- Finland

- /

- Metals and Mining

- /

- HLSE:AFAGR

3 European Penny Stocks With Market Caps Under €80M

Reviewed by Simply Wall St

The European stock market has recently seen a boost, with the STOXX Europe 600 Index reaching record levels amid a rally in technology stocks and expectations for lower U.S. borrowing costs. As investors navigate these evolving conditions, penny stocks—often representing smaller or newer companies—continue to offer intriguing opportunities. While the term 'penny stocks' may seem outdated, their potential for growth remains significant when backed by strong financial health, making them an attractive option for those looking beyond mainstream investments.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.134 | €1.43B | ✅ 5 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.16 | €17.23M | ✅ 4 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.30 | €43.83M | ✅ 4 ⚠️ 1 View Analysis > |

| DigiTouch (BIT:DGT) | €2.09 | €28.47M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €229.45M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.57 | DKK115.54M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.92 | €39.89M | ✅ 3 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.30 | SEK200.77M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.15 | €297.17M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 271 stocks from our European Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Afarak Group (HLSE:AFAGR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Afarak Group SE extracts, processes, markets, and trades specialized metals globally, with a market cap of €73.45 million.

Operations: The company generates revenue from its Ferro Alloys segment, amounting to €13.05 million, and its Speciality Alloys segment, which contributes €120.43 million.

Market Cap: €73.45M

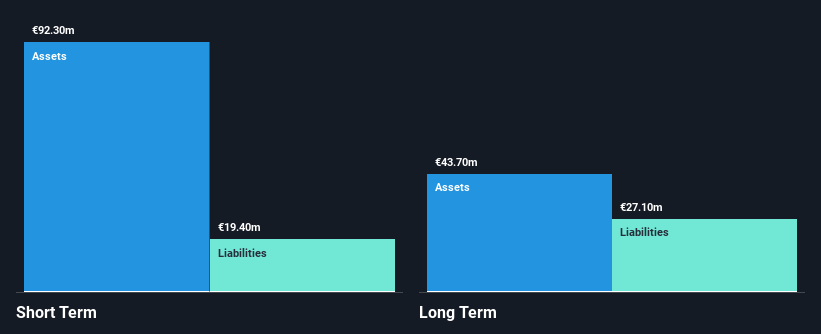

Afarak Group, with a market cap of €73.45 million, reported half-year sales of €77.07 million and net income of €2.06 million, showing improvement from the previous year. Despite being unprofitable and having negative operating cash flow, Afarak's financial position is bolstered by more cash than total debt and short-term assets exceeding both short- and long-term liabilities. The board is experienced, with an average tenure of 8.4 years, while management has a tenure averaging 2.1 years. However, its share price remains highly volatile and interest payments are not well covered by EBIT at 1.8 times coverage.

- Get an in-depth perspective on Afarak Group's performance by reading our balance sheet health report here.

- Evaluate Afarak Group's historical performance by accessing our past performance report.

Tecnotree Oyj (HLSE:TEM1V)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tecnotree Oyj offers telecommunication IT solutions focused on charging, billing, customer care, and messaging and content services across Europe, the Americas, the Middle East, Africa, and the Asia Pacific with a market cap of €76.45 million.

Operations: The company's revenue is segmented into €18.73 million from Europe and the Americas, and €52.03 million from the Middle East, Africa, and Asia Pacific regions.

Market Cap: €76.45M

Tecnotree Oyj, with a market cap of €76.45 million, is navigating challenges in earnings growth but maintains a solid financial footing with short-term assets exceeding liabilities and satisfactory debt levels. The management team is seasoned, and the company's interest payments are well-covered by EBIT. Despite recent declines in sales and net income compared to last year, Tecnotree has raised its earnings guidance for 2025, expecting low to high-single digit growth in net sales. Recent successful delivery of an integrated BSS ecosystem for Emtel highlights its capability to enhance customer engagement and operational efficiency within the telecom sector.

- Dive into the specifics of Tecnotree Oyj here with our thorough balance sheet health report.

- Gain insights into Tecnotree Oyj's future direction by reviewing our growth report.

Tesgas (WSE:TSG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tesgas S.A. focuses on the construction, renovation, and modernization of gas facilities in Poland with a market cap of PLN31.89 million.

Operations: The company generates its revenue primarily from Gas Services (PLN50.09 million), followed by Metal Processing (PLN9.83 million) and Renewable Energy Source (PLN9.88 million).

Market Cap: PLN31.89M

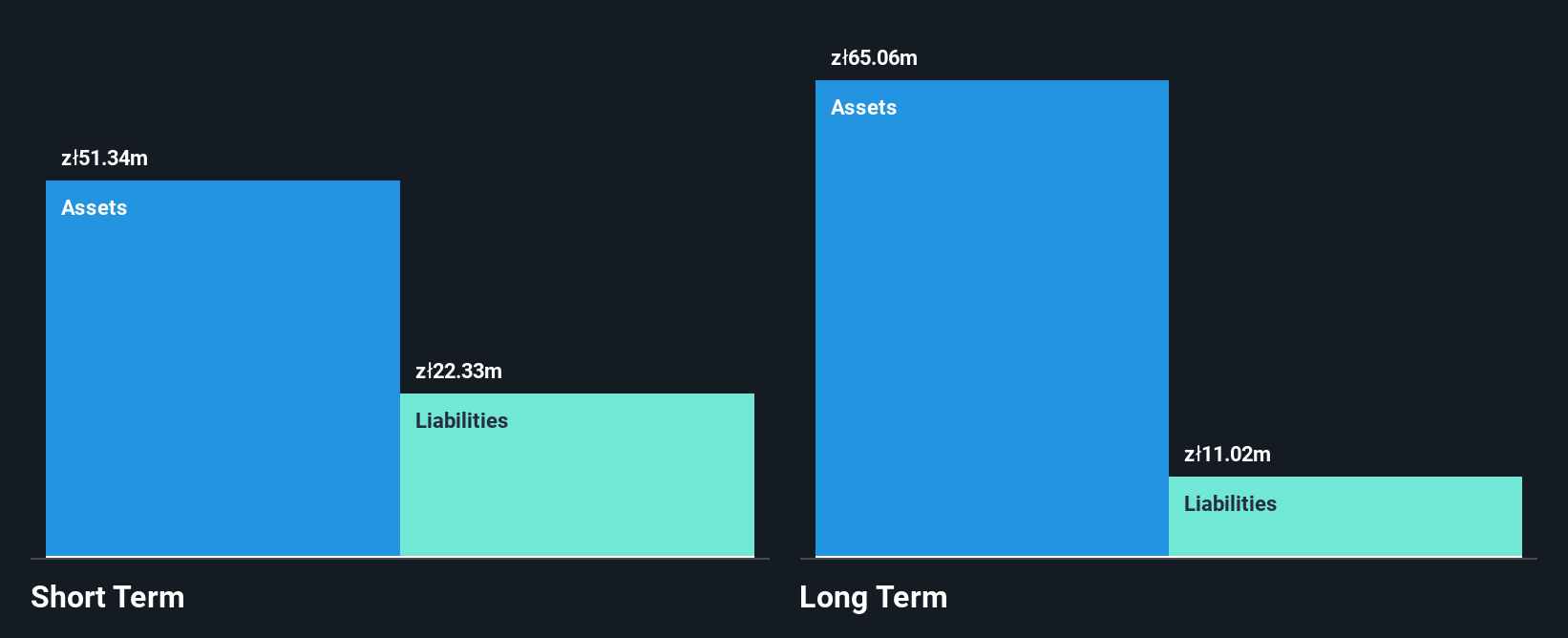

Tesgas S.A., with a market cap of PLN31.89 million, is facing challenges as it remains unprofitable with increasing losses over the past five years. Despite a seasoned management team and board, Tesgas's revenue for the first half of 2025 decreased to PLN31.42 million from PLN40.02 million year-on-year, while net loss widened significantly to PLN5.13 million from PLN0.725 million. The company's short-term assets exceed both its short and long-term liabilities, providing some financial stability despite negative operating cash flow and high share price volatility compared to other Polish stocks in recent months.

- Click here and access our complete financial health analysis report to understand the dynamics of Tesgas.

- Assess Tesgas' previous results with our detailed historical performance reports.

Key Takeaways

- Investigate our full lineup of 271 European Penny Stocks right here.

- Interested In Other Possibilities? The end of cancer? These 28 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:AFAGR

Afarak Group

Afarak Group SE extracts, process, markets, and trades specialised metals in Finland, other EU countries, the United States, China, Africa, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.