- Finland

- /

- Electronic Equipment and Components

- /

- HLSE:ICP1V

If You Had Bought Incap Oyj (HEL:ICP1V) Shares Five Years Ago You'd Have Made 385%

It might be of some concern to shareholders to see the Incap Oyj (HEL:ICP1V) share price down 22% in the last month. But over five years returns have been remarkably great. To be precise, the stock price is 385% higher than it was five years ago, a wonderful performance by any measure. So we don't think the recent decline in the share price means its story is a sad one. Only time will tell if there is still too much optimism currently reflected in the share price.

View our latest analysis for Incap Oyj

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

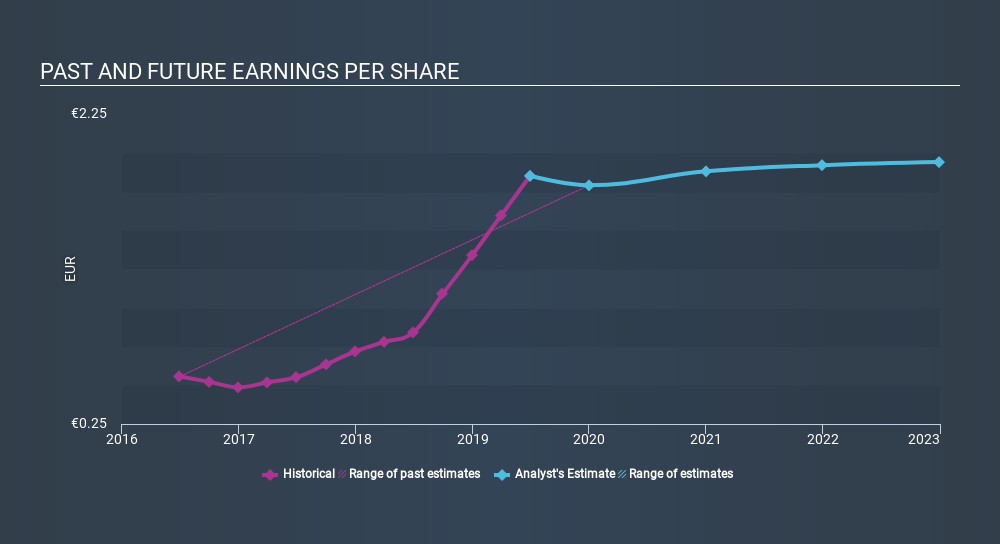

During the last half decade, Incap Oyj became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. Indeed, the Incap Oyj share price has gained 200% in three years. Meanwhile, EPS is up 49% per year. This EPS growth is reasonably close to the 44% average annual increase in the share price (over three years, again). So you could reasonably conclude that investor sentiment towards the stock has remained pretty steady, over time. Rather, the share price has approximately tracked EPS growth.

The graphic below depicts how EPS has changed over time.

We know that Incap Oyj has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Incap Oyj's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Incap Oyj's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Incap Oyj hasn't been paying dividends, but its TSR of 715% exceeds its share price return of 385%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's nice to see that Incap Oyj shareholders have received a total shareholder return of 120% over the last year. That gain is better than the annual TSR over five years, which is 52%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Before deciding if you like the current share price, check how Incap Oyj scores on these 3 valuation metrics.

But note: Incap Oyj may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FI exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About HLSE:ICP1V

Incap Oyj

Provides electronics manufacturing services in Europe, North America, and Asia.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives