3 European Penny Stocks With Market Caps Under €200M To Consider

Reviewed by Simply Wall St

The European market has recently experienced a pullback, with concerns over artificial intelligence-related stock valuations affecting investor sentiment across major indices. Despite these challenges, penny stocks remain an intriguing area for investors seeking growth opportunities at lower price points. Often associated with smaller or newer companies, penny stocks can still offer significant potential when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €3.666 | €1.27B | ✅ 5 ⚠️ 2 View Analysis > |

| DigiTouch (BIT:DGT) | €2.00 | €27.64M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €239.95M | ✅ 2 ⚠️ 2 View Analysis > |

| Libertas 7 (BME:LIB) | €3.16 | €67.03M | ✅ 3 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.46 | SEK210.5M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.575 | €404.36M | ✅ 4 ⚠️ 1 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.955 | €77.06M | ✅ 2 ⚠️ 4 View Analysis > |

| High (ENXTPA:HCO) | €3.94 | €77.07M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.085 | €288.19M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 279 stocks from our European Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Crypto Blockchain Industries (ENXTPA:ALCBI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Crypto Blockchain Industries operates in the cryptocurrency and blockchain application sector in France, with a market cap of €58.11 million.

Operations: The company generates its revenue from the blockchain segment, totaling €5.21 million.

Market Cap: €58.11M

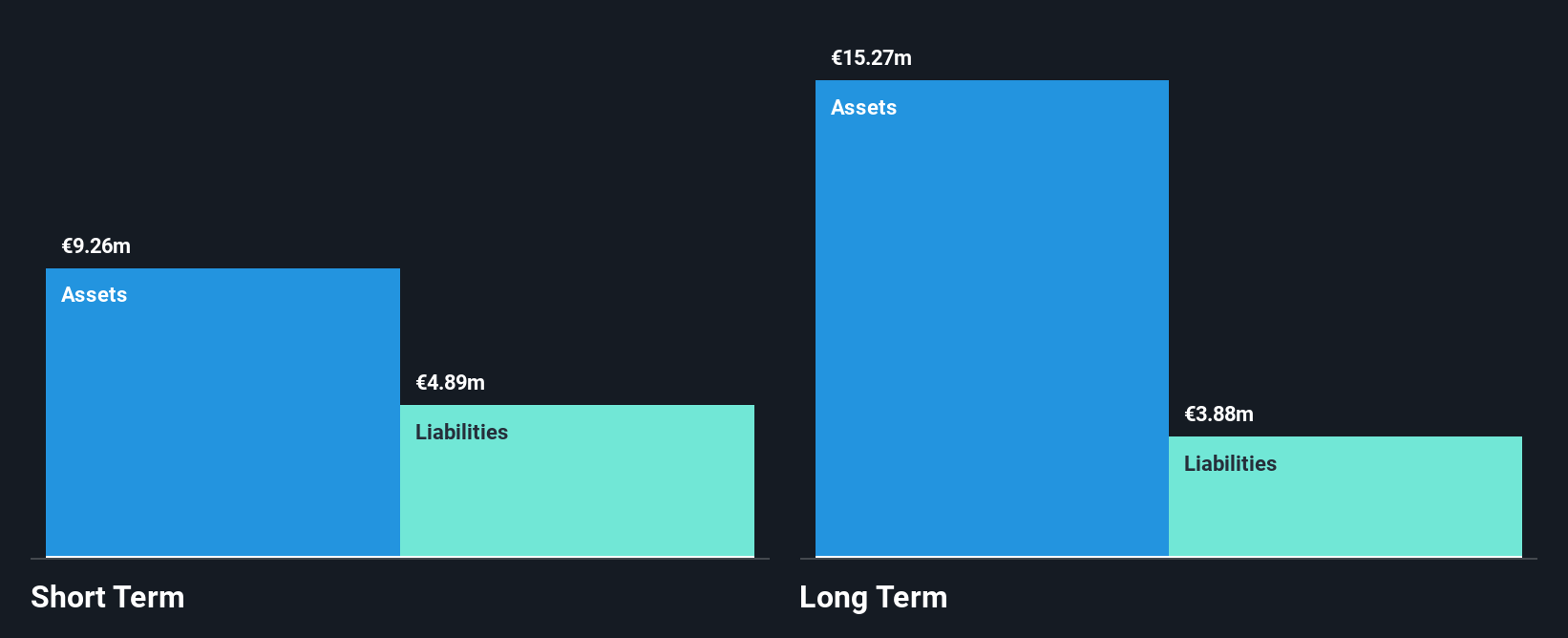

Crypto Blockchain Industries, with a market cap of €58.11 million, operates in the volatile cryptocurrency and blockchain sector in France. Despite generating €5.21 million from its blockchain segment, the company remains unprofitable and has seen earnings decline by 60.1% annually over five years. Positively, ALCBI's debt to equity ratio has improved significantly from 33.4% to 3.9%, and it holds more cash than total debt. However, its share price remains highly volatile, although volatility has decreased recently. Short-term assets exceed both short- and long-term liabilities, providing some financial stability amidst ongoing challenges.

- Click here to discover the nuances of Crypto Blockchain Industries with our detailed analytical financial health report.

- Examine Crypto Blockchain Industries' past performance report to understand how it has performed in prior years.

Verkkokauppa.com Oyj (HLSE:VERK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Verkkokauppa.com Oyj is an online retailer based in Finland with a market cap of €180.69 million.

Operations: The company generates revenue primarily from its online retail operations, amounting to €498.33 million.

Market Cap: €180.69M

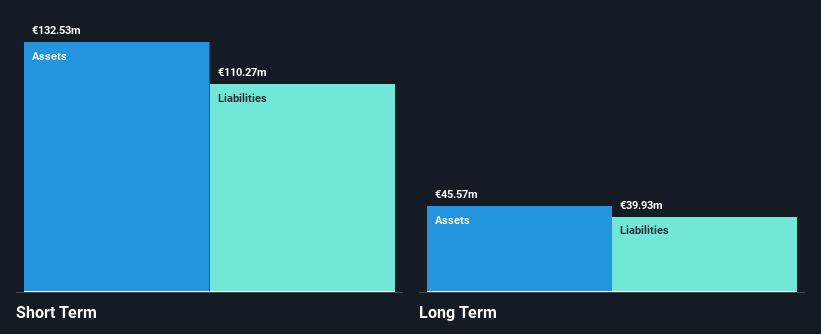

Verkkokauppa.com Oyj, with a market cap of €180.69 million, has shown financial resilience by becoming profitable this year and reporting a net income of €5.32 million for Q3 2025. The company effectively manages its debt, as cash exceeds total debt and short-term assets cover both short- and long-term liabilities. However, recent regulatory challenges include a €540,000 fine related to anti-money laundering compliance issues. Despite these hurdles, Verkkokauppa.com is undertaking share repurchases to improve capital structure and support incentive plans while maintaining high-quality earnings and strong interest coverage from EBIT at 8.4 times interest payments.

- Navigate through the intricacies of Verkkokauppa.com Oyj with our comprehensive balance sheet health report here.

- Examine Verkkokauppa.com Oyj's earnings growth report to understand how analysts expect it to perform.

Polytec Holding (WBAG:PYT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Polytec Holding AG, with a market cap of €66.43 million, develops, manufactures, and sells plastic solutions for passenger cars and light commercial vehicles, commercial vehicles, and smart plastic and industrial applications.

Operations: The company's revenue primarily comes from its Plastics Processing segment, which generated €687.15 million.

Market Cap: €66.43M

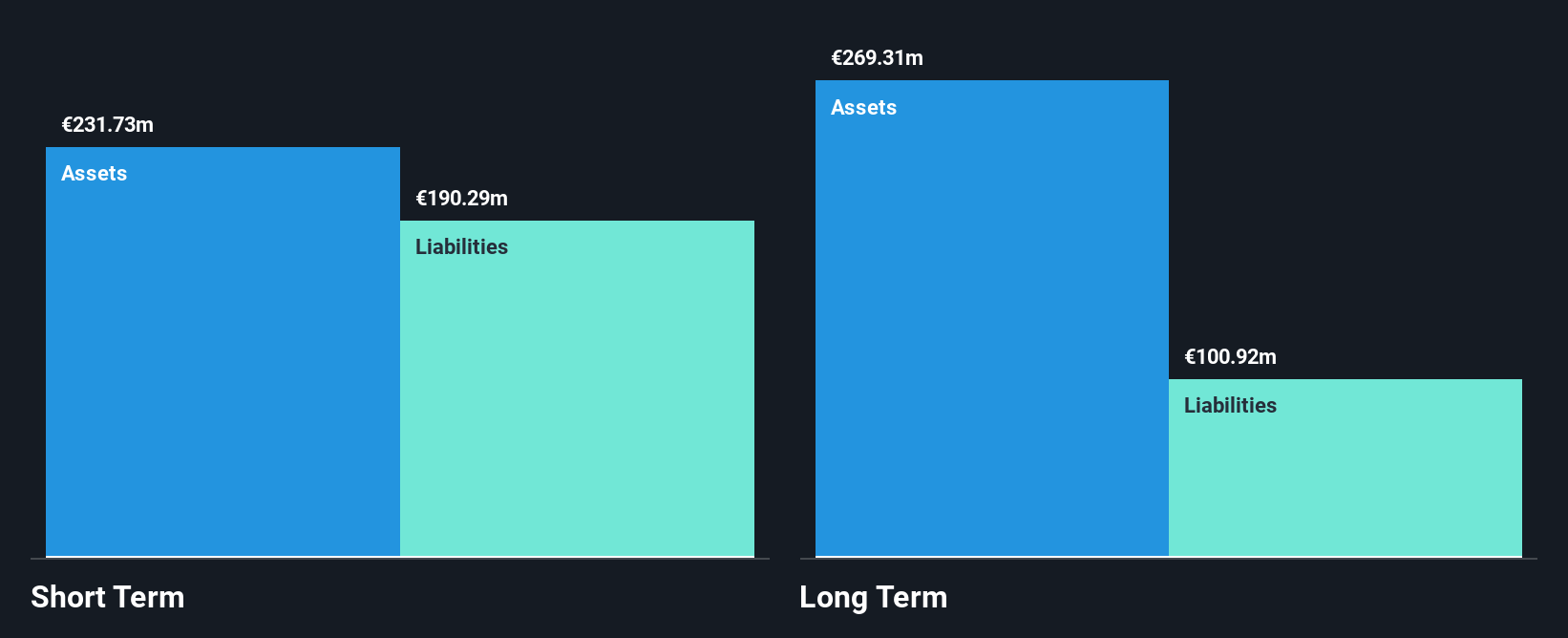

Polytec Holding AG, with a market cap of €66.43 million, is navigating the penny stock landscape with mixed financial health indicators. The company recently reaffirmed its earnings guidance for 2025, projecting sales between €650 million and €700 million. Despite stable weekly volatility and sufficient short-term asset coverage over liabilities, Polytec remains unprofitable with negative return on equity and interest payments not well covered by EBIT. However, debt levels have improved over five years as the debt-to-equity ratio decreased significantly. Analysts anticipate a potential stock price increase of 42%, reflecting cautious optimism in its future performance.

- Click here and access our complete financial health analysis report to understand the dynamics of Polytec Holding.

- Explore Polytec Holding's analyst forecasts in our growth report.

Summing It All Up

- Discover the full array of 279 European Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALCBI

Crypto Blockchain Industries

Engages in the cryptocurrency and blockchain-based application business in France.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives