As global markets navigate a mixed landscape, with U.S. stocks closing out a strong year despite recent volatility, investors are increasingly exploring diverse opportunities. Penny stocks, though often seen as relics of earlier market eras, remain an intriguing investment area due to their affordability and potential for growth. These smaller or newer companies can offer compelling opportunities when backed by robust financials, and in this article, we explore three such penny stocks that stand out for their financial strength and potential to uncover hidden value.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.71 | £425.03M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.01 | £757.4M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.64 | HK$40.08B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.87 | £469.45M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.966 | £152.38M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,820 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Verkkokauppa.com Oyj (HLSE:VERK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Verkkokauppa.com Oyj is an online retailer based in Finland with a market cap of €65.19 million.

Operations: The company generates €478.28 million in revenue from its online retail operations.

Market Cap: €65.19M

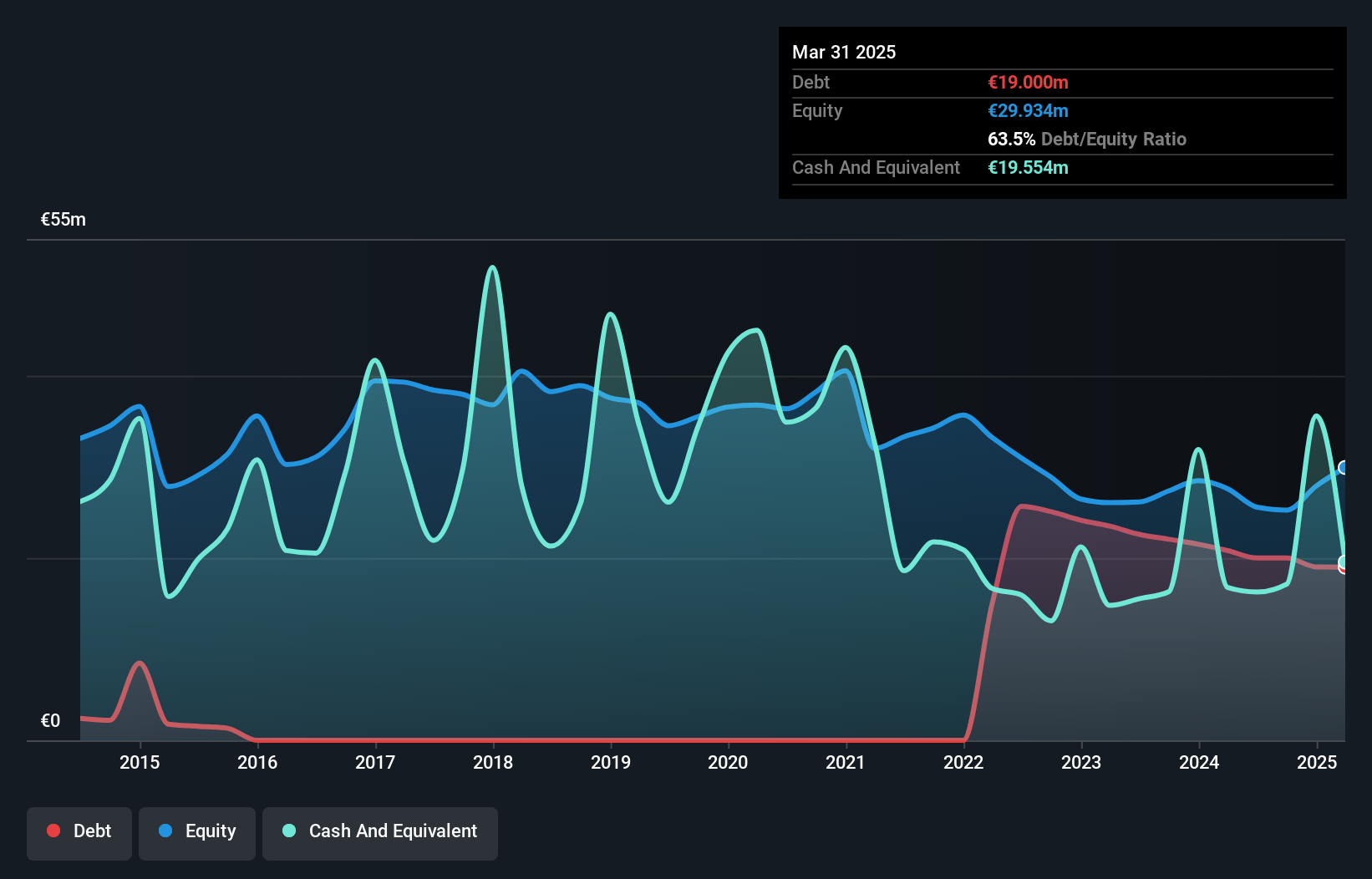

Verkkokauppa.com Oyj, with a market cap of €65.19 million and revenue of €478.28 million, is navigating challenges typical for penny stocks. Despite being unprofitable, the company trades at 53.1% below its estimated fair value and offers good relative value compared to peers. Recent earnings reports show a net loss of €0.329 million for Q3 2024 and increased losses over the past five years by 41% annually, highlighting financial struggles but also potential turnaround opportunities as earnings are forecasted to grow significantly in the future. The management team shows experience with an average tenure of 2.3 years.

- Unlock comprehensive insights into our analysis of Verkkokauppa.com Oyj stock in this financial health report.

- Learn about Verkkokauppa.com Oyj's future growth trajectory here.

Xinjiang Xinxin Mining Industry (SEHK:3833)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Xinjiang Xinxin Mining Industry Co., Ltd. operates in the mining, ore processing, smelting, refining, and sale of nickel, copper, and other nonferrous metals with a market capitalization of HK$1.83 billion.

Operations: The company generates revenue of CN¥2.35 billion from its metals and mining operations, specifically in miscellaneous activities.

Market Cap: HK$1.83B

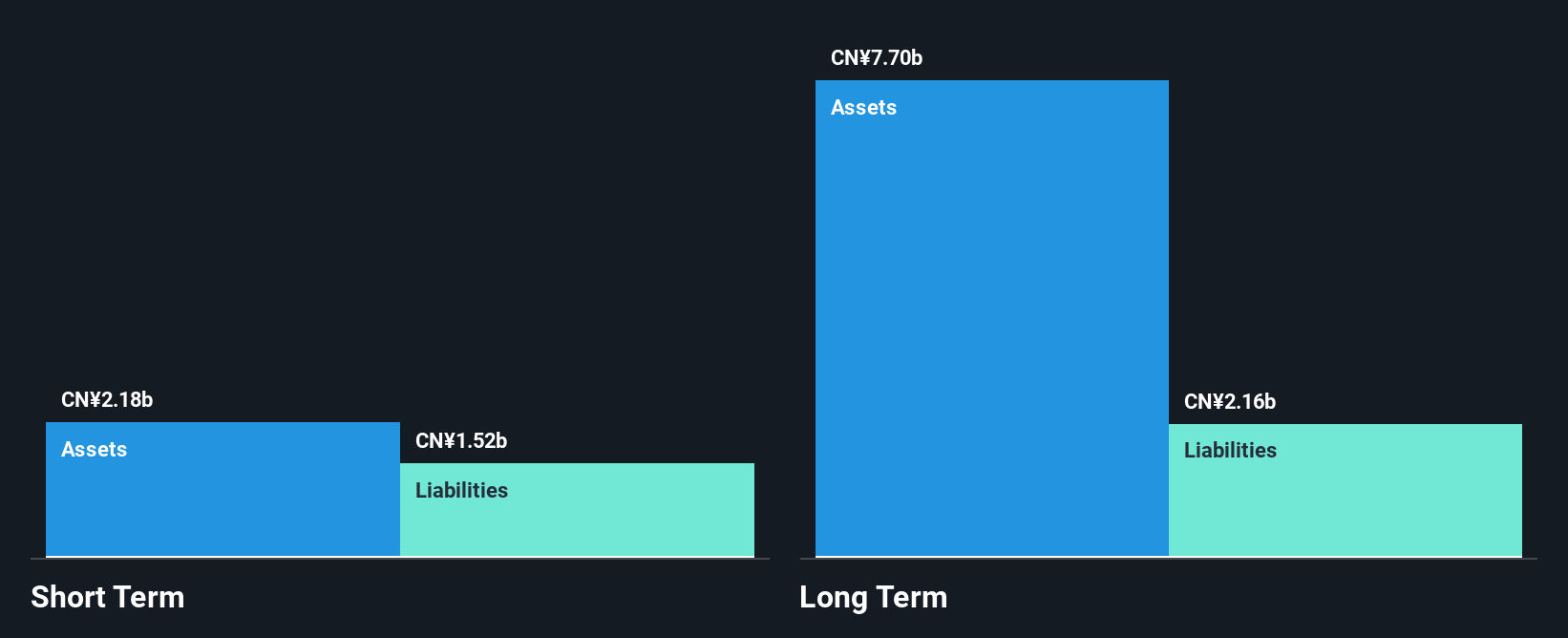

Xinjiang Xinxin Mining Industry, with a market cap of HK$1.83 billion and revenue of CN¥2.35 billion, has recently experienced executive changes and amendments to its Articles of Association. The company's short-term assets exceed both its short- and long-term liabilities, indicating solid liquidity management. Despite a decline in profit margins from 16.2% to 5.9%, Xinjiang Xinxin's debt is well covered by operating cash flow, and interest payments are comfortably managed by EBIT at 27.5x coverage. However, recent financials were impacted by a significant one-off loss of CN¥63.9 million, affecting overall earnings quality.

- Click here to discover the nuances of Xinjiang Xinxin Mining Industry with our detailed analytical financial health report.

- Explore historical data to track Xinjiang Xinxin Mining Industry's performance over time in our past results report.

Jilin Province Huinan Changlong Bio-pharmacy (SEHK:8049)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jilin Province Huinan Changlong Bio-pharmacy Company Limited manufactures and distributes Chinese medicines and pharmaceutical products in the People’s Republic of China, with a market cap of HK$806.76 million.

Operations: The company generates CN¥839 million in revenue from its operations in manufacturing and distributing Chinese medicines and pharmaceutical products.

Market Cap: HK$806.76M

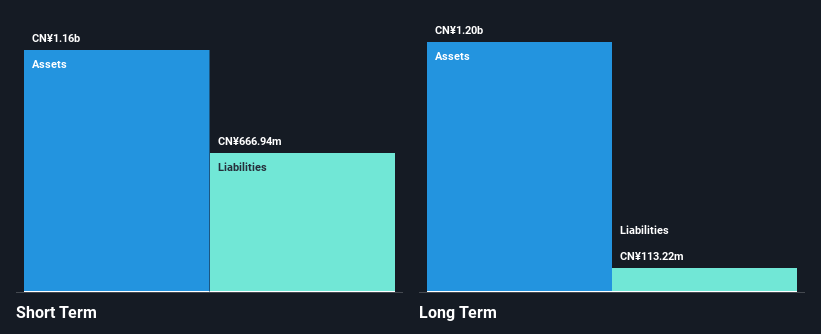

Jilin Province Huinan Changlong Bio-pharmacy, with a market cap of HK$806.76 million and revenue of CN¥839 million, shows a mixed financial picture. The company benefits from strong liquidity, as its short-term assets surpass both short- and long-term liabilities. Debt is well-covered by operating cash flow, and interest payments are not a concern due to sufficient earnings coverage. However, the company faces challenges with negative earnings growth over the past year and declining profit margins from 22.9% to 20.5%. Despite these issues, it trades significantly below estimated fair value and has not diluted shareholders recently.

- Get an in-depth perspective on Jilin Province Huinan Changlong Bio-pharmacy's performance by reading our balance sheet health report here.

- Understand Jilin Province Huinan Changlong Bio-pharmacy's track record by examining our performance history report.

Next Steps

- Click this link to deep-dive into the 5,820 companies within our Penny Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:VERK

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives