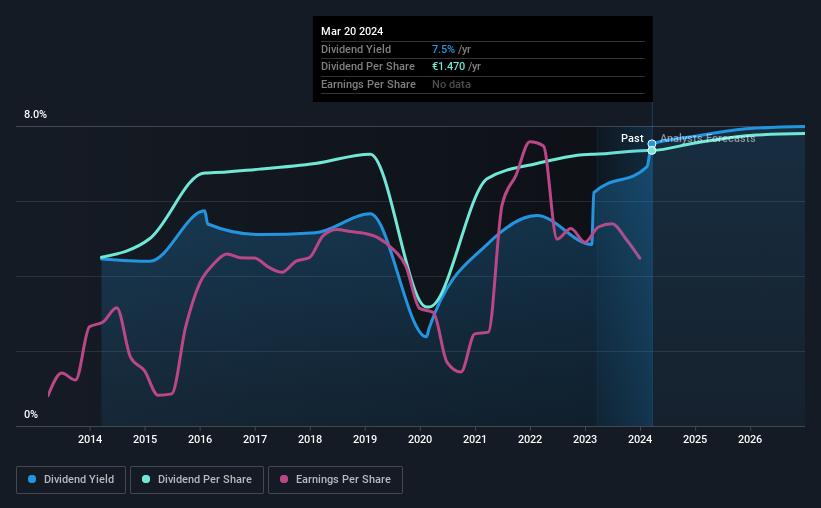

TietoEVRY Oyj (HEL:TIETO) will pay a dividend of €0.735 on the 3rd of October. This takes the dividend yield to 7.5%, which shareholders will be pleased with.

Check out our latest analysis for TietoEVRY Oyj

TietoEVRY Oyj's Dividend Is Well Covered By Earnings

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Before making this announcement, the company's dividend was much higher than its earnings. Without profits and cash flows increasing, it would be difficult for the company to continue paying the dividend at this level.

Over the next year, EPS is forecast to expand by 34.4%. Assuming the dividend continues along recent trends, our estimates say the payout ratio could reach 78% - on the higher side, but we wouldn't necessarily say this is unsustainable.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2014, the annual payment back then was €0.90, compared to the most recent full-year payment of €1.47. This implies that the company grew its distributions at a yearly rate of about 5.0% over that duration. We have seen cuts in the past, so while the growth looks promising we would be a little bit cautious about its track record.

Dividend Growth May Be Hard To Achieve

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. In the last five years, TietoEVRY Oyj's earnings per share has shrunk at approximately 2.7% per annum. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

We're Not Big Fans Of TietoEVRY Oyj's Dividend

Overall, while the dividend being raised can be good, there are some concerns about its long term sustainability. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. Overall, this doesn't get us very excited from an income standpoint.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 2 warning signs for TietoEVRY Oyj you should be aware of, and 1 of them doesn't sit too well with us. Is TietoEVRY Oyj not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if TietoEVRY Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:TIETO

Undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026