Orion Oyj (HLSE:ORNBV) Margin Decline Challenges Bullish Growth Narrative

Reviewed by Simply Wall St

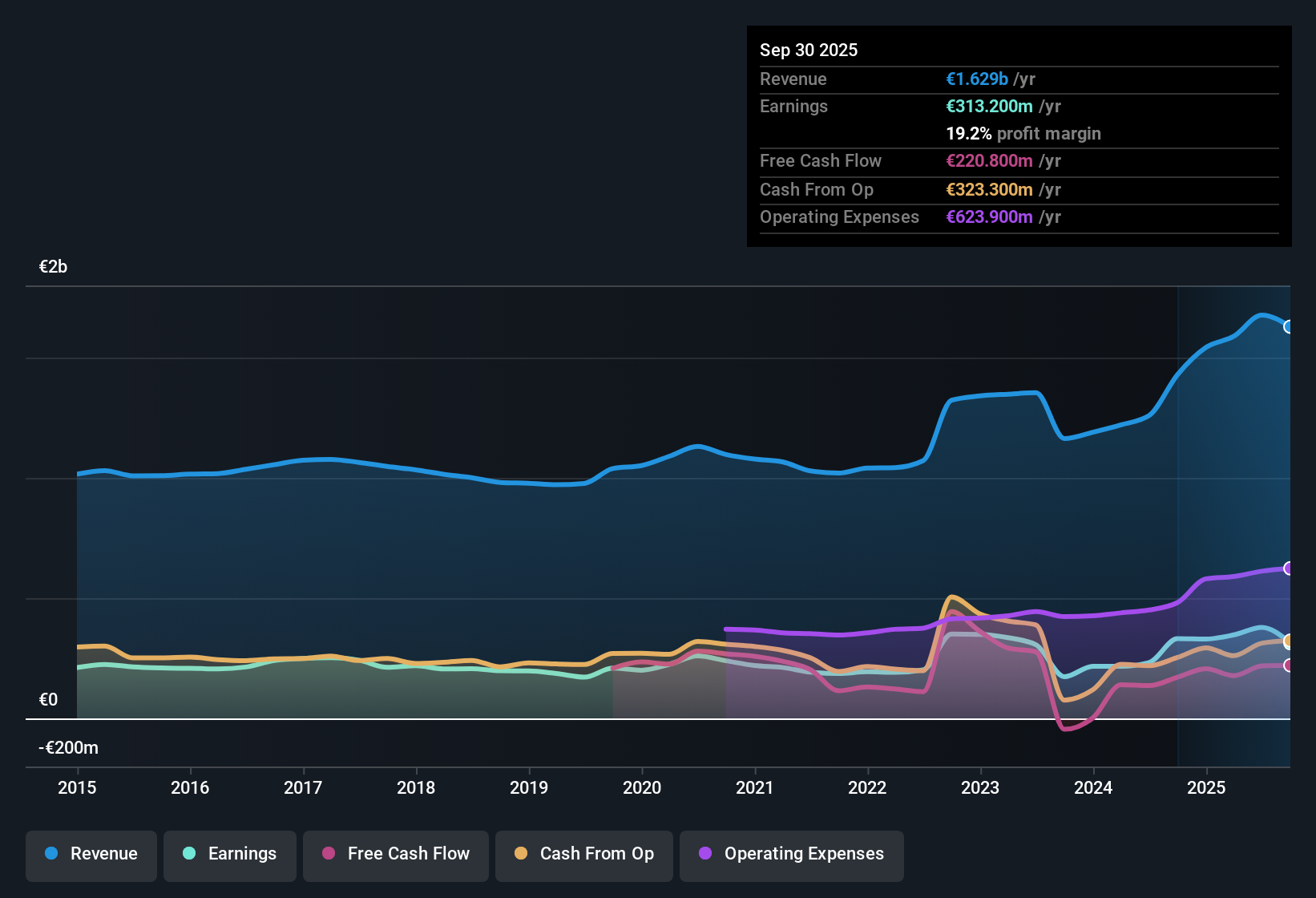

Orion Oyj (HLSE:ORNBV) posted a net profit margin of 19.2%, down from last year's 23.2%. Over the past five years, the company’s earnings have increased at a 9.9% annual rate, and while forecasts call for earnings growth of 13.9% per year, this lags the Finnish market’s average pace. Revenue is projected to rise 9.7% yearly, comfortably ahead of the broader Finnish market, but ORNBV trades at a premium valuation. Its P/E ratio of 28.1x sits well above its peers and the European pharmaceuticals industry. On a high level, investors see a track record of solid long-term growth but also near-term margin pressures and a punchy price tag that weighs on sentiment.

See our full analysis for Orion Oyj.Next, we’re taking a look at how these results compare with the widely held narratives in the market, setting the numbers against investor expectations to see which stories hold up and which ones might get challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Annual Profit Growth Outpaces Revenue Gains

- Orion Oyj’s annual earnings growth averaged 9.9% over five years, a notably faster rate than its projected revenue growth of 9.7% per year going forward.

- What is striking in the prevailing market view is that while profit growth historically kept ahead of revenue, the forecasts now show both metrics nearly aligned. This may indicate less room for margin expansion ahead.

- With consensus showing revenue growth set to outpace the Finnish market (9.7% versus 4%), the close alignment with earnings growth suggests cost discipline will be key for delivering further upside.

- This convergence puts a spotlight on the company’s ability to manage expenses and efficiency as a way of protecting profitability trends when top-line expansion is expected to slow relative to the past.

Profit Margins Slip Against Strong Track Record

- Net profit margin dropped to 19.2% this period, down from last year’s 23.2%, marking a shift after several years of profit growth.

- The prevailing market view sees this margin compression as a meaningful but not alarming development, given Orion’s longer-term record of earnings expansion.

- Even with this year’s decrease in margin, the five-year average for earnings growth remains a healthy 9.9% per year, highlighting the resilience of core operations.

- Investors will be watching to see if this is a single-year dip or a multi-year trend, particularly with bottom-line growth becoming more reliant on cost controls as revenue projections flatten.

Premium Price Tag Raises the Bar

- Orion Oyj trades at a P/E of 28.1x, which stands noticeably higher than peers (22x) and the broader European pharmaceuticals industry (22.5x).

- The prevailing market view is that such a premium price sets high expectations for future delivery.

- If forecasted earnings grow just 13.9% annually, significantly below the Finnish market’s 18.1%, investors may question whether the elevated valuation is justified.

- The share price premium could limit near-term upside, unless Orion surprises on margin improvement or accelerates its profitable growth.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Orion Oyj's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Orion Oyj’s premium valuation and recent margin decline mean investors now face limited upside potential unless profitability rebounds or growth rates pick up.

If overpaying for modest growth concerns you, use these 855 undervalued stocks based on cash flows to quickly spot companies trading below fair value that could offer more attractive returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ORNBV

Orion Oyj

Develops, manufactures, and markets human and veterinary pharmaceuticals and active pharmaceutical ingredients (APIs) in Finland, Scandinavia, rest of Europe, North America, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives