European markets have been buoyed by a rally in technology stocks and expectations for lower U.S. borrowing costs, with the STOXX Europe 600 Index reaching record levels. In this context, penny stocks—often smaller or newer companies—remain an intriguing investment area due to their potential for significant returns when backed by strong financials. We'll explore several European penny stocks that combine balance sheet strength with long-term potential, offering investors the chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.07 | €1.41B | ✅ 5 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.14 | €16.94M | ✅ 4 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.24 | €43.03M | ✅ 4 ⚠️ 1 View Analysis > |

| DigiTouch (BIT:DGT) | €1.975 | €26.91M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €227.95M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.41 | DKK111.5M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.84 | €39.25M | ✅ 3 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.42 | SEK208.07M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.09 | €288.88M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 270 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Faes Farma (BME:FAE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Faes Farma, S.A. is engaged in the research, development, production, and marketing of pharmaceutical and healthcare products as well as raw materials globally, with a market cap of €1.37 billion.

Operations: The company's revenue is primarily derived from Pharmaceutical Specialties and Healthcare at €478.50 million, followed by Nutrition and Animal Health contributing €63.94 million.

Market Cap: €1.37B

Faes Farma, S.A. demonstrates financial stability with its cash exceeding total debt and strong interest coverage by EBIT. Despite a slight decrease in net profit margins from 19.7% to 19.4%, the company maintains high-quality earnings and has not diluted shareholders recently. The board's experience is notable, averaging nearly a decade of tenure, although management tenure data is lacking. Recent earnings growth of 8% annually over five years aligns closely with industry standards but falls short of outperforming it last year. Trading below fair value estimates suggests potential for value investors despite an unstable dividend history and low return on equity at 14.4%.

- Take a closer look at Faes Farma's potential here in our financial health report.

- Learn about Faes Farma's future growth trajectory here.

Digital Workforce Services Oyj (HLSE:DWF)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Digital Workforce Services Oyj offers business process automation services and technology solutions across multiple regions, including the Nordics and the European Union, with a market cap of €39.04 million.

Operations: Digital Workforce Services Oyj does not report specific revenue segments.

Market Cap: €39.04M

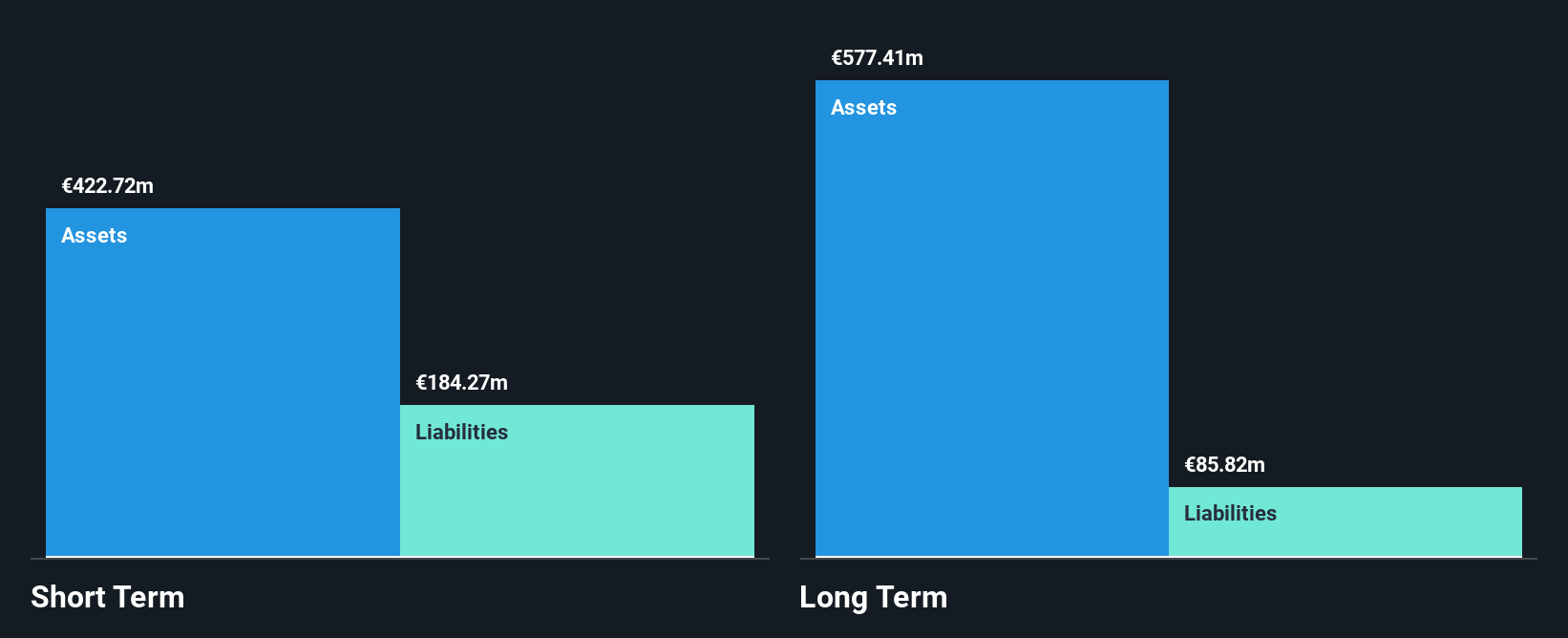

Digital Workforce Services Oyj, with a market cap of €39.04 million, showcases financial resilience as its short-term assets exceed both short and long-term liabilities, and it holds more cash than total debt. Despite being unprofitable currently, the company has reduced losses significantly over the past five years. Recent executive changes include appointing Louise Wall to enhance healthcare operations in the UK and Ireland. The company has completed a share buyback program worth €0.2 million and reaffirmed revenue growth guidance for 2025 and 2026, aiming for €50 million by 2026 through organic and inorganic means.

- Click to explore a detailed breakdown of our findings in Digital Workforce Services Oyj's financial health report.

- Explore Digital Workforce Services Oyj's analyst forecasts in our growth report.

Eurosnack (WSE:ECK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eurosnack S.A. is a company that produces and distributes salty snacks and biscuits both in Poland and internationally, with a market cap of PLN109.07 million.

Operations: The company's revenue from food processing amounts to PLN157.92 million.

Market Cap: PLN109.07M

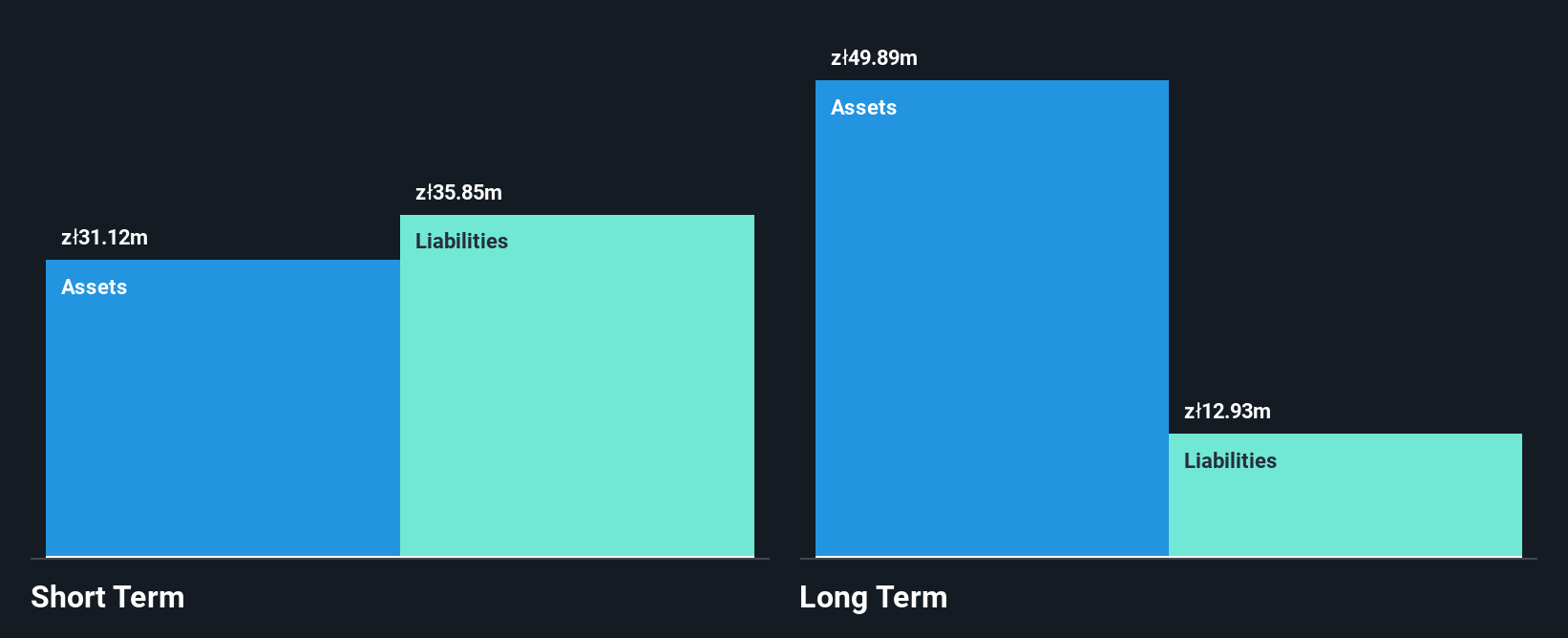

Eurosnack S.A., with a market cap of PLN109.07 million, demonstrates financial stability through its improved debt position, reducing its debt to equity ratio from 58.1% to 24.5% over five years and maintaining a satisfactory net debt to equity ratio of 20.5%. The company's short-term assets exceed long-term liabilities but fall short of covering all short-term liabilities. Despite stable weekly volatility and high-quality earnings, Eurosnack's recent earnings report indicates flat net income growth year-over-year for Q2 2025 at PLN3.47 million, while six-month revenue increased to PLN82.52 million from the previous year's PLN76.15 million.

- Dive into the specifics of Eurosnack here with our thorough balance sheet health report.

- Explore historical data to track Eurosnack's performance over time in our past results report.

Seize The Opportunity

- Dive into all 270 of the European Penny Stocks we have identified here.

- Want To Explore Some Alternatives? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:DWF

Digital Workforce Services Oyj

Provides business process automation services and technology solutions in Finland, Sweden, Norway, Denmark, Poland, rest of the European Union, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026