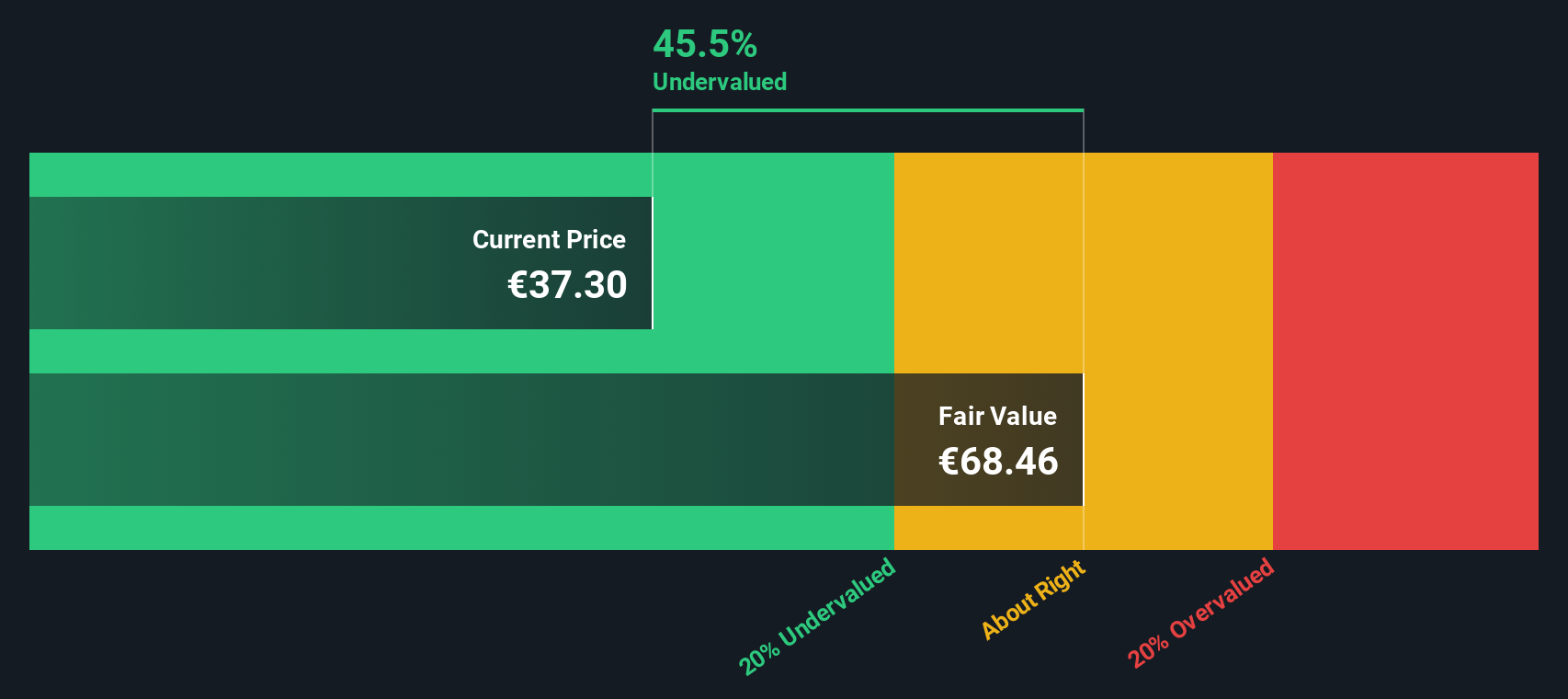

Another View: SWS DCF Model Points to Undervaluation

While the price-to-earnings ratio suggests Elisa Oyj trades close to its industry’s fair value, our DCF model offers a strikingly different conclusion. It estimates Elisa’s fair value at €71.07, which is far above the current share price. Could investors be missing a significant long-term opportunity, or is there a catch behind this apparent discount?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Elisa Oyj for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 834 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Elisa Oyj Narrative

If you have a different perspective or want to dive deeper into the numbers, you can craft your own Elisa Oyj analysis in just a few minutes using our tools. Do it your way

A great starting point for your Elisa Oyj research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Act now to find compelling stocks beyond telecom. Get ahead of the curve and position your portfolio where opportunity meets innovation with Simply Wall Street’s powerful tools.

- Secure your income stream and uncover top opportunities among high-yield plays through these 24 dividend stocks with yields > 3% offering more than 3% yields and robust track records.

- Tap into game-changing breakthroughs by checking out these 26 AI penny stocks where pioneers in artificial intelligence have the potential to reshape entire industries.

- Stay ahead of the market by targeting exceptional value with these 834 undervalued stocks based on cash flows based on cash flows, perfect for investors seeking bargains before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Elisa Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ELISA

Elisa Oyj

Provides telecommunications, information and communication technology (ICT), and online services in Finland, rest of Europe, and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)