Lemonsoft Oyj (HEL:LEMON) Is Paying Out A Larger Dividend Than Last Year

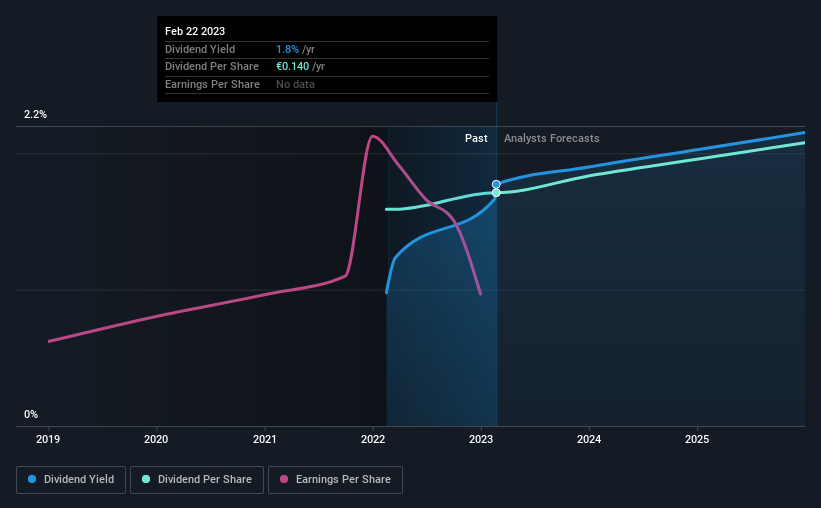

The board of Lemonsoft Oyj (HEL:LEMON) has announced that it will be paying its dividend of €0.14 on the 3rd of April, an increased payment from last year's comparable dividend. Despite this raise, the dividend yield of 1.8% is only a modest boost to shareholder returns.

Check out our latest analysis for Lemonsoft Oyj

Lemonsoft Oyj's Earnings Easily Cover The Distributions

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Prior to this announcement, Lemonsoft Oyj was paying out 80% of earnings and more than 75% of free cash flows. This indicates that the company is more focused on returning cash to shareholders than growing the business, but we don't think that there are necessarily signs that the dividend might be unsustainable.

Looking forward, earnings per share is forecast to rise by 67.6% over the next year. Under the assumption that the dividend will continue along recent trends, we think the payout ratio could be 56% which would be quite comfortable going to take the dividend forward.

Lemonsoft Oyj Is Still Building Its Track Record

The company hasn't been paying a dividend for very long at all, so we can't really make a judgement on how stable the dividend has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend Has Growth Potential

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Lemonsoft Oyj has impressed us by growing EPS at 6.0% per year over the past three years. Past earnings growth has been decent, but unless this is one of those rare businesses that can grow without additional capital investment or marketing spend, we'd generally expect the higher payout ratio to limit its future growth prospects.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The payments are bit high to be considered sustainable, and the track record isn't the best. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 1 warning sign for Lemonsoft Oyj that investors should know about before committing capital to this stock. Is Lemonsoft Oyj not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:LEMON

Lemonsoft Oyj

A software company, designs, develops, and sells enterprise resource planning software solutions in Finland and internationally.

Good value with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion