Nixu Oyj (HEL:NIXU) Could Be Less Than A Year Away From Profitability

We feel now is a pretty good time to analyse Nixu Oyj's (HEL:NIXU) business as it appears the company may be on the cusp of a considerable accomplishment. Nixu Oyj operates as a cybersecurity services company in Finland, Sweden, the Netherlands, Norway, Denmark, Belgium, and internationally. On 31 December 2020, the €71m market-cap company posted a loss of €1.8m for its most recent financial year. The most pressing concern for investors is Nixu Oyj's path to profitability – when will it breakeven? In this article, we will touch on the expectations for the company's growth and when analysts expect it to become profitable.

Check out our latest analysis for Nixu Oyj

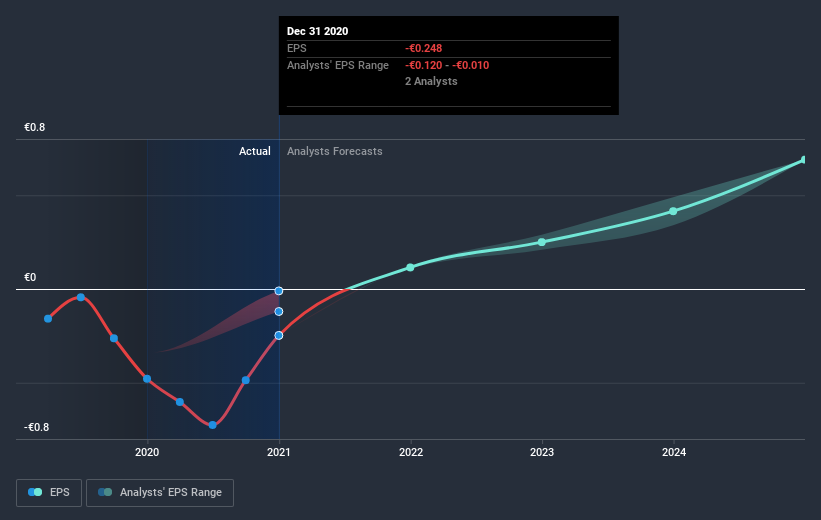

Consensus from 2 of the Finnish IT analysts is that Nixu Oyj is on the verge of breakeven. They anticipate the company to incur a final loss in 2020, before generating positive profits of €875k in 2021. Therefore, the company is expected to breakeven roughly a year from now or less! How fast will the company have to grow to reach the consensus forecasts that anticipate breakeven by 2021? Working backwards from analyst estimates, it turns out that they expect the company to grow 63% year-on-year, on average, which signals high confidence from analysts. Should the business grow at a slower rate, it will become profitable at a later date than expected.

Underlying developments driving Nixu Oyj's growth isn’t the focus of this broad overview, but, take into account that by and large a high growth rate is not out of the ordinary, particularly when a company is in a period of investment.

One thing we would like to bring into light with Nixu Oyj is its relatively high level of debt. Typically, debt shouldn’t exceed 40% of your equity, which in Nixu Oyj's case is 42%. A higher level of debt requires more stringent capital management which increases the risk in investing in the loss-making company.

Next Steps:

This article is not intended to be a comprehensive analysis on Nixu Oyj, so if you are interested in understanding the company at a deeper level, take a look at Nixu Oyj's company page on Simply Wall St. We've also compiled a list of pertinent aspects you should further research:

- Valuation: What is Nixu Oyj worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Nixu Oyj is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Nixu Oyj’s board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

If you’re looking to trade Nixu Oyj, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nixu Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About HLSE:NIXU

Nixu Oyj

Nixu Oyj operates as a cybersecurity services company in Finland, Sweden, Denmark, Benelux, Norway, and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026