- Finland

- /

- Real Estate

- /

- HLSE:KOJAMO

Shareholders in Kojamo Oyj (HEL:KOJAMO) have lost 49%, as stock drops 6.7% this past week

Many investors define successful investing as beating the market average over the long term. But if you try your hand at stock picking, you risk returning less than the market. Unfortunately, that's been the case for longer term Kojamo Oyj (HEL:KOJAMO) shareholders, since the share price is down 51% in the last three years, falling well short of the market decline of around 16%. Furthermore, it's down 12% in about a quarter. That's not much fun for holders.

With the stock having lost 6.7% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Kojamo Oyj

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

We know that Kojamo Oyj has been profitable in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics might give us a better handle on how its value is changing over time.

Revenue is actually up 5.5% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Kojamo Oyj further; while we may be missing something on this analysis, there might also be an opportunity.

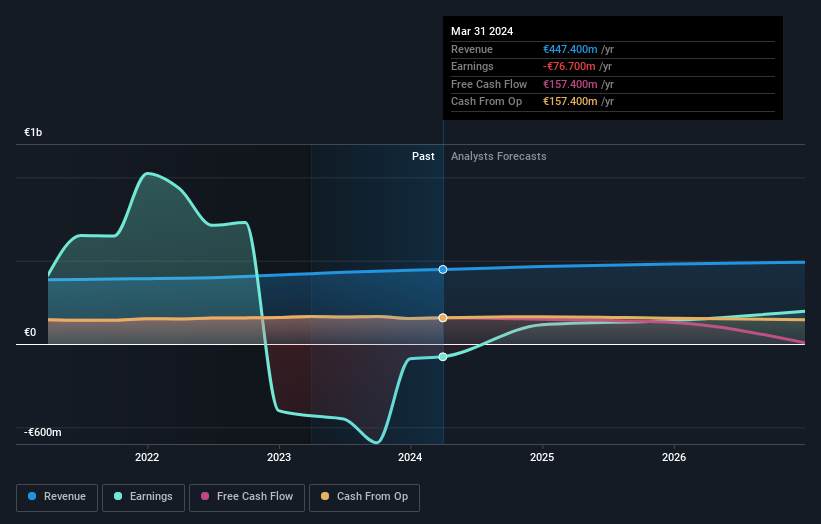

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Kojamo Oyj's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We've already covered Kojamo Oyj's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Kojamo Oyj's TSR, which was a 49% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

While it's never nice to take a loss, Kojamo Oyj shareholders can take comfort that their trailing twelve month loss of 1.6% wasn't as bad as the market loss of around 3.3%. Of far more concern is the 3% p.a. loss served to shareholders over the last five years. This sort of share price action isn't particularly encouraging, but at least the losses are slowing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Kojamo Oyj that you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Finnish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Kojamo Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:KOJAMO

Kojamo Oyj

Operates as a private residential real estate company in Finland.

Moderate growth potential and overvalued.