Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, the QPR Software Oyj (HEL:QPR1V) share price is up 92% in the last 5 years, clearly besting than the market return of around 32% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 6.4% in the last year, including dividends.

View our latest analysis for QPR Software Oyj

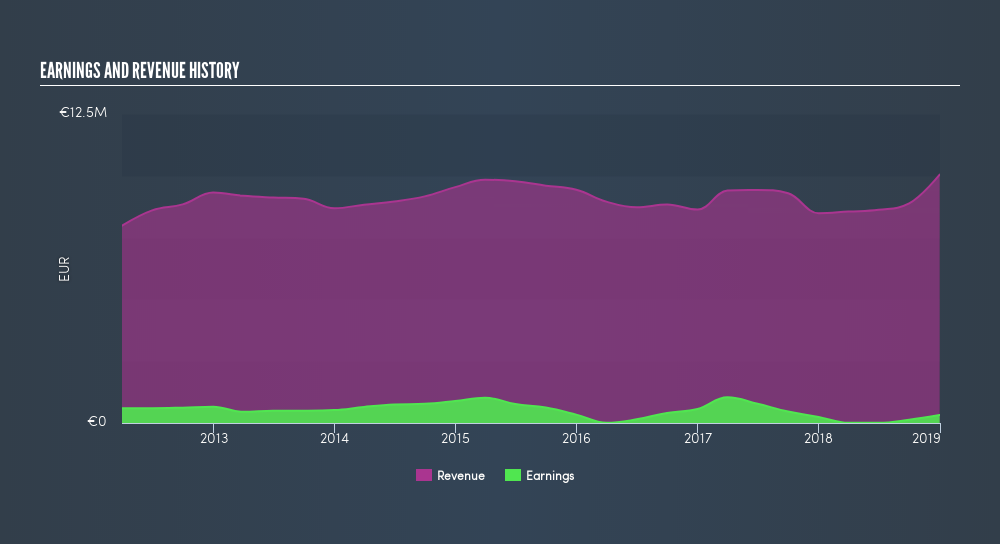

While QPR Software Oyj made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, if the market is looking past earnings to focus on revenue, there is a hope for, or expectation of, strong growth. That's because it's hard for shareholders to have confidence a company will grow profits significantly if it isn't growing revenue.

Over the last half decade QPR Software Oyj's revenue has actually been trending down at about 0.3% per year. Despite the lack of revenue growth, the stock has returned a respectable 14%, compound, over that time. It's probably worth checking other factors such as the profitability, to try to understand the share price action. It may not be reflecting the revenue.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

Take a more thorough look at QPR Software Oyj's financial health with this freereport on its balance sheet.

A Dividend Lost

It's important to keep in mind that we've been talking about the share price returns, which don't include dividends, while the total shareholder return does. By accounting for the value of dividends paid, the TSR can be seen as a more complete measure of the value a company brings to its shareholders. Over the last 5 years, QPR Software Oyj generated a TSR of 119%, which is, of course, better than the share price return. Even though the company isn't paying dividends at the moment, it has done in the past.

A Different Perspective

We're pleased to report that QPR Software Oyj shareholders have received a total shareholder return of 6.4% over one year. However, the TSR over five years, coming in at 17% per year, is even more impressive. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. Is QPR Software Oyj cheap compared to other companies? These 3 valuation measures might help you decide.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this freelist of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FI exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About HLSE:QPR1V

QPR Software Oyj

Provides services and software tools for developing business processes and enterprise architecture in Finland, rest of Europe, Russia, Turkey, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives