Discovering 3 Promising Penny Stocks With Over US$80M Market Cap

Reviewed by Simply Wall St

Amidst a backdrop of global market fluctuations, highlighted by U.S. tariff uncertainties and mixed economic indicators, investors are keenly observing the shifts in major indices. In such a climate, penny stocks—often overlooked due to their historical connotations—present intriguing opportunities for those willing to explore beyond the mainstream. These smaller or emerging companies can offer substantial growth potential when backed by strong financials and sound fundamentals, making them an appealing option for investors seeking value in less conventional spaces.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.85 | HK$44.2B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £476.68M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £321.93M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.33 | MYR918.11M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £148.85M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.13 | HK$717.31M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

Click here to see the full list of 5,704 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Verkkokauppa.com Oyj (HLSE:VERK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Verkkokauppa.com Oyj is an online retailer based in Finland with a market capitalization of €81.30 million.

Operations: The company generates revenue primarily from its Online Retailers segment, amounting to €467.83 million.

Market Cap: €81.3M

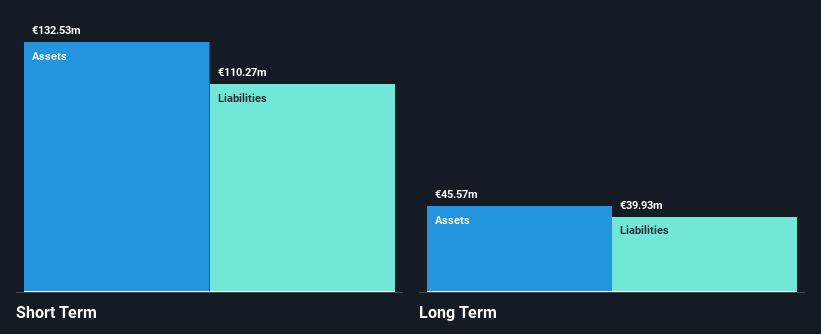

Verkkokauppa.com Oyj, with a market capitalization of €81.30 million, reported a mixed financial performance for 2024. While the company generated significant revenue of €467.83 million, it ended the year with a net loss of €0.803 million and remains unprofitable with negative return on equity (-2.88%). Despite trading below its estimated fair value by 28.3%, Verkkokauppa.com faces challenges such as high debt levels and interest coverage issues (0.3x EBIT). However, its short-term assets exceed both short- and long-term liabilities, providing some financial stability amidst volatility in share price and an inexperienced board.

- Get an in-depth perspective on Verkkokauppa.com Oyj's performance by reading our balance sheet health report here.

- Evaluate Verkkokauppa.com Oyj's prospects by accessing our earnings growth report.

Transcenta Holding (SEHK:6628)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Transcenta Holding Limited is a clinical stage biopharmaceutical company focused on the discovery, research, development, manufacture, and commercialization of drugs for unmet medical needs in China and the US, with a market cap of HK$274.88 million.

Operations: The company's revenue is primarily generated from its segment dedicated to discovering, developing, manufacturing, and commercializing novel drugs, amounting to CN¥22.33 million.

Market Cap: HK$274.88M

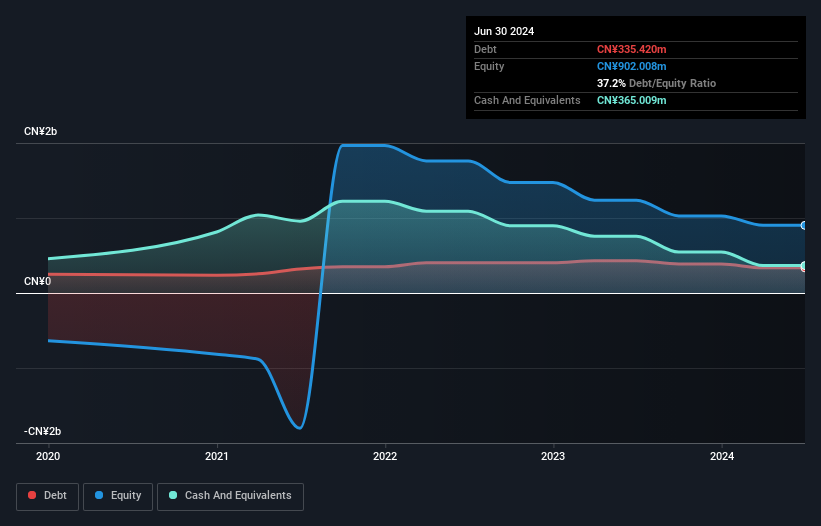

Transcenta Holding is a clinical-stage biopharmaceutical company with a market cap of HK$274.88 million, focusing on developing novel drugs. Despite being pre-revenue with earnings of CN¥22.33 million, the company has reduced losses by 14.4% annually over five years and holds more cash than its total debt, indicating financial resilience. Its short-term assets exceed liabilities, offering some stability amid high share price volatility. Recent advancements include promising preclinical results for its ADCs targeting triple-negative breast cancer, showcasing potential in addressing unmet medical needs but profitability remains elusive in the near term as per forecasts.

- Click to explore a detailed breakdown of our findings in Transcenta Holding's financial health report.

- Gain insights into Transcenta Holding's outlook and expected performance with our report on the company's earnings estimates.

Valuetronics Holdings (SGX:BN2)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Valuetronics Holdings Limited is an investment holding company that offers integrated electronics manufacturing services, with a market cap of SGD264.27 million.

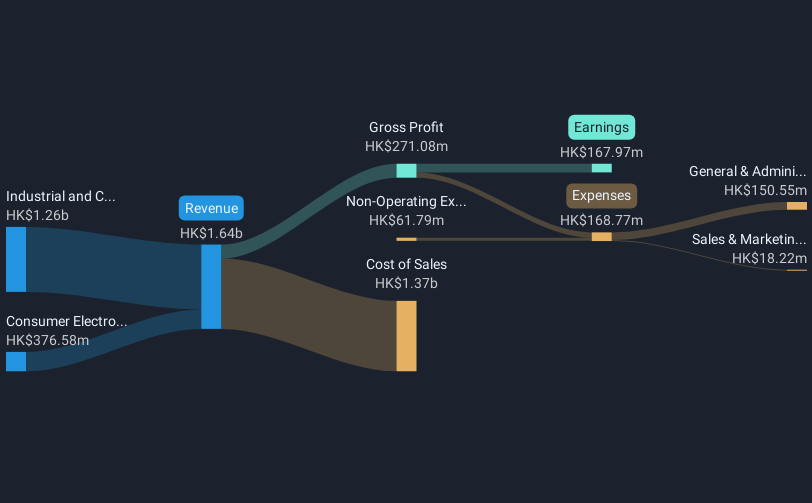

Operations: The company generates revenue from Consumer Electronics amounting to HK$376.58 million and Industrial and Commercial Electronics totaling HK$1.26 billion.

Market Cap: SGD264.27M

Valuetronics Holdings, with a market cap of SGD264.27 million, is an investment holding company in the electronics manufacturing sector, generating significant revenue from Consumer Electronics (HK$376.58 million) and Industrial and Commercial Electronics (HK$1.26 billion). The company has demonstrated financial stability with no debt and sufficient short-term assets (HK$1.8 billion) to cover liabilities. Despite a modest earnings growth forecast of 4.7% annually, its past five-year profit decline suggests challenges in sustained profitability improvement. Recent share buybacks reflect management's confidence but dividend sustainability remains questionable due to insufficient free cash flow coverage.

- Take a closer look at Valuetronics Holdings' potential here in our financial health report.

- Assess Valuetronics Holdings' future earnings estimates with our detailed growth reports.

Next Steps

- Investigate our full lineup of 5,704 Penny Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BN2

Valuetronics Holdings

An investment holding company, provides integrated electronics manufacturing services (EMS).

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives