3 European Stocks Estimated To Be Trading At Discounts Of Up To 49.9%

Reviewed by Simply Wall St

As European markets experience a modest upswing, with the pan-European STOXX Europe 600 Index rising by 1.03% amid expectations of U.S. interest rate cuts, investors are keenly observing opportunities to capitalize on potential undervaluations in the region's stocks. In this context, identifying stocks that are trading at significant discounts can be an effective strategy for those looking to harness value amidst evolving economic conditions and central bank policies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK43.64 | SEK85.68 | 49.1% |

| Talenom Oyj (HLSE:TNOM) | €3.605 | €7.18 | 49.8% |

| Micro Systemation (OM:MSAB B) | SEK62.00 | SEK122.46 | 49.4% |

| Lingotes Especiales (BME:LGT) | €5.80 | €11.22 | 48.3% |

| Gofore Oyj (HLSE:GOFORE) | €14.72 | €29.38 | 49.9% |

| Echo Investment (WSE:ECH) | PLN5.54 | PLN10.71 | 48.3% |

| DSV (CPSE:DSV) | DKK1380.00 | DKK2696.01 | 48.8% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.41 | €6.77 | 49.6% |

| cyan (XTRA:CYR) | €2.28 | €4.41 | 48.3% |

| ATON Green Storage (BIT:ATON) | €2.08 | €4.09 | 49.2% |

We'll examine a selection from our screener results.

Admicom Oyj (HLSE:ADMCM)

Overview: Admicom Oyj provides cloud-based software and business process automation solutions in Finland, with a market cap of €233.79 million.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated €36.45 million.

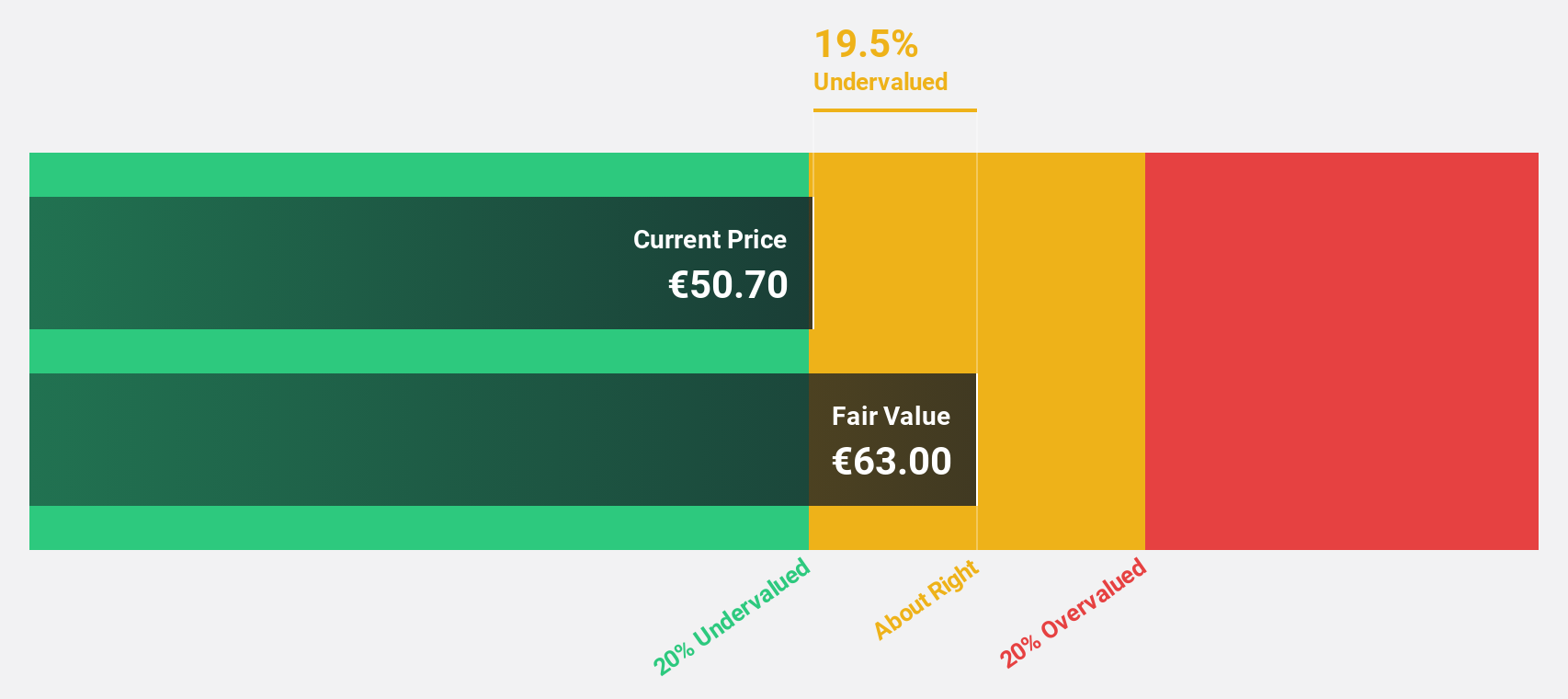

Estimated Discount To Fair Value: 29.3%

Admicom Oyj appears undervalued based on cash flows, trading at €46.6, significantly below its estimated fair value of €65.92. Despite a dip in Q2 2025 net income to €1.29 million from €1.92 million the previous year, revenue is expected to grow 10% annually, outpacing the Finnish market's 4%. Earnings are forecasted to rise substantially at 26.3% per year, supported by strong analyst consensus on a potential price increase of 25%.

- Our comprehensive growth report raises the possibility that Admicom Oyj is poised for substantial financial growth.

- Get an in-depth perspective on Admicom Oyj's balance sheet by reading our health report here.

Gofore Oyj (HLSE:GOFORE)

Overview: Gofore Oyj offers digital transformation consultancy services to both private and public sectors in Finland and internationally, with a market cap of €234.10 million.

Operations: The company's revenue is primarily derived from its computer services segment, which generated €179.99 million.

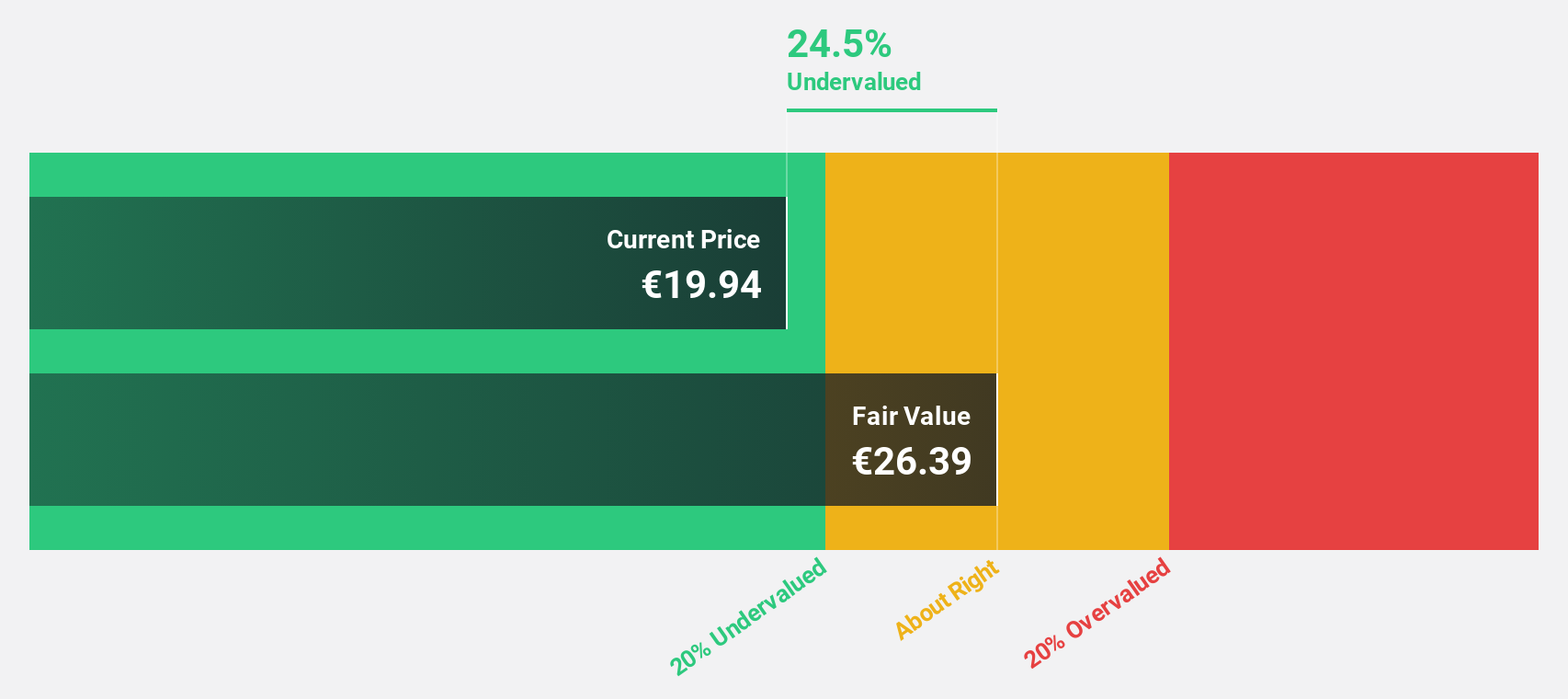

Estimated Discount To Fair Value: 49.9%

Gofore Oyj is trading at €14.72, significantly below its estimated fair value of €29.38, suggesting it is undervalued based on cash flows. Despite a decrease in profit margins from 9.2% to 5%, earnings are expected to grow significantly by 23.2% annually, surpassing the Finnish market's growth rate of 17.5%. Recent unaudited sales figures show a slight decline compared to last year, but share repurchases may support future valuation adjustments.

- Our earnings growth report unveils the potential for significant increases in Gofore Oyj's future results.

- Dive into the specifics of Gofore Oyj here with our thorough financial health report.

Metsä Board Oyj (HLSE:METSB)

Overview: Metsä Board Oyj operates in the folding boxboard, fresh fibre linerboard, and market pulp sectors both in Finland and internationally, with a market capitalization of €1.19 billion.

Operations: The company's revenue from its folding boxboard, fresh fibre linerboard, and market pulp operations amounts to €1.89 billion.

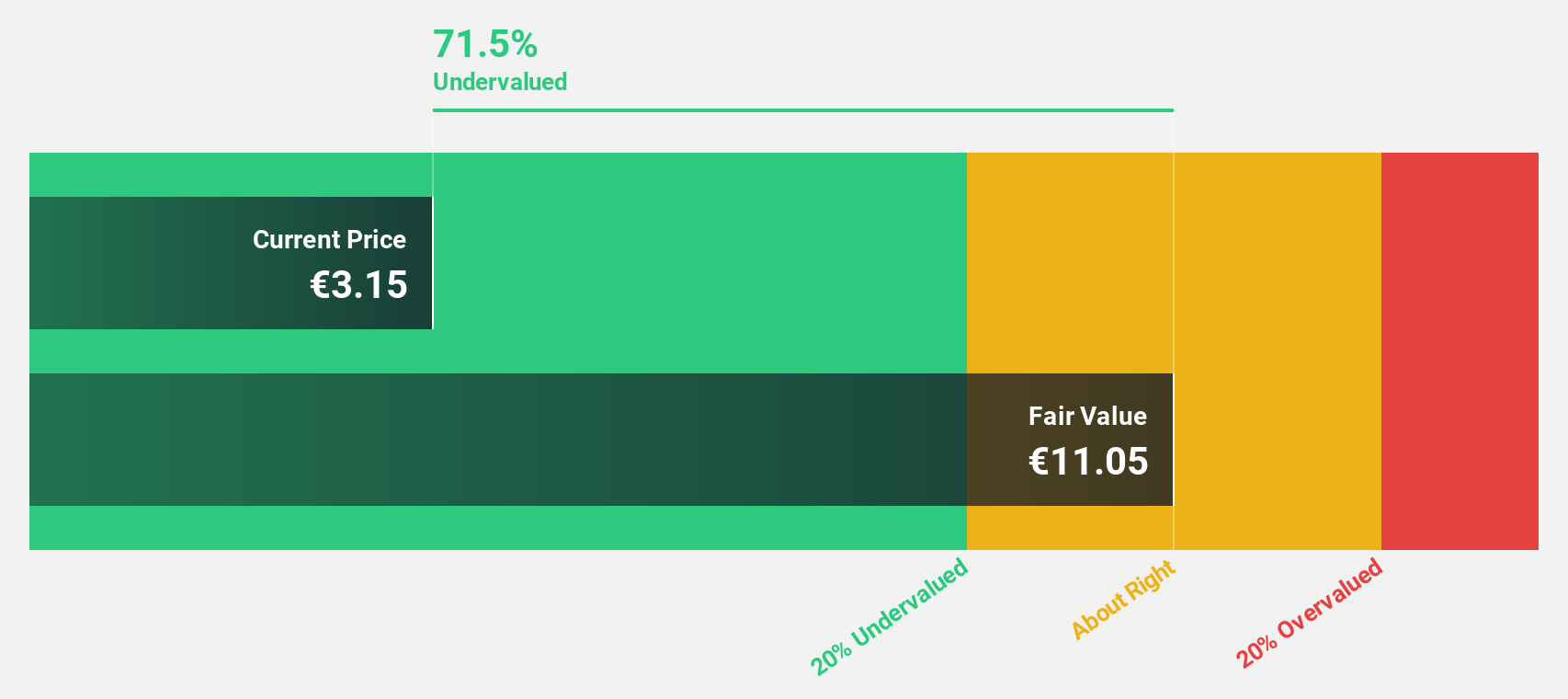

Estimated Discount To Fair Value: 40.3%

Metsä Board Oyj, trading at €3.11, is undervalued based on cash flows with an estimated fair value of €5.21. Despite recent financial challenges, including a net loss of €21.7 million in Q2 2025 and volatile share prices, the company is expected to achieve profitability within three years with earnings growth projected at 78.17% annually. The ongoing €60 million investment in modernizing its Simpele mill aligns with its sustainability goals and may enhance future cash flow potential despite current revenue growth lagging behind industry peers.

- Insights from our recent growth report point to a promising forecast for Metsä Board Oyj's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Metsä Board Oyj.

Next Steps

- Click here to access our complete index of 215 Undervalued European Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:GOFORE

Gofore Oyj

Provides digital transformation consultancy services for private and public sectors in Finland and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives