Introducing Tecnotree Oyj (HEL:TEM1V), The Stock That Soared 749% In The Last Three Years

Investing can be hard but the potential fo an individual stock to pay off big time inspires us. But when you hold the right stock for the right time period, the rewards can be truly huge. One such superstar is Tecnotree Oyj (HEL:TEM1V), which saw its share price soar 749% in three years. It's also good to see the share price up 38% over the last quarter.

It really delights us to see such great share price performance for investors.

Check out our latest analysis for Tecnotree Oyj

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

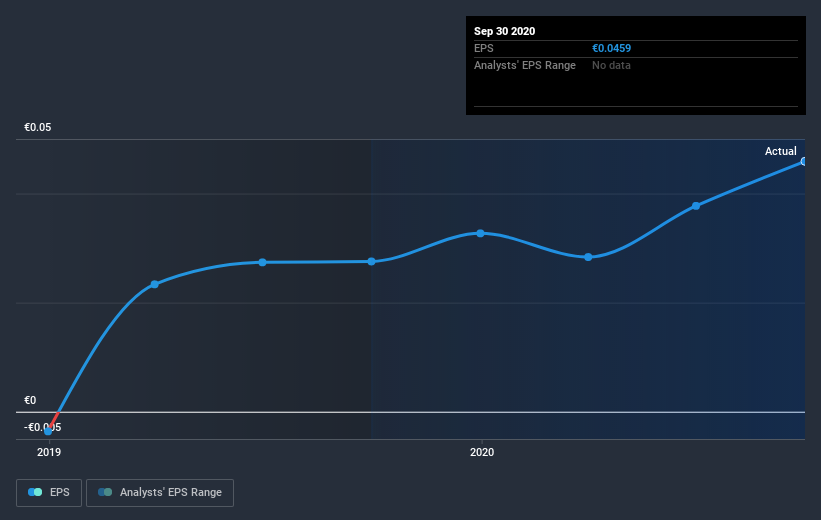

During three years of share price growth, Tecnotree Oyj achieved compound earnings per share growth of 155% per year. This EPS growth is higher than the 104% average annual increase in the share price. So it seems investors have become more cautious about the company, over time.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on Tecnotree Oyj's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Tecnotree Oyj shareholders have received a total shareholder return of 273% over the last year. That's better than the annualised return of 43% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 4 warning signs we've spotted with Tecnotree Oyj (including 1 which is significant) .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FI exchanges.

When trading Tecnotree Oyj or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tecnotree Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About HLSE:TEM1V

Tecnotree Oyj

Provides telecommunication IT solutions for charging, billing, customer care, and messaging and content services in Europe, the Americas, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives