Update: Basware Oyj (HEL:BAS1V) Stock Gained 24% In The Last Year

On average, over time, stock markets tend to rise higher. This makes investing attractive. But not every stock you buy will perform as well as the overall market. Over the last year the Basware Oyj (HEL:BAS1V) share price is up 24%, but that's less than the broader market return. However, the stock hasn't done so well in the longer term, with the stock only up 2.9% in three years.

Check out our latest analysis for Basware Oyj

Basware Oyj wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Basware Oyj saw its revenue grow by 0.3%. That's not great considering the company is losing money. It's probably fair to say that the modest growth is reflected in the modest share price gain of 24%. A closer look at the bottom line might reveal an opportunity.

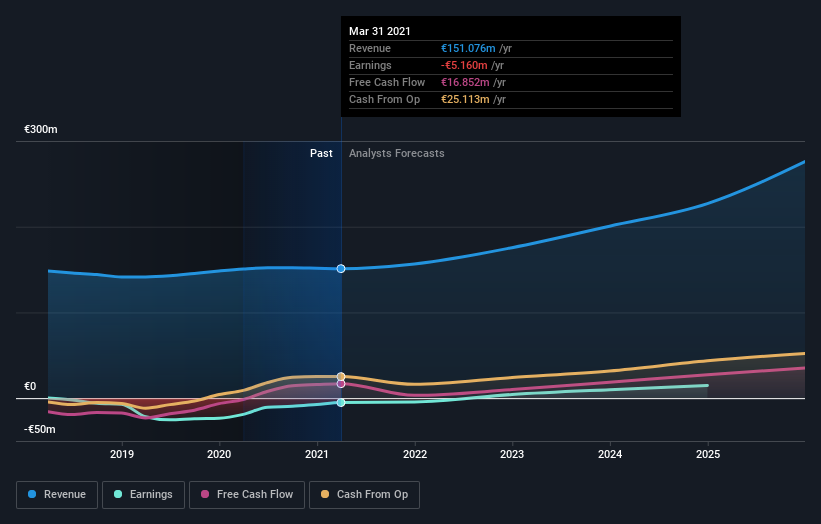

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Basware Oyj shareholders gained a total return of 24% during the year. But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 0.6% per year over five year. It is possible that returns will improve along with the business fundamentals. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FI exchanges.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Basware Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About HLSE:BAS1V

Basware Oyj

Basware Oyj provides networked purchase-to-pay solutions and e-invoicing services in the Americas, Europe, Nordics, and the Asia Pacific.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives