- Finland

- /

- Communications

- /

- HLSE:NOKIA

Is Nokia (HLSE:NOKIA) Fairly Priced After Its Recent Share Price Rebound? A Fresh Look at Valuation

Reviewed by Simply Wall St

Nokia Oyj (HLSE:NOKIA) has quietly delivered a strong rebound this year, and that kind of steady comeback invites a closer look at what is actually driving the share price and earnings trend.

See our latest analysis for Nokia Oyj.

With the share price now at $5.43, Nokia Oyj’s roughly 35 percent 3 month share price return and robust 5 year total shareholder return above 90 percent suggest momentum is rebuilding as investors reassess its earnings power and network exposure.

If Nokia’s turnaround has your attention, it could be a good time to explore other innovation driven network and software names via high growth tech and AI stocks for fresh ideas.

But with shares trading almost exactly in line with analyst targets after a powerful rebound and improving earnings, is Nokia still flying under the radar as a value play, or are markets already pricing in its next leg of growth?

Most Popular Narrative Narrative: 10% Undervalued

With Nokia Oyj last closing at €5.43 against a narrative fair value of €5.43, the latest consensus frames the current price as modestly attractive rather than stretched.

The analysts have a consensus price target of €4.447 for Nokia Oyj based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €5.75, and the most bearish reporting a price target of just €3.0.

Curious how modest revenue growth assumptions can still support sharply rising earnings and a richer future earnings multiple than many peers? The narrative leans on margin expansion, disciplined buybacks, and a specific discount rate that quietly reshapes what fair value could mean for this network heavyweight.

Result: Fair Value of €5.43 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, currency swings and prolonged telecom capex softness could still quickly undermine margin expansion assumptions and cast doubt over the current fair value narrative.

Find out about the key risks to this Nokia Oyj narrative.

Another View, Richer Multiple Signals Caution

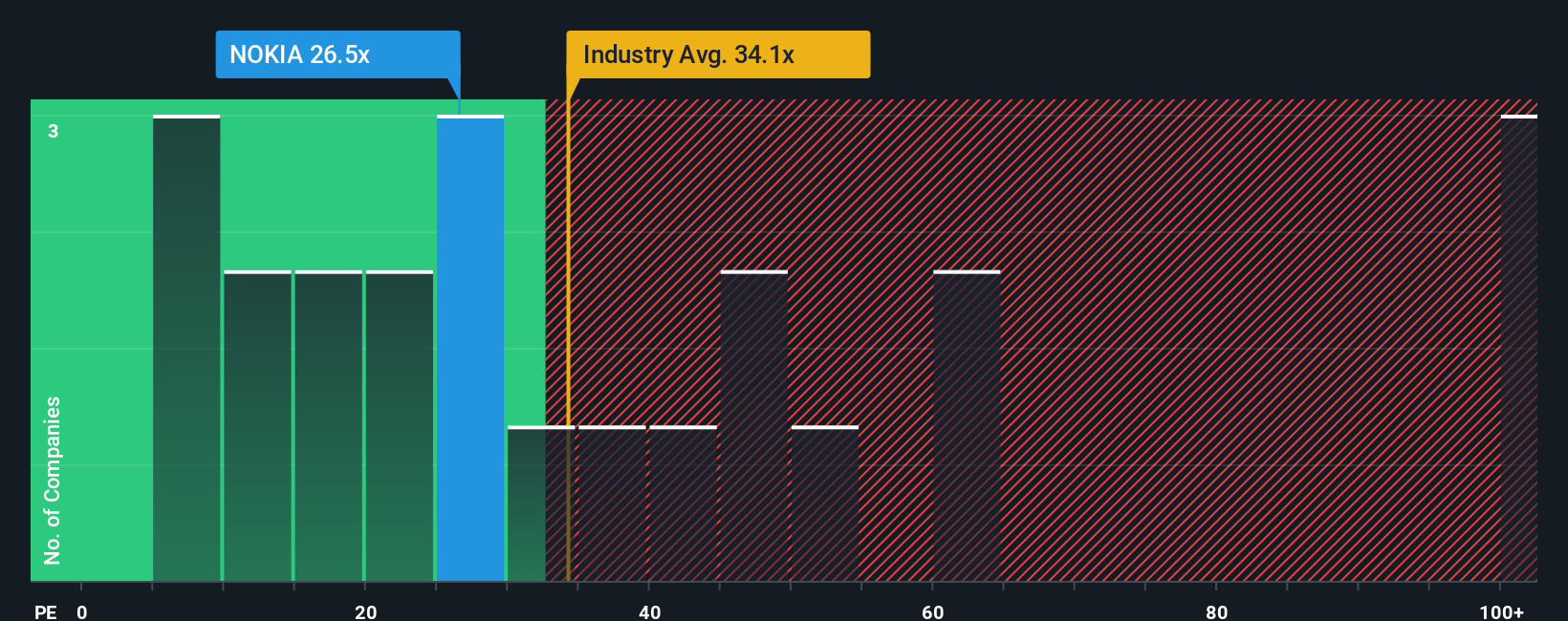

While the narrative fair value suggests Nokia Oyj looks about right, its current price to earnings ratio of 35.8 times sits below the European Communications average of 39.4 times yet above both peers at 28.3 times and a fair ratio of 32.4 times. This hints at limited upside if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nokia Oyj for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nokia Oyj Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a tailored view in just minutes: Do it your way.

A great starting point for your Nokia Oyj research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready to act on your next opportunity?

Do not stop at Nokia. You can use the Simply Wall St Screener to explore ideas and conduct further research for a smarter portfolio.

- Look for potential multi baggers early by scanning these 3608 penny stocks with strong financials that already match their tiny prices with real financial strength.

- Explore the center of the AI trend by targeting these 24 AI penny stocks involved in automation, data intelligence, and next generation software platforms.

- Research these 918 undervalued stocks based on cash flows that trade below some measures of cash flow potential to see if they may fit into your core holdings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nokia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NOKIA

Nokia Oyj

Provides mobile, fixed, and cloud network solutions in North and Latin America, Greater China, India, rest of the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion