- Finland

- /

- Electronic Equipment and Components

- /

- HLSE:VAIAS

Vaisala Oyj Shares Trade Near Fair Value After Stable Q1 2025 Performance

Reviewed by Bailey Pemberton

If you are weighing whether to hold, buy, or sell Vaisala Oyj stock right now, you are definitely not alone. The last twelve months have brought their own share of twists for this Finnish leader in environmental and industrial measurement, with the share price slipping by 4.3% over the past year and currently sitting at €45.4. Even so, a glance further back shows the stock is still up nearly 29% over five years, so the long-term story remains compelling.

In the shorter term, Vaisala’s price performance has been relatively stable. Over the last 30 days, shares are up 1.3%, essentially flat for the week, and down 8.1% year-to-date. This reflects a cautious tone among investors. With global concerns over supply chains and changing risk perceptions around technology shares in Europe, some of these movements could easily be tied to broader market sentiment rather than any fundamental company weakness.

Wondering how the stock shapes up on value? Our most recent valuation analysis gives Vaisala Oyj a score of 2 out of 6 for undervaluation. That means the company checks off two out of six major boxes analysts look for when hunting for undervalued stocks. This does not exactly indicate a “hidden gem,” but it is not overpriced either.

So, what do those six valuation checks actually mean, and how do they stack up for Vaisala? Let us take a closer look at these approaches and, before we wrap up, uncover an even smarter way to assess whether the stock deserves a spot in your portfolio.

Vaisala Oyj scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Vaisala Oyj Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s fair value by projecting its future cash flows and discounting them back to today. For Vaisala Oyj, this is done using a two-stage Free Cash Flow to Equity approach, which factors in both analyst forecasts and longer-term extrapolations.

Currently, Vaisala Oyj is generating €68.8 million in free cash flow. Predictions from analysts and models suggest steady growth over the coming decade. By 2029, projected free cash flow reaches €98.7 million according to the latest estimates. After analyst-supplied numbers run out in five years, further projections are calculated using estimated growth rates from Simply Wall St.

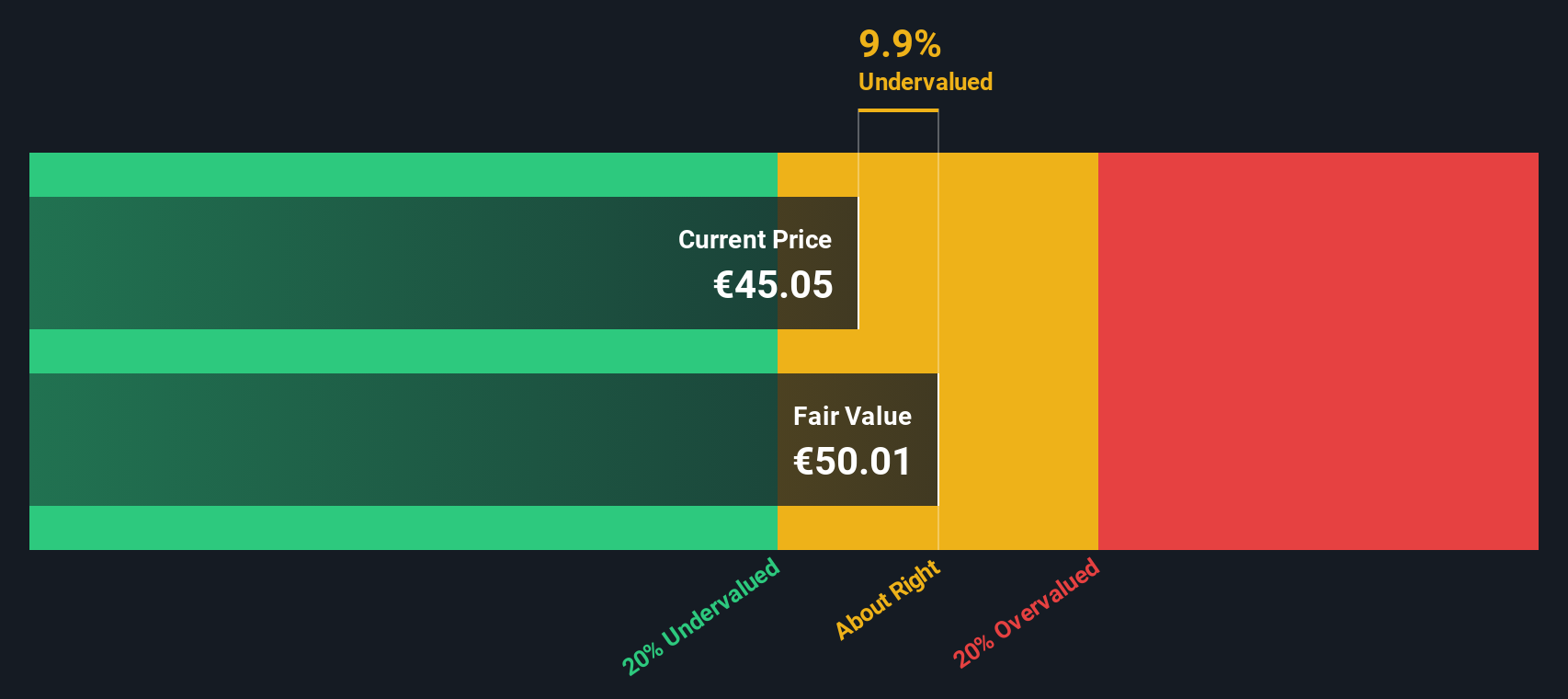

Based on this DCF model, the estimated intrinsic value for Vaisala’s shares stands at €50.05. With the current share price at €45.40, this implies the stock is trading at a 9.3% discount to its calculated fair value.

That gap is quite modest, placing the stock in the “almost fairly valued” category rather than making it a clear-cut bargain or overvalued bet.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Vaisala Oyj's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Vaisala Oyj Price vs Earnings (PE Ratio) Analysis

The Price-to-Earnings (PE) ratio is a go-to valuation tool for profitable companies like Vaisala Oyj. It reveals what investors are willing to pay for each euro of current earnings, making it especially useful when comparing businesses with a steady earnings track record. Generally, higher expected growth and lower perceived risk justify a higher PE, while slower growth or more uncertainty can push the multiple lower.

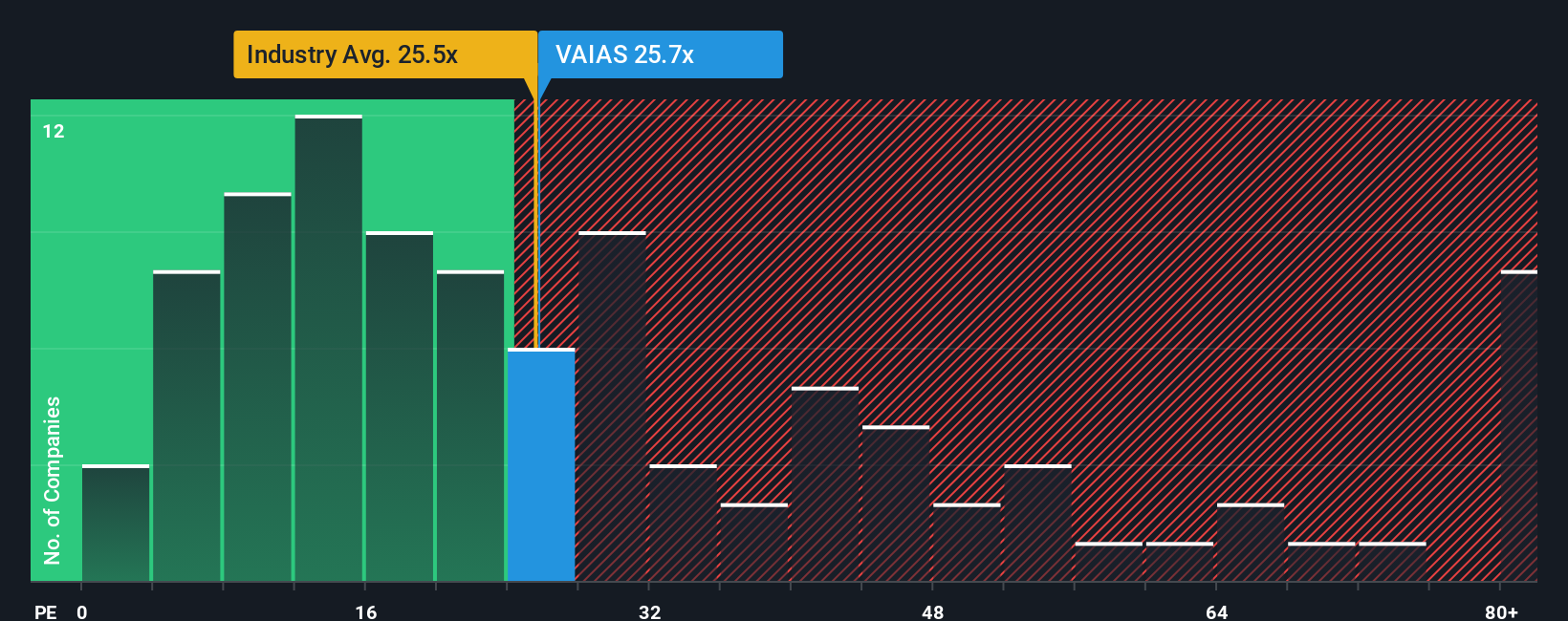

Vaisala's current PE ratio is 25.9x. For context, the average PE across the Electronic industry stands at 27.4x, while peers trade around 27.3x. This positions Vaisala slightly below the broader market’s pricing for similar firms, suggesting that, on pure peer comparison, the stock is not demanding a premium.

But to truly understand value, Simply Wall St’s “Fair Ratio” gives a more tailored benchmark. This proprietary metric flexibly factors in Vaisala’s earnings growth prospects, profit margins, risk, industry nuances, and company size. Unlike raw comparisons to peers or sector averages, the Fair Ratio aims for a more apples-to-apples judgment. Here, it’s calculated at 19.3x for Vaisala. This means Vaisala is trading somewhat above its Fair Ratio, implying investors are willing to pay extra relative to what the fundamentals would suggest.

With a PE of 25.9x versus a Fair Ratio of 19.3x, there is a noticeable premium, so the stock looks a little expensive by this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vaisala Oyj Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives, a smarter approach that takes you beyond the numbers and lets you connect Vaisala Oyj’s story to its potential value.

A Narrative is a clear, personal investment thesis. It is a way to explain your outlook for a company using your own assumptions about its future revenue, profit margins, and growth, and to see how this translates into a Fair Value estimate. Instead of just checking ratios or looking at historical trends, Narratives help you articulate and quantify the reasoning behind your conviction or caution for Vaisala shares.

Narratives are easily accessible on Simply Wall St’s Community page, trusted by millions of investors worldwide. You can quickly compare your view with others’, test “what if” scenarios, and see live Fair Value calculations that update automatically whenever fresh news, earnings, or forecasts come in.

This dynamic approach helps you decide when Vaisala shares truly offer an opportunity. You can directly compare your fair value to the actual share price, and see how shifts in the company's story could move that value.

For example, one Narrative projects weather data and digital services will drive accelerating growth and values Vaisala at €53.8 per share. Another sees persistent headwinds in renewables and values it closer to €44.5. This allows you to see how every investor’s story leads to a different number, and make better, more personal decisions.

Do you think there's more to the story for Vaisala Oyj? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:VAIAS

Vaisala Oyj

Provides weather, environmental, and industrial measurement solutions and services for weather-related and industrial markets.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives