TietoEVRY (HLSE:TIETO) Eyes Profitability With 63% Earnings Growth Forecast, Valuation Below Fair Value

Reviewed by Simply Wall St

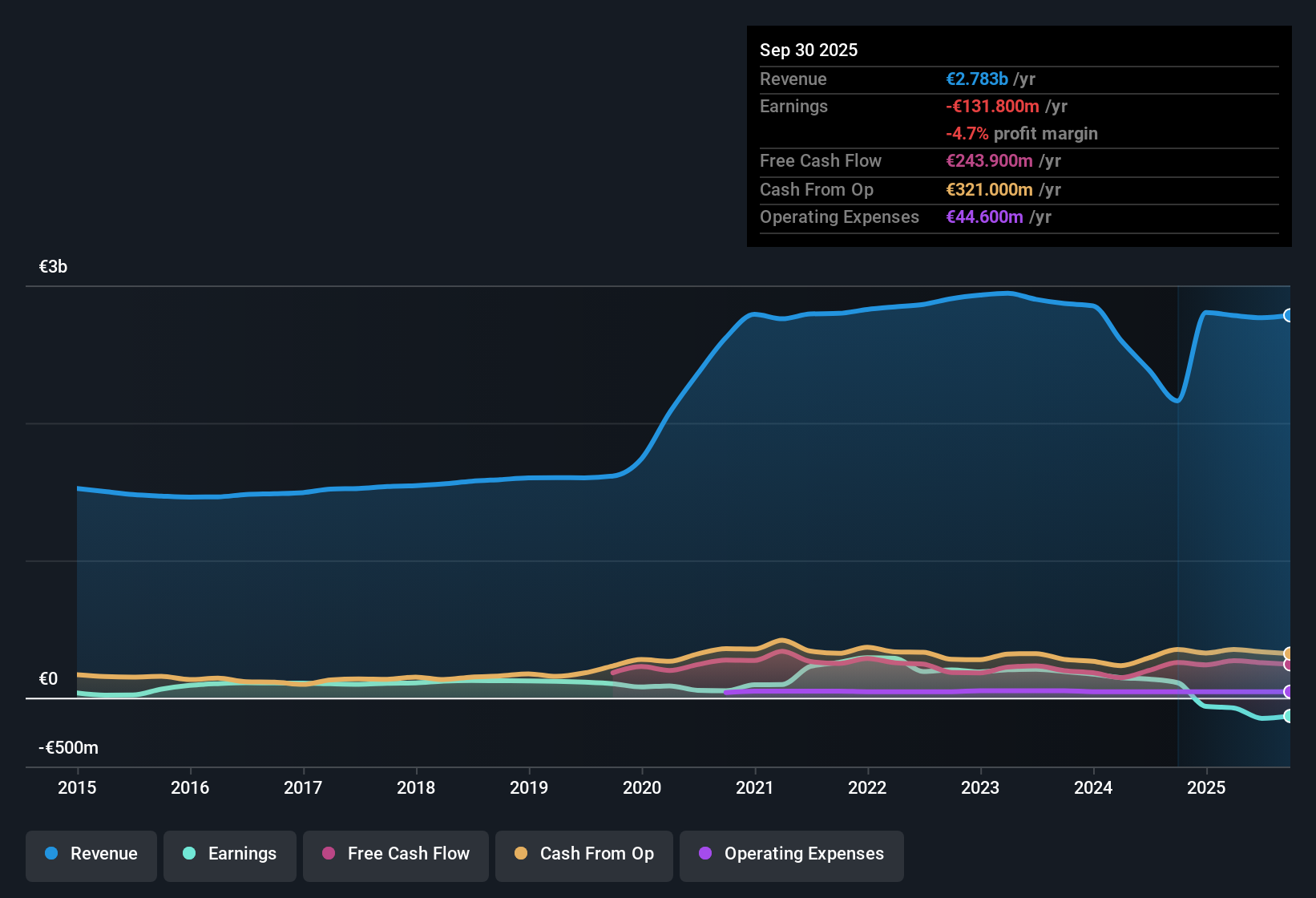

TietoEVRY Oyj (HLSE:TIETO) remains unprofitable, with net losses having increased at an average rate of 24.6% per year over the last five years. Looking ahead, the company’s earnings are forecast to grow by 63.39% per year, with a return to profitability expected within three years. Revenue is projected to grow at 2.2% per year, which is slower than the broader Finnish market’s 4% rate. However, there remains notable optimism around the company’s above-average projected earnings growth.

See our full analysis for TietoEVRY Oyj.The numbers are in, but the real question is how these results stack up against the most widely followed market narratives. Let’s see where the prevailing stories hold up, and what might need a rethink.

See what the community is saying about TietoEVRY Oyj

Margins Expected to Rebound Sharply

- Profit margins are projected to increase from -5.4% today to 15.5% within three years, reflecting a major shift from deep losses to strong profitability.

- According to the analysts' consensus view, two key factors stand out:

- Accelerating wins in AI-driven contracts and advanced analytics, especially as digital transformation spending rises, are expected to improve both top-line growth and margin rates.

- A €115 million cost optimization initiative targeting SG&A and process efficiencies by 2026 is designed to structurally lift net margins. The first benefits are anticipated from H2 2024 onwards.

- With this rapid margin turnaround forecast, the consensus narrative points to better-than-average profit growth potential for TietoEVRY, even as headline revenue growth lags the Finnish market.

See what investors and analysts agree on about TietoEVRY's margin turnaround and growth strategy. 📊 Read the full TietoEVRY Oyj Consensus Narrative.

Order Backlog Bolsters Revenue Visibility

- The Banking segment’s order backlog is at a record high, up 14% year-over-year, providing medium-term revenue visibility as these contract wins convert into reported revenue.

- Consensus narrative highlights two reinforcing trends for TietoEVRY’s recurring growth:

- Strategic international expansion in Banking and Care segments, including contract wins outside the Nordics, reduces reliance on local markets and creates new opportunities for higher-margin, recurring revenues.

- Heightened customer focus on cybersecurity and regulatory compliance is driving multi-year, higher-margin software and services contracts in regulated sectors like financial services and healthcare.

Discount to Fair Value and Peers

- TietoEVRY trades at €18.20, below its DCF fair value of €20.53, and has a price-to-sales ratio of 0.8x versus a peer and industry average of 0.9x. This signals possible relative value for investors targeting discounted plays in software and services.

- Analysts' consensus view contends that the relatively low gap between the current share price and the analyst price target (€16.52) suggests the stock is fairly priced, but the ongoing value gap to DCF fair value and peer multiples may appeal to bargain hunters:

- Revenue growth is forecast at 2.2% per year, lagging the broader Finnish market, leaving the value case more dependent on margin improvements and cost containment than sector momentum.

- Despite trading at a discount, sustained concerns over financial stability and dividend sustainability could limit rerating potential unless the company can show steady improvements on both fronts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for TietoEVRY Oyj on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the figures with a fresh angle? Share your unique interpretation and shape your own narrative in just a few minutes. Do it your way

A great starting point for your TietoEVRY Oyj research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

TietoEVRY Oyj’s muted revenue growth and ongoing financial stability concerns may limit its ability to outperform unless margins steadily improve and debt risks are managed.

If stable finances top your checklist, use our solid balance sheet and fundamentals stocks screener (1984 results) to zero in on companies with stronger balance sheets and healthier debt profiles built for resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TietoEVRY Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:TIETO

Good value with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives