- Finland

- /

- Communications

- /

- HLSE:NOKIA

Nokia (HLSE:NOKIA) Valuation in Focus Following $1 Billion Nvidia AI Network Partnership

Reviewed by Simply Wall St

Nokia Oyj (HLSE:NOKIA) is in the spotlight after Nvidia announced a $1 billion equity investment and a strategic partnership to embed Nvidia’s AI technologies into Nokia’s 5G and 6G network infrastructure. This move signals a new phase of collaboration between the two companies.

See our latest analysis for Nokia Oyj.

Nokia's latest moves come on the heels of a remarkable run for the shares, fueled by surging interest in its AI and next-generation networking partnerships. The Nvidia deal has clearly shifted sentiment and driven a 58.65% 1-month share price return, lifting the year-to-date return to 46.02%. Looking at a longer time frame, total shareholder returns have compounded significantly, up 47.58% over one year and more than doubling in five years. This suggests momentum is building as investors consider Nokia’s role in the AI-powered connectivity boom.

Given all this excitement around Nokia, it’s an ideal time to broaden your focus and discover See the full list for free.

But with shares sprinting higher after the Nvidia announcement, investors are left asking a key question: Is Nokia still trading at attractive valuations, or are future growth prospects already fully reflected in the price?

Most Popular Narrative: 39.2% Overvalued

With the most popular narrative estimating a fair value of €4.53 versus Nokia's recent close at €6.31, sentiment points to a share price well ahead of underlying fundamentals. This valuation calls for a closer look at the assumptions powering optimism and exploring why the market is paying such a premium today.

“Strategic innovation, disciplined operations, and IP monetization are boosting recurring revenues, expanding net margins, and supporting long-term profitability. Ongoing currency, competitive, and operational challenges threaten Nokia's revenue growth, market share, and long-term profitability across key network and cloud segments.”

Curious about what justifies this punchy premium? The valuation hinges on bold predictions for future profit margins and earnings acceleration, with assumed improvements that could reframe Nokia's earnings power. Only the full narrative reveals which gears are expected to drive the next leg of growth and value.

Result: Fair Value of €4.53 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing currency volatility and persistent competitive pressures could quickly challenge the upbeat outlook and shift analyst sentiment for Nokia’s future growth.

Find out about the key risks to this Nokia Oyj narrative.

Another View: Multiples Tell a Different Story

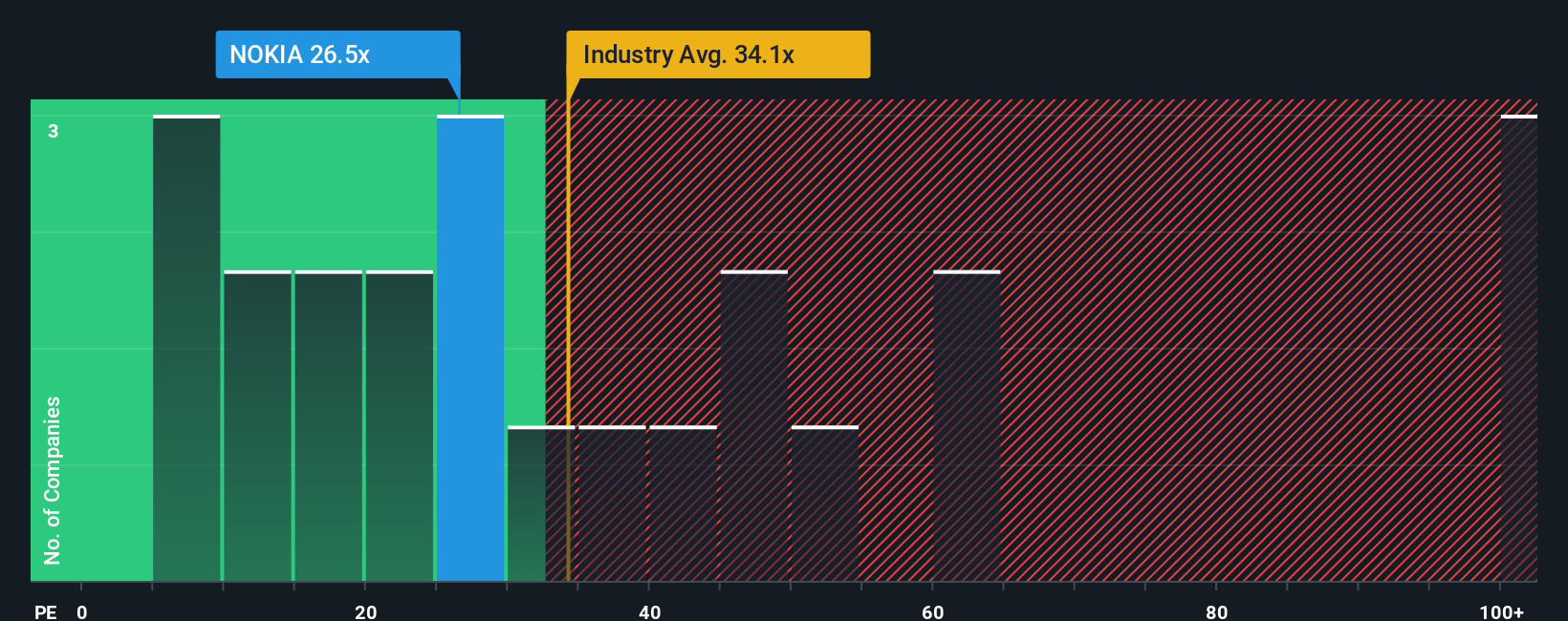

Looking at Nokia's price-to-earnings ratio, a different perspective emerges. With a ratio of 40.3x, Nokia looks cheaper than its European industry peers averaging 43.1x, but pricier than the fair ratio of 31.6x. This gap could signal valuation risk, especially if market expectations shift. What happens if sentiment cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nokia Oyj Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own valuation narrative in just a few minutes with Do it your way.

A great starting point for your Nokia Oyj research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Serious about growing your portfolio? Don’t miss your chance to spot tomorrow’s winners before everyone else by using these powerful, handpicked tools from Simply Wall Street:

- Tap into untapped potential with these 3579 penny stocks with strong financials that boast strong financials and room for explosive growth as niche disruptors.

- Boost your passive income by reviewing these 21 dividend stocks with yields > 3% delivering robust yields above 3% and outshining traditional savings options.

- Stay ahead of megatrends by targeting these 34 healthcare AI stocks at the intersection of healthcare and artificial intelligence innovation for the next wave of breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nokia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NOKIA

Nokia Oyj

Provides mobile, fixed, and cloud network solutions in North and Latin America, Greater China, India, rest of the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives