Ariston Holding Leads The Charge Among 3 European Penny Stocks

Reviewed by Simply Wall St

As European markets show resilience with the pan-European STOXX Europe 600 Index closing 2.35% higher, investors are keenly observing opportunities within smaller-cap stocks. Penny stocks, though an older term, remain relevant for those seeking growth potential in emerging companies that may offer a blend of value and opportunity often overlooked by larger firms. This article will explore several such penny stocks that stand out for their financial strength and potential long-term prospects.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.65 | €82.58M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €0.985 | €14.63M | ✅ 4 ⚠️ 5 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €230.2M | ✅ 3 ⚠️ 3 View Analysis > |

| Enervit (BIT:ENV) | €3.84 | €68.35M | ✅ 2 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.10 | €65.75M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.42 | €390.66M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.295 | €317.22M | ✅ 3 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0812 | €8.58M | ✅ 2 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.83 | €27.79M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 277 stocks from our European Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Ariston Holding (BIT:ARIS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ariston Holding N.V. operates through its subsidiaries to produce and distribute hot water and space heating solutions in the Netherlands, Germany, Italy, Switzerland, and internationally, with a market cap of €1.50 billion.

Operations: The company's revenue is primarily derived from its Thermal Comfort segment, which generated €2.48 billion, followed by Burners at €89.2 million and Components at €83.3 million.

Market Cap: €1.5B

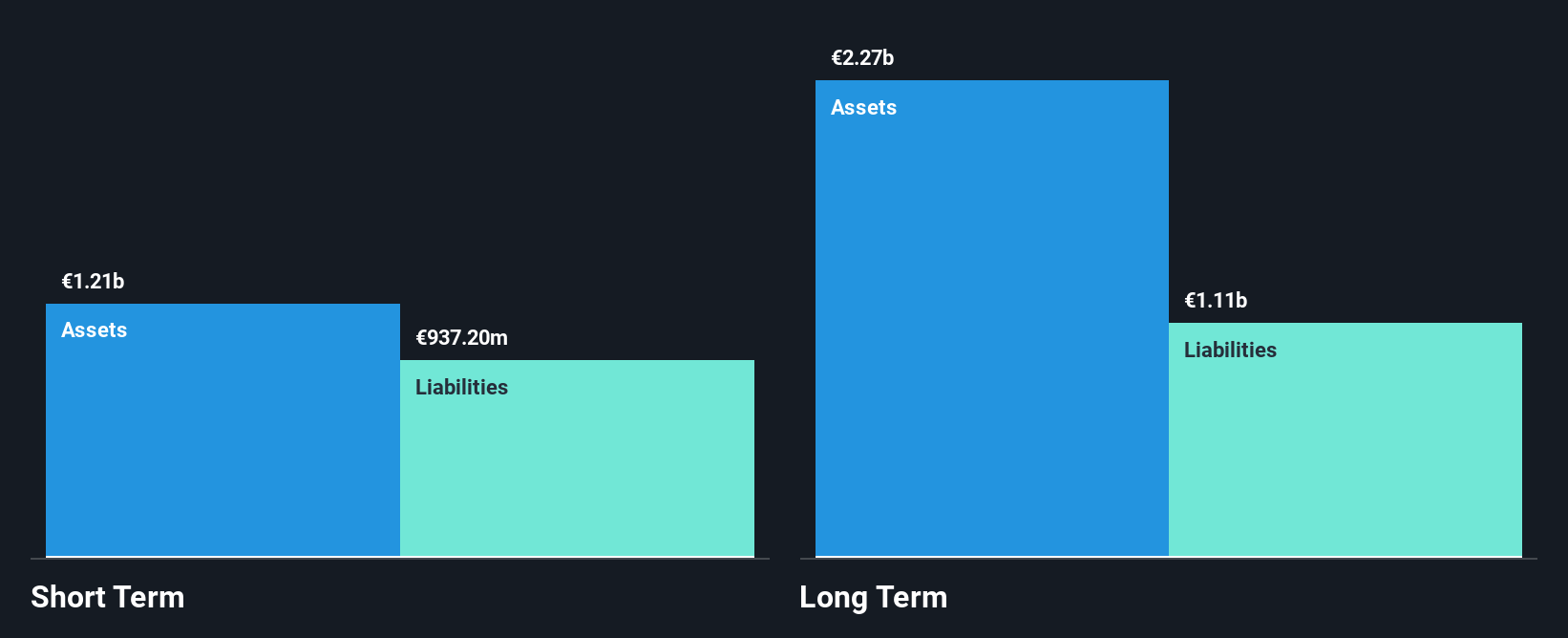

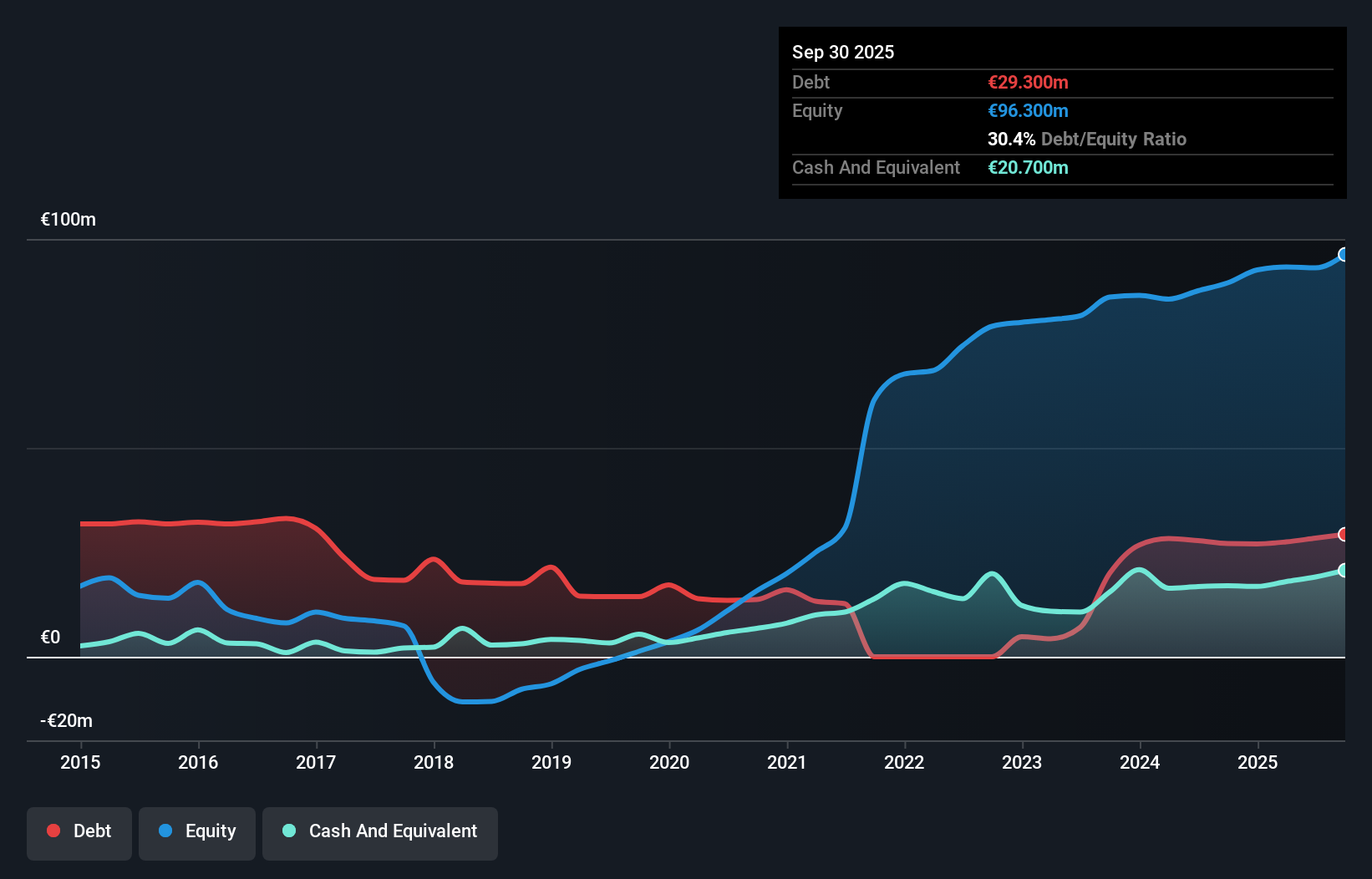

Ariston Holding N.V. has demonstrated robust earnings growth of 61.4% over the past year, significantly outpacing the building industry's decline. The company's debt is well-covered by operating cash flow, and its interest payments are adequately covered by EBIT, indicating strong financial management despite a high net debt to equity ratio of 48%. Recent announcements include a €16 million share buyback program aimed at fulfilling long-term incentive plans. While Ariston trades below estimated fair value and shows stable weekly volatility, its return on equity remains low at 6.6%, and it carries an unstable dividend track record.

- Unlock comprehensive insights into our analysis of Ariston Holding stock in this financial health report.

- Understand Ariston Holding's earnings outlook by examining our growth report.

I.M.D. International Medical Devices (BIT:IMD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: I.M.D. International Medical Devices S.p.A. operates in the medical devices industry and has a market cap of €25.81 million.

Operations: The company's revenue is derived entirely from its Medical Imaging Systems segment, which generated €36.64 million.

Market Cap: €25.81M

I.M.D. International Medical Devices S.p.A., with a market cap of €25.81 million, faces challenges as recent earnings show a decline in revenue to €18.31 million from €20.8 million year-over-year and net income dropping to €0.45 million from €1.34 million. Despite this, the company maintains financial stability with short-term assets exceeding both long-term (€2.6M) and short-term liabilities (€8.6M). Its debt is well-covered by operating cash flow, and it holds more cash than total debt, though earnings growth remains negative at -47.9% over the past year amidst high share price volatility compared to Italian peers.

- Jump into the full analysis health report here for a deeper understanding of I.M.D. International Medical Devices.

- Evaluate I.M.D. International Medical Devices' prospects by accessing our earnings growth report.

Tecnotree Oyj (HLSE:TEM1V)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tecnotree Oyj offers telecommunication IT solutions focusing on charging, billing, customer care, and messaging and content services across Europe, the Americas, the Middle East, Africa, and the Asia Pacific with a market cap of €73.28 million.

Operations: The company's revenue is primarily derived from the MEA and APAC regions, contributing €51.63 million, while Europe and the Americas account for €18.73 million.

Market Cap: €73.28M

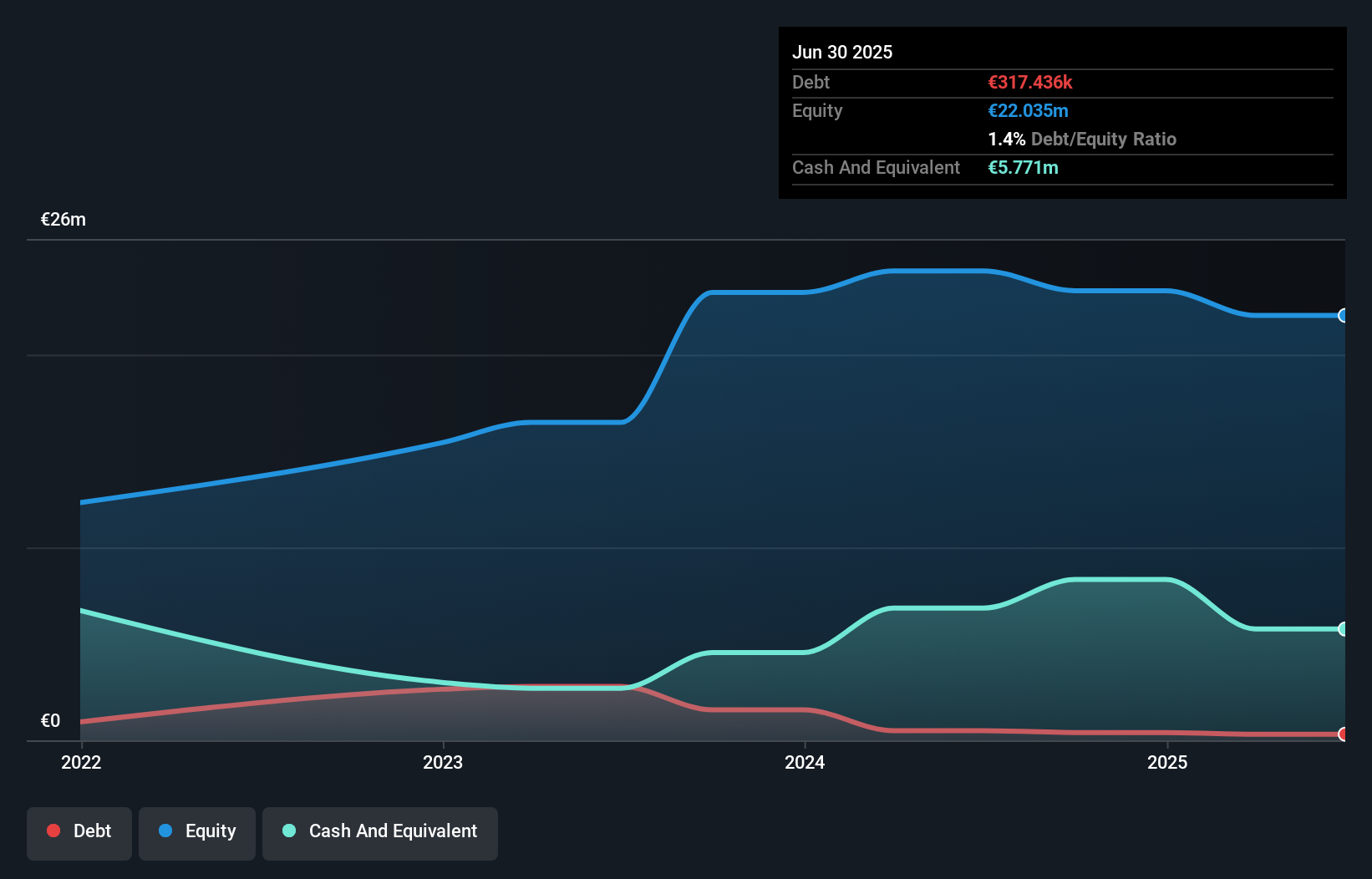

Tecnotree Oyj, with a market cap of €73.28 million, has experienced stable earnings but declining growth over the past year. The company's revenue primarily stems from the MEA and APAC regions, totaling €51.63 million. Despite high share price volatility and a low return on equity at 6.8%, Tecnotree maintains financial health with short-term assets exceeding liabilities and satisfactory debt levels well-covered by operating cash flow. Recent earnings showed slight declines in sales and net income compared to last year; however, the company reaffirmed its dividend policy targeting 10% of free cash flow for 2025 amidst stable profit margins.

- Dive into the specifics of Tecnotree Oyj here with our thorough balance sheet health report.

- Explore Tecnotree Oyj's analyst forecasts in our growth report.

Next Steps

- Unlock more gems! Our European Penny Stocks screener has unearthed 274 more companies for you to explore.Click here to unveil our expertly curated list of 277 European Penny Stocks.

- Contemplating Other Strategies? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ARIS

Ariston Holding

Through its subsidiaries, produces and distributes hot water and space heating solutions in the Netherlands, Germany, Italy, Switzerland, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026