Results: Efecte Oy Exceeded Expectations And The Consensus Has Updated Its Estimates

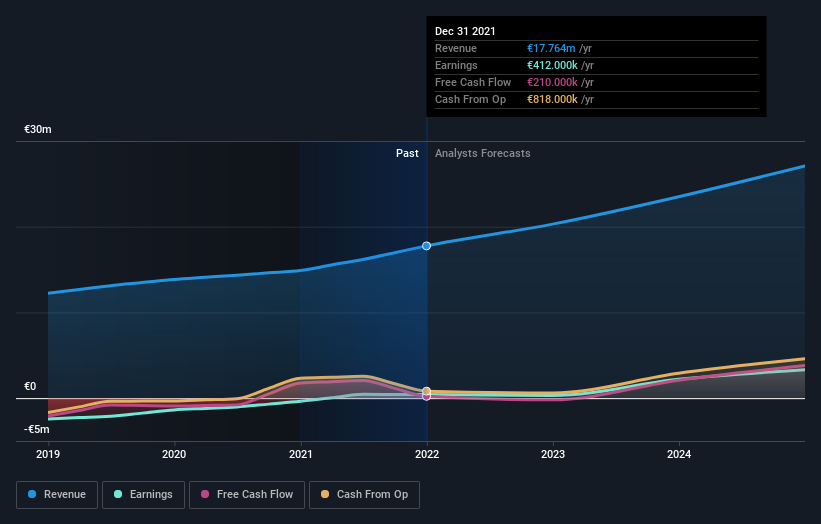

Investors in Efecte Oy (HEL:EFECTE) had a good week, as its shares rose 9.1% to close at €13.80 following the release of its full-year results. It was overall a positive result, with revenues beating expectations by 2.1% to hit €18m. Efecte Oy also reported a statutory profit of €0.07, which was a nice improvement from the loss that the analyst were predicting. Following the result, the analyst has updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We've gathered the most recent statutory forecasts to see whether the analyst has changed their earnings models, following these results.

See our latest analysis for Efecte Oy

Taking into account the latest results, the most recent consensus for Efecte Oy from single analyst is for revenues of €20.3m in 2022 which, if met, would be a solid 14% increase on its sales over the past 12 months. Statutory earnings per share are expected to crater 24% to €0.05 in the same period. Before this earnings report, the analyst had been forecasting revenues of €20.1m and earnings per share (EPS) of €0.08 in 2022. The analyst seem to have become more bearish following the latest results. While there were no changes to revenue forecasts, there was a pretty serious reduction to EPS estimates.

It might be a surprise to learn that the consensus price target fell 9.1% to €15.00, with the analyst clearly linking lower forecast earnings to the performance of the stock price.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We can infer from the latest estimates that forecasts expect a continuation of Efecte Oy'shistorical trends, as the 14% annualised revenue growth to the end of 2022 is roughly in line with the 12% annual revenue growth over the past five years. Juxtapose this against our data, which suggests that other companies (with analyst coverage) in the industry are forecast to see their revenues grow 17% per year. It's clear that while Efecte Oy's revenue growth is expected to continue on its current trajectory, it's only expected to grow in line with the industry itself.

The Bottom Line

The biggest concern is that the analyst reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Efecte Oy. They also reconfirmed their revenue estimates, with the company predicted to grow at about the same rate as the wider industry. The consensus price target fell measurably, with the analyst seemingly not reassured by the latest results, leading to a lower estimate of Efecte Oy's future valuation.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At least one analyst has provided forecasts out to 2024, which can be seen for free on our platform here.

You should always think about risks though. Case in point, we've spotted 2 warning signs for Efecte Oy you should be aware of.

Valuation is complex, but we're here to simplify it.

Discover if Efecte Oy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:EFECTE

Efecte Oy

A software company, provides cloud-based service management solutions in Finland and internationally.

High growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion