The European stock market recently experienced a downturn, with the pan-European STOXX Europe 600 Index snapping five weeks of gains following proposed U.S. tariffs on EU goods. Amidst this backdrop of economic uncertainty and shifting trade policies, investors often seek companies that not only demonstrate growth potential but also have high insider ownership, indicating strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 17.5% | 34.2% |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Yubico (OM:YUBICO) | 36.2% | 30.4% |

| Vow (OB:VOW) | 13.1% | 84.7% |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 56.1% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.3% |

| Lokotech Group (OB:LOKO) | 14.5% | 58.1% |

| Elliptic Laboratories (OB:ELABS) | 25.8% | 79% |

We'll examine a selection from our screener results.

CVC Capital Partners (ENXTAM:CVC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CVC Capital Partners plc is a private equity and venture capital firm focusing on middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales and spinouts with a market cap of €17.72 billion.

Operations: The firm's revenue segments include Private Equity (€861.04 million), Credit (€135.64 million), Secondaries (€94.99 million), and Infrastructure (€89.56 million).

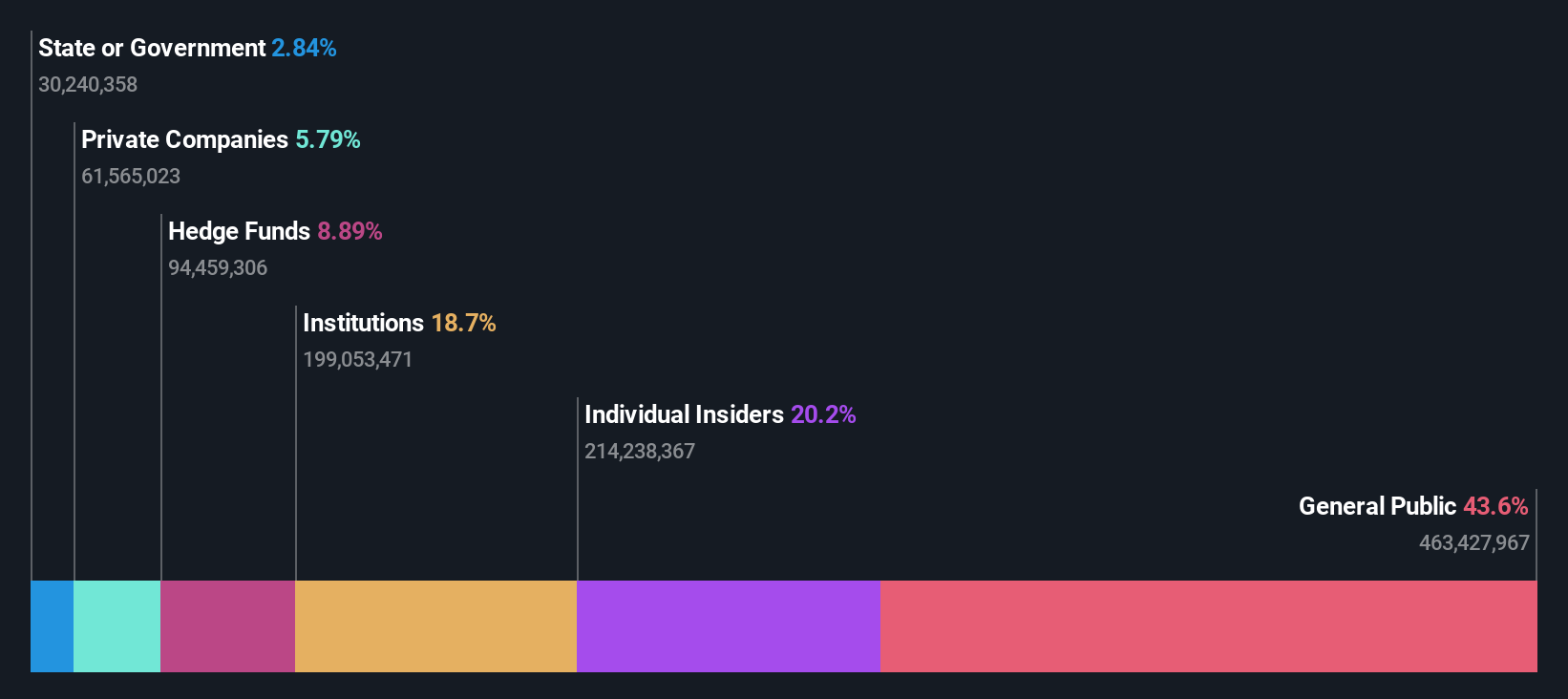

Insider Ownership: 20.2%

Earnings Growth Forecast: 31% p.a.

CVC Capital Partners is positioned for significant growth, with earnings forecasted to expand by over 30% annually, outpacing the Dutch market. Despite a high level of debt and recent volatility in share price, CVC remains undervalued by 28.3% relative to its fair value estimate. Recent M&A discussions indicate strategic expansion opportunities, such as potential acquisitions in animal nutrition and diagnostics sectors valued at billions of euros. However, profit margins have decreased compared to last year.

- Click here to discover the nuances of CVC Capital Partners with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of CVC Capital Partners shares in the market.

Admicom Oyj (HLSE:ADMCM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Admicom Oyj provides cloud-based software and business process automation solutions in Finland, with a market capitalization of €266.28 million.

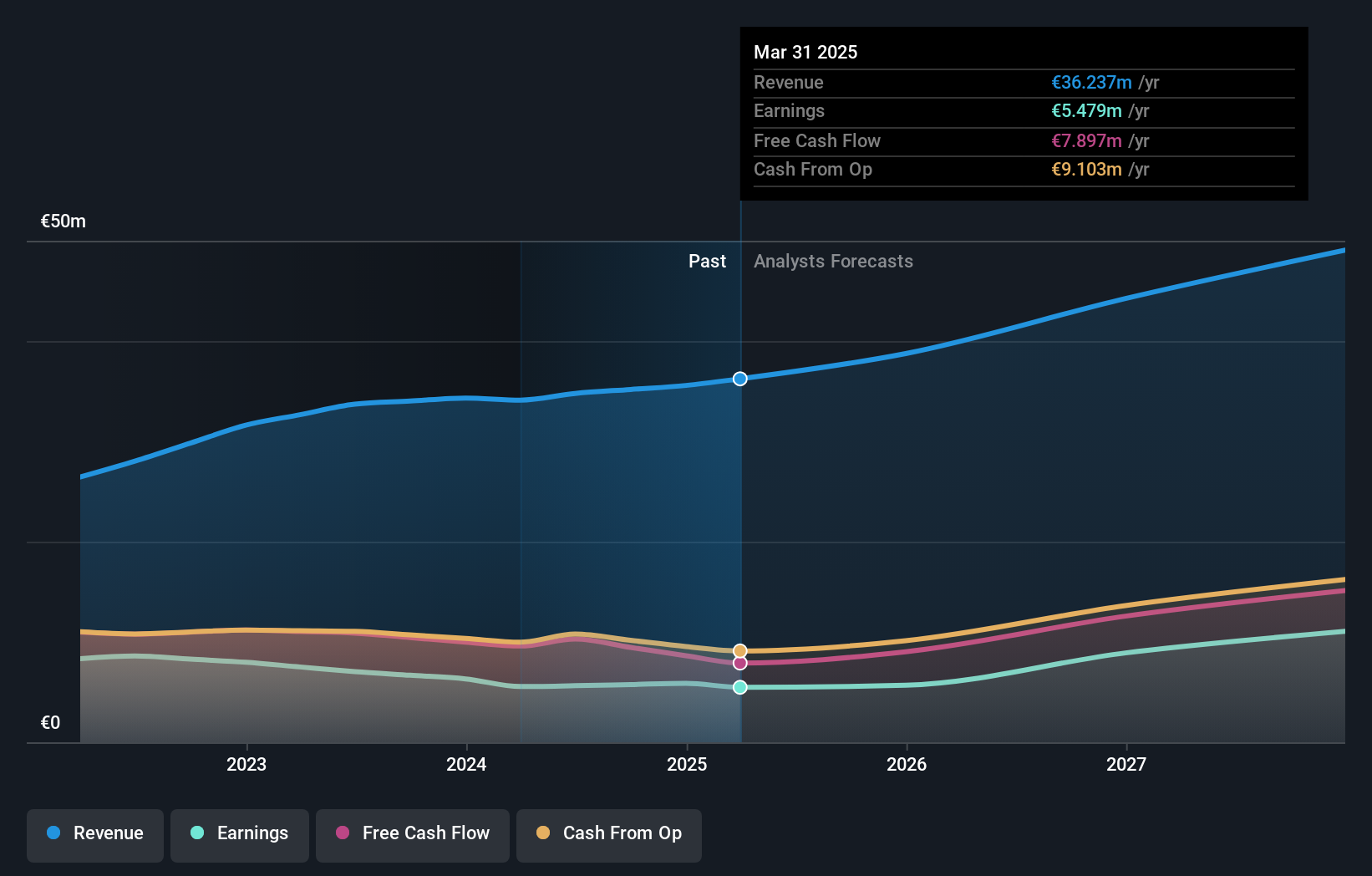

Operations: The company generates revenue of €36.24 million from its software and programming segment.

Insider Ownership: 21.8%

Earnings Growth Forecast: 21.5% p.a.

Admicom Oyj is poised for growth, with earnings expected to rise by 21.5% annually, surpassing the Finnish market's pace. Despite a dip in Q1 net income to €0.676 million from €1.07 million last year, revenue increased to €9.27 million from €8.61 million year-over-year. The company trades at a discount of 16.7% below its estimated fair value and anticipates annual recurring revenue growth between 8% and 14% for 2025, alongside strategic insider ownership stability.

- Navigate through the intricacies of Admicom Oyj with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Admicom Oyj's shares may be trading at a premium.

Nagarro (XTRA:NA9)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nagarro SE, along with its subsidiaries, offers digital product engineering and technology solutions across North America, Central Europe, the rest of Europe, and internationally, with a market cap of €758.89 million.

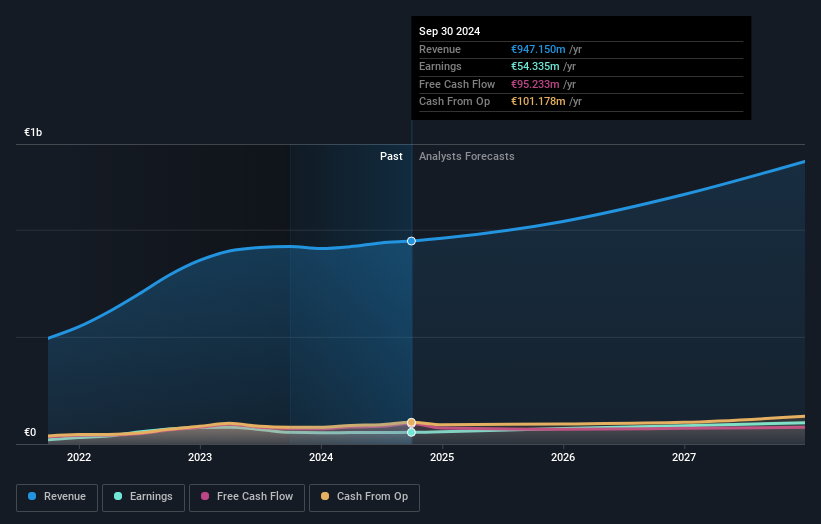

Operations: The company's revenue is primarily derived from its Computer Services segment, which generated €980.84 million.

Insider Ownership: 12.3%

Earnings Growth Forecast: 20.8% p.a.

Nagarro SE is experiencing significant growth, with earnings projected to rise 20.8% annually, outpacing the German market. Despite being dropped from major indices, Nagarro's strategic expansion into SAP solutions through acquiring Notion Edge France enhances its competitive edge in Europe and Africa. The company trades at a 26.3% discount to its estimated fair value and plans a €1 dividend per share, reflecting commitment to shareholder value amidst high insider ownership stability.

- Click here and access our complete growth analysis report to understand the dynamics of Nagarro.

- Insights from our recent valuation report point to the potential undervaluation of Nagarro shares in the market.

Summing It All Up

- Investigate our full lineup of 210 Fast Growing European Companies With High Insider Ownership right here.

- Looking For Alternative Opportunities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 28 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Nagarro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:NA9

Nagarro

Provides digital product engineering and technology solutions in Germany, the United States of America, and internationally.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives