- Finland

- /

- Communications

- /

- HLSE:NOKIA

Nokia (HLSE:NOKIA) Earnings Growth Slows, Challenging Bullish Narratives on Profit Trajectory

Reviewed by Simply Wall St

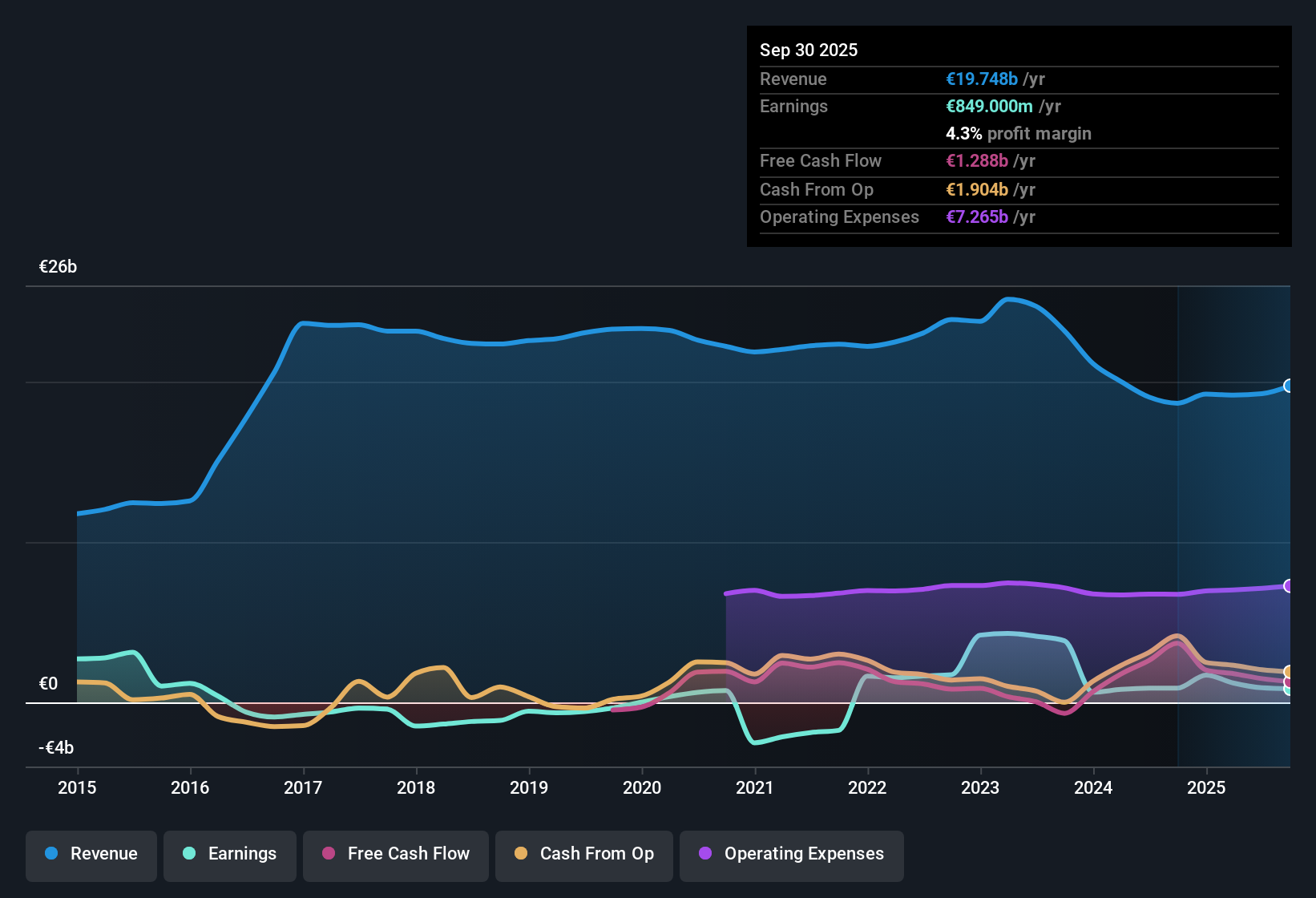

Nokia Oyj (HLSE:NOKIA) reported earnings growth of 2.5% over the past year, a notable slowdown compared to its 5-year average of 29.8% per year. The net profit margin held steady at 4.7%, and forecasts point to earnings growth of about 18% per year, outpacing the Finnish market’s 16.2% expectation while revenue is projected to expand at 2.5% annually. With profitability remaining consistent and growth estimates above the local market, investors are weighing strong value signals against ongoing questions around the sustainability of Nokia’s dividend.

See our full analysis for Nokia Oyj.Up next, we will see how these results measure up alongside the most widely held narratives about Nokia according to the community on Simply Wall St. Some themes may be confirmed, and others put to the test.

See what the community is saying about Nokia Oyj

Profit Margins Projected to Expand

- Analysts expect Nokia's profit margins to climb from 4.7% today to 8.3% within three years, supporting a thesis of stronger long-term profitability.

- According to the analysts' consensus view, multi-year growth in Nokia’s higher-margin Fixed and Optical Networks, coupled with steady strategic innovation and IP monetization, could drive this improvement.

- Net margin currently holds at 4.7%, and recurring revenue is expanding as per the consensus. Both are seen as key contributors to upward margin momentum.

- Consensus narrative notes that investments in next-generation technologies, such as cybersecurity and AI network solutions, are expected to further shift the revenue mix toward high-margin streams.

To see how analysts’ forecasts stack up and where they might miss the mark, check our full take on the consensus narrative. 📊 Read the full Nokia Oyj Consensus Narrative.

Price-to-Earnings Ratio Signals Relative Value

- Nokia trades at a price-to-earnings ratio of 31.3x, well below peers (68.9x) and the broader industry average (38x), but above its DCF fair value of €2.00 per share.

- Consensus narrative emphasizes that while this valuation gap appears attractive, confidence in upside depends on Nokia maintaining increased profitability and shifting to lower future PE ratios.

- Consensus notes that for the stock to justify the analysts’ average price target of €4.52, earnings would need to reach €1.7 billion and trade at a much lower forward PE (16.3x) by 2028. This creates a significant hurdle.

- Despite the compelling peer discount, market skepticism lingers given the current share price of €5.25 is still above DCF fair value, leaving little room for error.

Dividend Sustainability Questions Persist

- The primary risk flagged in official disclosures is ongoing uncertainty about Nokia’s ability to sustain its dividend at current profitability and forecast growth rates.

- Per the consensus narrative, dependable profit and recurring revenues provide some buffer, but volatility in high-stakes areas like Mobile Networks and dependence on large carrier capex cycles make stable payouts less certain.

- Analysts highlight that seasonality and execution risk, especially a reliance on strong fourth quarters, may undermine dividend predictability even as other metrics improve.

- The risk of underperforming cloud and hyperscaler segments also features as a key factor challenging the narrative of safe, growing dividends.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Nokia Oyj on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Interpreting the numbers in your own way? Share your perspective and shape your narrative in just a few minutes. Do it your way

A great starting point for your Nokia Oyj research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite Nokia’s improved earnings outlook, persistent doubts remain about the sustainability of its dividend because of margin volatility and exposure to large, unpredictable customers.

If you want more reliable income, use these 1979 dividend stocks with yields > 3% to focus on companies proven to deliver stronger, more stable yields than what Nokia currently offers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nokia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NOKIA

Nokia Oyj

Provides mobile, fixed, and cloud network solutions in North and Latin America, Greater China, India, rest of the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives