- Denmark

- /

- Real Estate

- /

- CPSE:CEMAT

Cemat And 2 European Penny Stocks With Promising Potential

Reviewed by Simply Wall St

Amid concerns over the independence of the U.S. Federal Reserve and political uncertainties in Europe, the pan-European STOXX Europe 600 Index recently ended lower, reflecting broader market apprehensions. For investors looking beyond well-known stocks, penny stocks—often associated with smaller or newer companies—remain an intriguing area of exploration. Despite being considered a somewhat outdated term, these stocks can still offer compelling opportunities when backed by strong financials and potential for growth. In this article, we explore three European penny stocks that stand out for their financial strength and growth potential.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.464 | €1.54B | ✅ 4 ⚠️ 2 View Analysis > |

| Maps (BIT:MAPS) | €3.35 | €44.5M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €252.7M | ✅ 2 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.46 | RON16.91M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €3.16 | €66.65M | ✅ 4 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.00 | €9.52M | ✅ 2 ⚠️ 5 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.68 | €413.64M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.115 | €292.34M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.94 | €31.7M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 332 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Cemat (CPSE:CEMAT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cemat A/S is involved in the development, operation, and sale of properties in Poland with a market cap of DKK241.65 million.

Operations: The company's revenue is primarily derived from Property Management & Holding, which accounts for DKK38.77 million, with a smaller contribution from Development at DKK0.02 million.

Market Cap: DKK241.65M

Cemat A/S, operating in the property sector in Poland, has shown strong financial performance with a market cap of DKK241.65 million. Despite a slight decrease in sales to DKK19.44 million for the half-year ending June 2025, net income surged to DKK13.77 million from DKK0.624 million previously, indicating significant profitability growth and high-quality earnings despite large one-off items impacting results. The company maintains robust financial health with short-term assets exceeding both short and long-term liabilities and debt well-covered by cash flow, though its Return on Equity remains low at 13.2%.

- Take a closer look at Cemat's potential here in our financial health report.

- Examine Cemat's past performance report to understand how it has performed in prior years.

Verkkokauppa.com Oyj (HLSE:VERK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Verkkokauppa.com Oyj is an online retailer based in Finland with a market cap of €170.80 million.

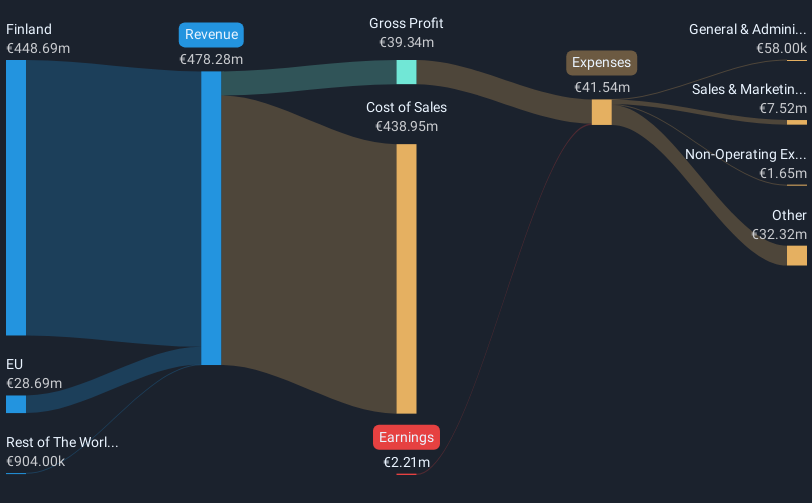

Operations: The company generates revenue primarily from its online retail operations, amounting to €481.35 million.

Market Cap: €170.8M

Verkkokauppa.com Oyj, with a market cap of €170.80 million, has shown improvement by becoming profitable in the past year. The company reported second-quarter sales of €116.47 million and a net income of €0.95 million, contrasting with a loss from the previous year. Short-term assets exceed both short and long-term liabilities, indicating solid financial health. However, the share price remains highly volatile and recent insider selling suggests caution. Despite these challenges, debt is well covered by operating cash flow and interest payments are adequately managed by EBIT coverage at 4.2 times interest repayments.

- Click here to discover the nuances of Verkkokauppa.com Oyj with our detailed analytical financial health report.

- Gain insights into Verkkokauppa.com Oyj's future direction by reviewing our growth report.

NEXT Biometrics Group (OB:NEXT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NEXT Biometrics Group ASA, with a market cap of NOK414.56 million, provides fingerprint sensor technology across Asia, Europe, Africa, and North America.

Operations: The company's revenue is derived from its Fingerprint Sensor Technology segment, amounting to NOK45.17 million.

Market Cap: NOK414.56M

NEXT Biometrics Group ASA, with a market cap of NOK414.56 million, is currently unprofitable but has made significant strides in its fingerprint sensor technology. Recent announcements highlight a large-scale production order for the new FAP 30 ‘Granite’ sensor, valued at NOK3.2 million, aimed at government ID programs in Africa and Latin America. Despite reporting increased net losses and reduced sales compared to last year, NEXT's debt-free status and stable shareholder structure provide some financial stability. The company also extended its partnership with XM Holder for the FAP 20 Basalt L1 Slim sensor, anticipating further orders worth NOK25 million annually.

- Navigate through the intricacies of NEXT Biometrics Group with our comprehensive balance sheet health report here.

- Gain insights into NEXT Biometrics Group's historical outcomes by reviewing our past performance report.

Next Steps

- Click this link to deep-dive into the 332 companies within our European Penny Stocks screener.

- Ready To Venture Into Other Investment Styles? Uncover 14 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:CEMAT

Excellent balance sheet and good value.

Market Insights

Community Narratives