As global markets show resilience with U.S. indexes nearing record highs and positive sentiment driven by strong labor market data, investors are increasingly looking for stability amidst geopolitical uncertainties and economic fluctuations. In such an environment, dividend stocks can offer a reliable income stream and potential portfolio enhancement, making them an attractive consideration for those seeking to balance growth with income in today's dynamic market landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.34% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.18% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.55% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.55% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.91% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.42% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Ålandsbanken Abp (HLSE:ALBAV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ålandsbanken Abp, with a market cap of €523.29 million, operates as a commercial bank serving private individuals and companies in Finland and Sweden through its subsidiaries.

Operations: Ålandsbanken Abp generates its revenue from several segments, including IT (€52.97 million), Premium Banking (€73.37 million), Corporate and Other (€8.42 million), and Private Banking (Including Asset Management) (€100.64 million).

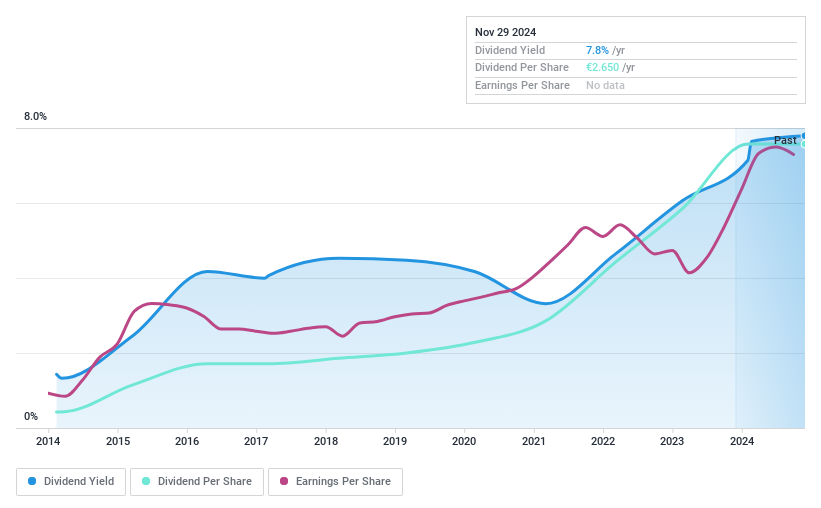

Dividend Yield: 7.7%

Ålandsbanken Abp offers an attractive dividend yield of 7.7%, placing it in the top 25% of Finnish dividend payers. Over the past decade, its dividends have grown steadily with minimal volatility, supported by a reasonable payout ratio of 65.8%. Despite recent earnings showing a slight decline in Q3 compared to last year, the nine-month figures reflect strong growth. However, concerns include a high level of bad loans at 2% and insufficient data on long-term dividend coverage sustainability.

- Click to explore a detailed breakdown of our findings in Ålandsbanken Abp's dividend report.

- In light of our recent valuation report, it seems possible that Ålandsbanken Abp is trading beyond its estimated value.

EFG International (SWX:EFGN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: EFG International AG, along with its subsidiaries, offers private banking, wealth management, and asset management services and has a market capitalization of CHF3.59 billion.

Operations: EFG International AG's revenue segments are comprised of the Americas (CHF128.80 million), Asia Pacific (CHF176.70 million), United Kingdom (CHF193.30 million), Switzerland & Italy (CHF449.70 million), Global Markets & Treasury (CHF55.30 million), Investment and Wealth Solutions (CHF122.90 million), and Continental Europe & Middle East (CHF257.30 million).

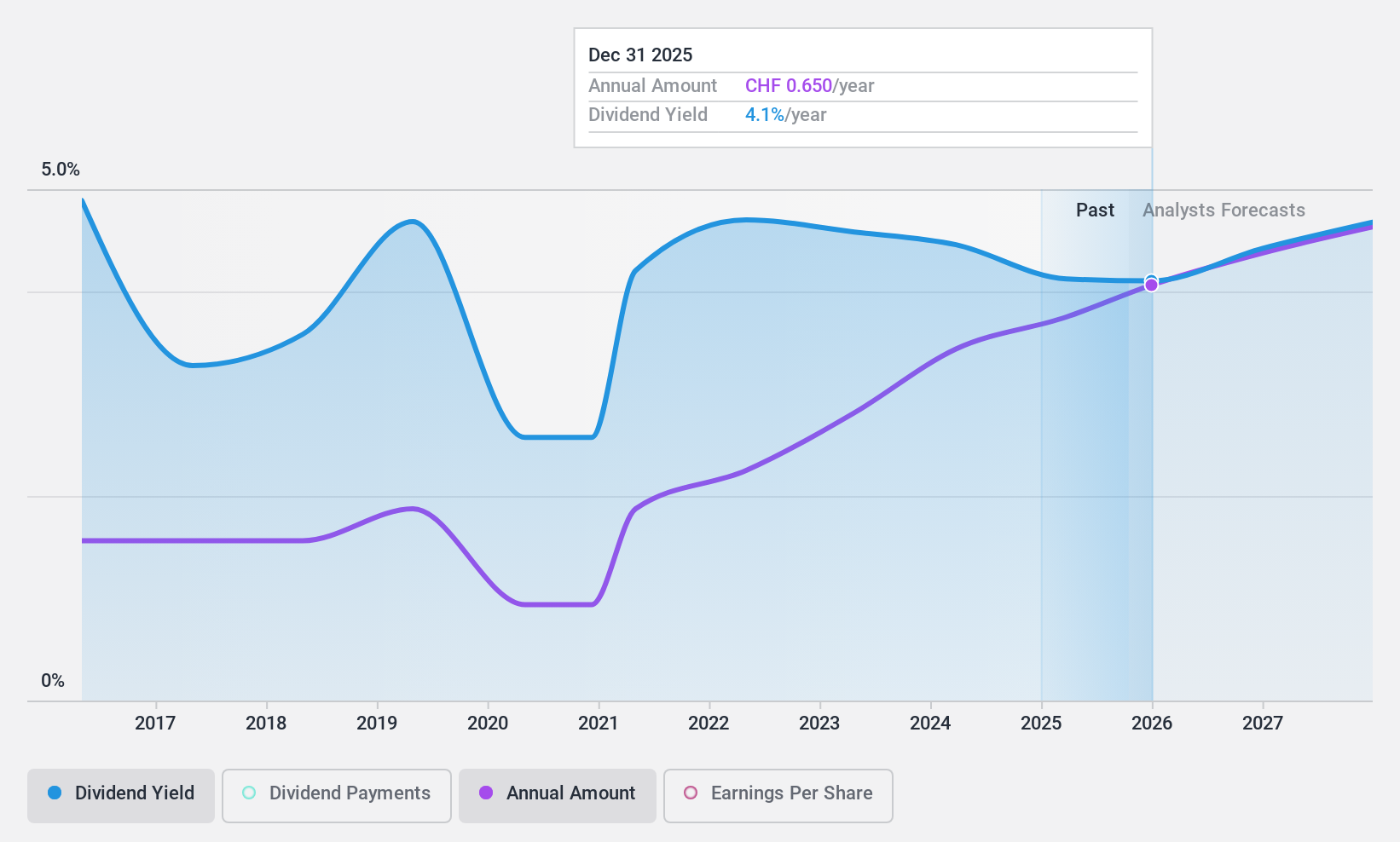

Dividend Yield: 4.6%

EFG International offers a dividend yield of 4.64%, ranking in the top 25% of Swiss payers, with dividends covered by earnings at a payout ratio of 55.2%. However, its dividend history is volatile and unreliable over the past decade. While earnings grew by 31% last year and are forecasted to grow annually, the firm faces challenges with high bad loans at 2.4% and low allowance for them at 5%.

- Unlock comprehensive insights into our analysis of EFG International stock in this dividend report.

- According our valuation report, there's an indication that EFG International's share price might be on the cheaper side.

BAWAG Group (WBAG:BG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BAWAG Group AG functions as a holding company for BAWAG P.S.K. with a market capitalization of €5.78 billion.

Operations: BAWAG Group AG generates revenue from segments including Retail & SME (€1.08 billion), Corporates, Real Estate & Public Sector (€295.10 million), and Treasury (€74.60 million).

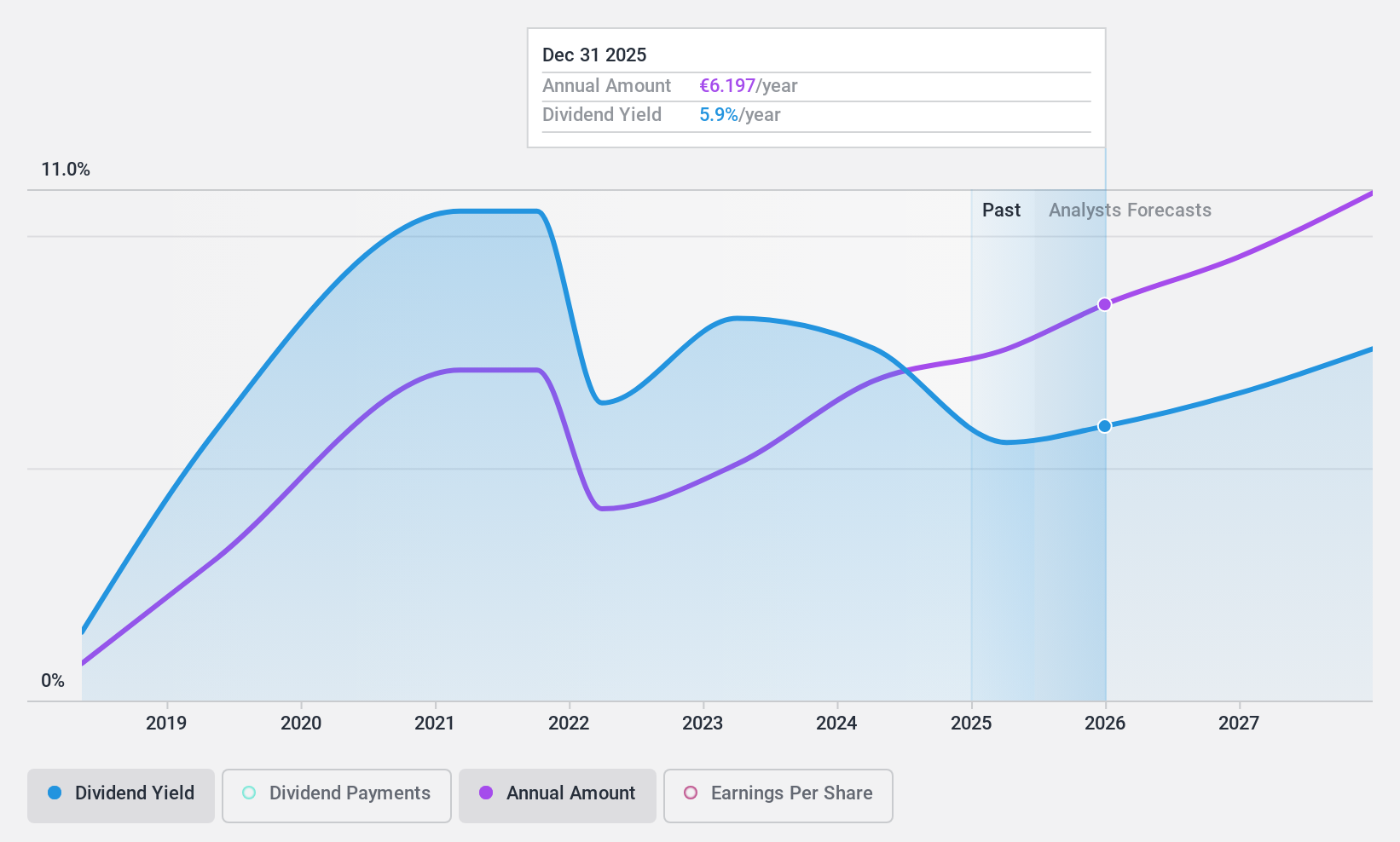

Dividend Yield: 6.8%

BAWAG Group's dividend yield of 6.79% is among the top 25% in Austria, with a payout ratio of 58.7%, indicating coverage by earnings. Despite this, its seven-year dividend history is marked by volatility and unreliability, including annual drops over 20%. The company's allowance for bad loans is low at 60%, with a high level of bad loans at 2%. Earnings have grown consistently but modestly forecasted to continue growing annually.

- Take a closer look at BAWAG Group's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that BAWAG Group is trading behind its estimated value.

Where To Now?

- Take a closer look at our Top Dividend Stocks list of 1981 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ALBAV

Ålandsbanken Abp

Operates as a commercial bank for private individuals and companies in Finland and Sweden.

Solid track record established dividend payer.