- Sweden

- /

- Communications

- /

- OM:KEBNI B

European Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index rises by 1.32%, buoyed by positive developments such as a ceasefire in the Middle East and potential German economic stimulus, investors are watching closely for opportunities within this evolving market landscape. Penny stocks, while often associated with speculative trading, can still represent significant value when supported by strong financials. In this article, we explore several European penny stocks that stand out for their financial strength and potential growth prospects amidst current market conditions.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.53 | €80.45M | ✅ 4 ⚠️ 1 View Analysis > |

| Maps (BIT:MAPS) | €3.53 | €46.89M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.79 | €58.85M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.45 | €16.64M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.22 | PLN11.37M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.455 | SEK2.35B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.60 | SEK219.02M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.065 | €285.1M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.984 | €33.18M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 325 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Aiforia Technologies Oyj (HLSE:AIFORIA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aiforia Technologies Oyj, along with its subsidiary Aiforia Inc., provides deep learning AI software to assist pathologists and scientists in various labs globally, with a market cap of €102.72 million.

Operations: The company generates revenue from its healthcare software segment, amounting to €2.85 million.

Market Cap: €102.72M

Aiforia Technologies Oyj, with a market cap of €102.72 million, is navigating the challenges typical of many penny stocks. Despite generating €2.85 million in revenue from its healthcare software segment, it remains unprofitable with increasing losses over the past five years. Recent strategic moves include launching a new AI solution for breast cancer diagnostics and securing an €8 million follow-on equity offering to bolster its financial position. The company maintains more cash than debt and has short-term assets exceeding liabilities, but faces volatility with a cash runway of two years if current outflows persist.

- Navigate through the intricacies of Aiforia Technologies Oyj with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Aiforia Technologies Oyj's future.

WithSecure Oyj (HLSE:WITH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: WithSecure Oyj operates in the corporate security business globally, with a market cap of €177.25 million.

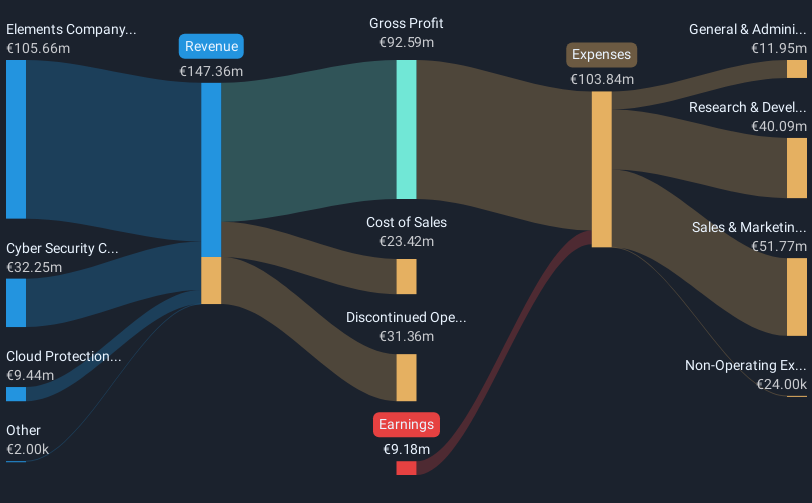

Operations: The company's revenue segments include Elements Company (€105.66 million) and Cloud Protection for Salesforce (€10.72 million).

Market Cap: €177.25M

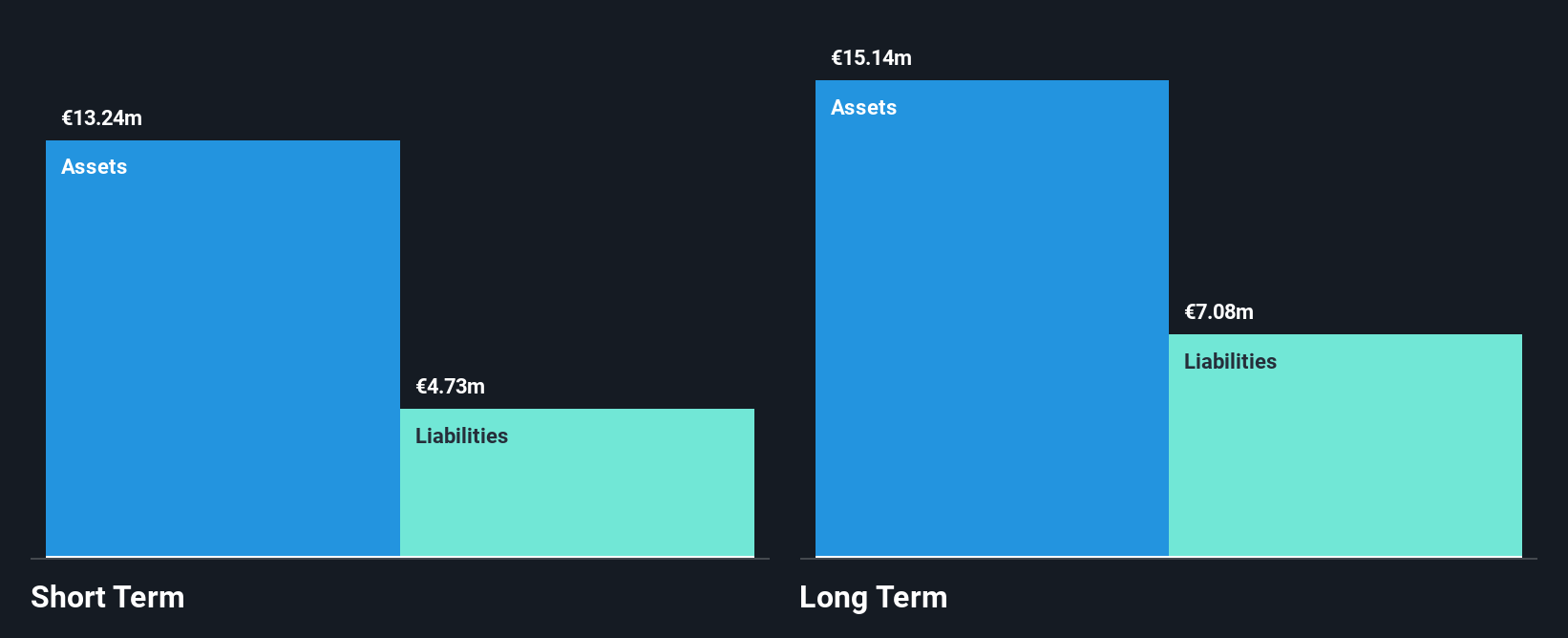

WithSecure Oyj, with a market cap of €177.25 million, operates in the corporate security space and faces typical challenges associated with penny stocks. Despite having revenue segments like Elements Company (€105.66 million) and Cloud Protection for Salesforce (€10.72 million), it remains unprofitable, reporting a net loss of €3.58 million in Q1 2025. The company has more cash than debt, providing financial stability with short-term assets exceeding liabilities and a cash runway extending over three years if current conditions persist. Recent initiatives include completing a share buyback program worth €0.32 million to enhance shareholder value amidst stable volatility levels.

- Unlock comprehensive insights into our analysis of WithSecure Oyj stock in this financial health report.

- Evaluate WithSecure Oyj's prospects by accessing our earnings growth report.

KebNi (OM:KEBNI B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: KebNi AB (publ) develops, produces, and sells products and applications for stabilization, navigation, and satellite communications worldwide with a market cap of SEK561.29 million.

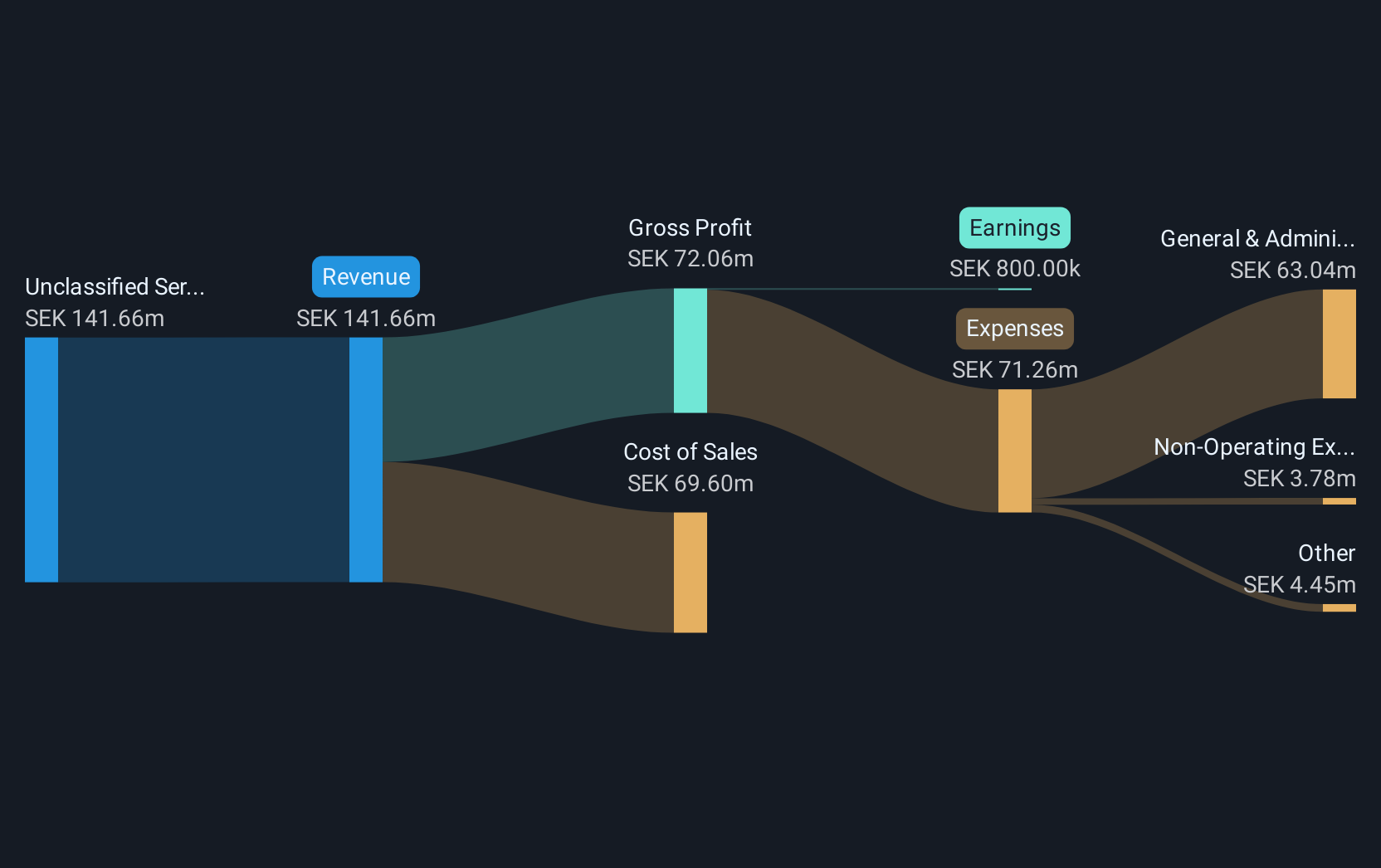

Operations: The company's revenue segment is derived from Unclassified Services, totaling SEK141.66 million.

Market Cap: SEK561.29M

KebNi AB, with a market cap of SEK561.29 million, has recently secured significant volume orders for its tailored IMU from Saab, totaling SEK348 million over 30 months. The company's Q1 2025 revenue was SEK37.08 million, showing growth from the previous year despite a drop in net income to SEK0.874 million. KebNi's stock trades significantly below estimated fair value and remains highly volatile but stable over the past year compared to peers. The firm is debt-free with sufficient short-term assets covering liabilities, though insider selling and an inexperienced board may raise concerns for potential investors in this penny stock space.

- Dive into the specifics of KebNi here with our thorough balance sheet health report.

- Gain insights into KebNi's outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Click here to access our complete index of 325 European Penny Stocks.

- Contemplating Other Strategies? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KebNi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:KEBNI B

KebNi

Develops, produces, and sells products and applications for stabilization, navigation, and satcom worldwide.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives